This story was co-reported with The Atlantic.

Introduction

The Center for Public Integrity is a nonprofit newsroom that investigates betrayals of public trust. Sign up to receive our stories.

SAN MARCOS, Texas — In the autumn of 2012, Ricardo Gonzalez Jurado was 25 feet off the ground, balancing on metal scaffolding as he sawed a stack of wood. Gonzalez Jurado owns a Central Texas yoga retreat — an oasis deep in the woods where he’s built a cluster of small houses for customers seeking a few days of bodily and spiritual cleansing. That day, he was precariously constructing a large, hollow pyramid — intended as a meditation room — out of the mountain cedar that grows all over his land.

Suddenly, the saw snagged on Gonzalez Jurado’s clothing. He jumped back instinctively and stepped off the metal platform. Plummeting toward the pyramid’s wood floor, he tucked his knees to his chin, so that his heels took the brunt of the impact. There was a loud crack, then searing pain radiating up his left foot. He dragged himself out of the pyramid and called an ambulance.

He asked to be taken to a nearby hospital in San Marcos. But because of the height from which he fell, he told us, the paramedics instead took him to the Brooke Army Medical Center, or BAMC, a trauma center about 50 miles away that was better equipped to handle his injuries. Located on Fort Sam Houston in San Antonio, BAMC is the flagship of the military health system — a network of 37 hospitals and medical centers that are meant for soldiers, but that also treat civilians to give military doctors experience with the variety of injuries they might face when deployed to a war zone.

The doctors at BAMC explained to Gonzalez Jurado that he had fractured his heel bone and would need surgery. They inserted three pins in his heel, making a slanted “H” shape. Gonzalez Jurado called the doctors’ work amazing. After three days, he was out of the hospital and on his way to a full recovery. Soon, however, he would learn that treatment at a military health facility can come with a catch.

Before the surgery, Gonzalez Jurado, who is uninsured, had asked how much the procedure would cost, and he said the doctors told him they didn’t know. (BAMC told us, “Before any unplanned surgery, as in the case of trauma, it is exceptionally difficult to determine what charges may be incurred, as a variety of procedures may be necessary.”)

About a month later, he received his bills from the hospital. They totaled more than $28,000. Gonzalez Jurado was taken aback. He hadn’t asked to go to BAMC, and he couldn’t afford to pay the hospital a giant lump sum. He negotiated a deal with the hospital to pay in increments.

But even after years of on-time payments, he only sunk deeper into a billing nightmare. His account was sent to a collections agency, and he said the federal government garnished his tax refund as a penalty for supposedly underpaying his bill.

Gonzalez Jurado had fallen into a dark, little-known crevice of the medical-debt world: The federal government, which tracks down debts for military hospitals, is one of the most unforgiving debt collectors around. Even as many policy makers are looking for ways to protect Americans from burdensome medical costs, the government itself can go after civilian patients in ways that are as punitive as they are unproductive. Military hospitals like BAMC are, in fact, required to aggressively pursue debts, even if the patients are uninsured or low-income.

Treatment at a military hospital is the rare case in which a government service might take a needy American’s money, as opposed to providing it.

‘Prompt and aggressive action’

Gonzalez Jurado’s retreat lies down a dirt road about 15 miles from town. On the way is a street named Purgatory, an appropriate preview of Gonzalez Jurado’s vision of his property. “Out here,” he told us, “is paradise.” Beyond the cacti and bamboo thickets are a koi pond, sweeping views of the Central Texas hills, and few humans for miles.

At 66, Gonzalez Jurado is bald and thin, with sinewy limbs and a ramrod-straight back that belie his age. He moved to the U.S. from Guatemala in 1986, and for most of his life in America, he’s been self-employed and uninsured. Because of his age, he said, the cheapest Obamacare plan would be too expensive — about $700 a month — and he doesn’t qualify for Medicare.

