Introduction

Congress is on the verge of significantly increasing the country’s investment in its housing stock as millions of renters face the threat of eviction.

Late Thursday night, a divided U.S. Supreme Court sided with landlords who claimed the federal government overstepped its bounds by placing a moratorium on evictions in 2020. The decision leaves millions of people suffering from job loss and illness at risk of losing their homes.

Meanwhile, Congress has signaled a push to address the nation’s housing crisis. Earlier this week, the U.S. House of Representatives passed a $3.5 trillion spending plan that includes as much as $339 billion for the committee overseeing housing and banking issues to divide on programs.

The budget resolution had already been passed by the Senate on August 11. The Senate’s version called for spending $332 billion on housing and transportation initiatives.

Now the respective House and Senate committees will figure out how to divvy up the pots of money, assigning dollar figures to specific programs.

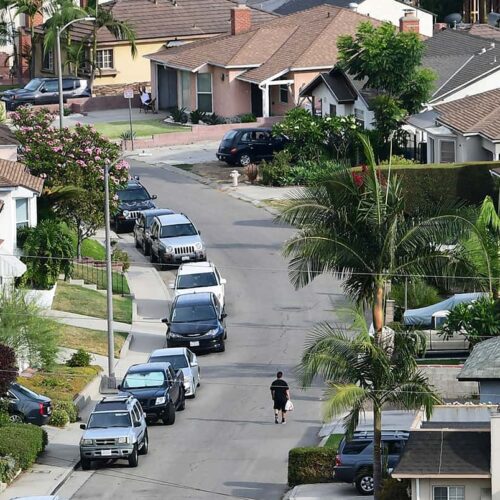

Regardless of how the pie is sliced, advocates say, it will boost housing dollars — and that comes at a critical time. The nation was already in the throes of an affordable housing crisis before the COVID-19 pandemic, but widespread illness and job loss have caused the problem to cascade, largely at the expense of communities of color.

Housing advocates have urged Congress to expand rental assistance in an effort to end homelessness; prop up the flagging public housing stock with a $70 to $80 billion outlay of cash; expand the housing voucher program; and add to the nation’s dwindling supply of affordable homes by expanding the National Housing Trust Fund.

“Our advocacy work is not done at this point,” said Georgi Banna, director of policy and program development for the National Association of Housing and Redevelopment Officials. “We have those big top numbers but now we need to break them down into line items” to ensure the programs that need the money are prioritized by the committees.

Historically, funds for housing programs have not kept up with the need, but the pandemic has shown that it’s more important than ever to ensure Americans have a safe, sanitary place to shelter, Banna said.

Last year, the Center for Public Integrity analyzed court records by ZIP code and found that people living in communities of color faced eviction filings during the pandemic at higher rates than people in white neighborhoods. Researchers later released a study that showed that eviction meant the difference between life and death for some renters.

The Centers for Disease Control and Prevention placed a moratorium on evictions in September, but landlords found creative ways around it.

Congress passed sweeping rent relief measures to try to avert large-scale evictions, but some state and local agencies have bungled the rollout. A Public Integrity investigation with The Associated Press found that more than $425 million in Coronavirus Relief Fund dollars set aside in 2020 for renters and their landlords was either redirected to other programs or remained unspent by March 31.

And of the federal government’s $46.5 billion allocated to states and cities for rental assistance in 2021, only $5.2 billion of that — or about 11% — had been spent by the end of July, according to data reported by the U.S. Department of the Treasury.

The consequences could be dire if rent relief doesn’t reach people in time: “The housing crisis to come will be worse than the Great Depression,” Ananya Roy, a professor at the University of California, Los Angeles, told the New York Times recently.

Banna said there’s room for optimism, though, because of the amount of money housing programs are poised to receive from Congress.

“These are good conversations to have,” Banna said. “We haven’t had conversations about these types of numbers in a long time.”

Sarah Kleiner is a senior reporter at the Center for Public Integrity. She can be reached at skleiner@publicintegrity.org. Follow her on Twitter at @bysarahkleiner.

Read more in Inside Public Integrity

Cheated at Work

What happened when I reported that USPS keeps cheating mail carriers

The Postal Service has repeatedly been shorting workers on pay.

Watchdog newsletter

Broken refugee program complicated Afghanistan evacuation crisis

The refugee resettlement program has been mired in red tape for years, preventing thousands of Afghans from being resettled in the United States.

Join the conversation

Show Comments