Calmly, he brought out a ream of medical bills, which tell a winding story of error and miscommunication. When Gonzalez Jurado received his first bill from BAMC, he and the hospital agreed that he would pay $100 each month until the balance was settled. He sent in his $100 faithfully, according to his medical records. In 2014, BAMC asked for larger installments, and they compromised on $300. He began sending in that amount monthly. In 2017, Gonzalez Jurado received a letter from the hospital saying his balance had been “paid in full.” Knowing it hadn’t — he had only paid about $8,000 at that point — Gonzalez Jurado said he tried in vain to reach the hospital’s billing department. The hospital also began returning his $300 checks.

Gonzalez Jurado figured that, perhaps, he had satisfied the hospital’s desire for cash. Maybe it had realized he was old and not rich, he thought, and had given up on collecting. It was a gift horse; he decided to stop inspecting its teeth. That is, until April 2018, when he received a letter from the U.S. Department of the Treasury, which collects delinquent debt for government agencies, including the Department of Defense. The letter informed him he had an unpaid debts at BAMC totaling $35,016 — about $15,000 more than the amount he still owed when his checks were returned. Worried, Gonzalez Jurado sent two certified letters and called, but he said the Treasury Department did not respond to him.

Getting treated at a military hospital is different from visiting a standard hospital in one important way. Many nonprofit or private hospitals are supposed to follow federal and state charity-care laws to write off the debts of poor or uninsured patients. Federal facilities like BAMC, meanwhile, are instead required to take “prompt and aggressive action” to settle all debts, according to Department of Defense regulations. Although the government may write off some debts, charity-care laws don’t apply.

When reached for comment, the Treasury Department’s Bureau of the Fiscal Service, which was responsible for collecting on Gonzalez Jurado’s debt, said it could not comment on specific cases for privacy reasons, but that while it is “required by law to collect debts, [it] works to ensure that debtors are treated fairly and receive proper notices and opportunities to dispute the debts, as well as the chance to repay debts over time.”

Who We Are

The Center for Public Integrity is an independent, investigative newsroom that exposes betrayals of the public trust by powerful interests.

BAMC sees more civilians than other military hospitals because, as a level-one trauma center, it is better equipped to handle emergencies than other local hospitals. Nearly 85 percent of the trauma patients admitted to BAMC last year were civilians. It has also held on to its regional dominance. When other hospitals in the area discussed expanding their trauma centers in 2017, BAMC top brass spoke with the San Antonio city council to voice opposition. More trauma centers in the area, BAMC doctors said, would threaten the facility’s “medical readiness.”

In an email, a BAMC spokesman wrote, “Per federal law, [military treatment facilities] do not have the authority to waive, compromise or terminate any debt incurred when a civilian emergency patient is seen.” Although “BAMC bills patients once all efforts to collect from insurance companies have been exhausted,” he added, after a debt is transferred to the U.S. Treasury Department, “BAMC may not interfere with collection actions.” He also noted that an assessment by the Southwest Texas Regional Advisory Council, a health agency, found that the area “currently did not need another higher-level Trauma Center.”

Because of the billing confusion with BAMC, Gonalez Jurado’s surgery haunted his personal finances for years. This past March, Gonzalez Jurado tried to apply for a mortgage credit to refinance a tire shop he owns in Houston. To his surprise, he was declined. His mortgage lender told him he had a notice on his credit report from the Treasury Department.

‘It’s like a steamroller’

There’s a reason military hospitals pursue patient debts so aggressively.

Military health facilities made it a priority after the Department of Defense’s inspector general found that BAMC’s and other facilities’ debt-collecting systems were not working. The inspector general completed a series of audits, the first of which were published in 2014, that identified millions in mishandled delinquent accounts at five facilities. The amount of debt per facility varied, from $769,385 owed to the David Grant Air Force Medical Center in California, to $73.1 million owed to BAMC. Civilians currently owe about $198 million to military hospitals for medical treatments, according to data from the Defense Health Agency.

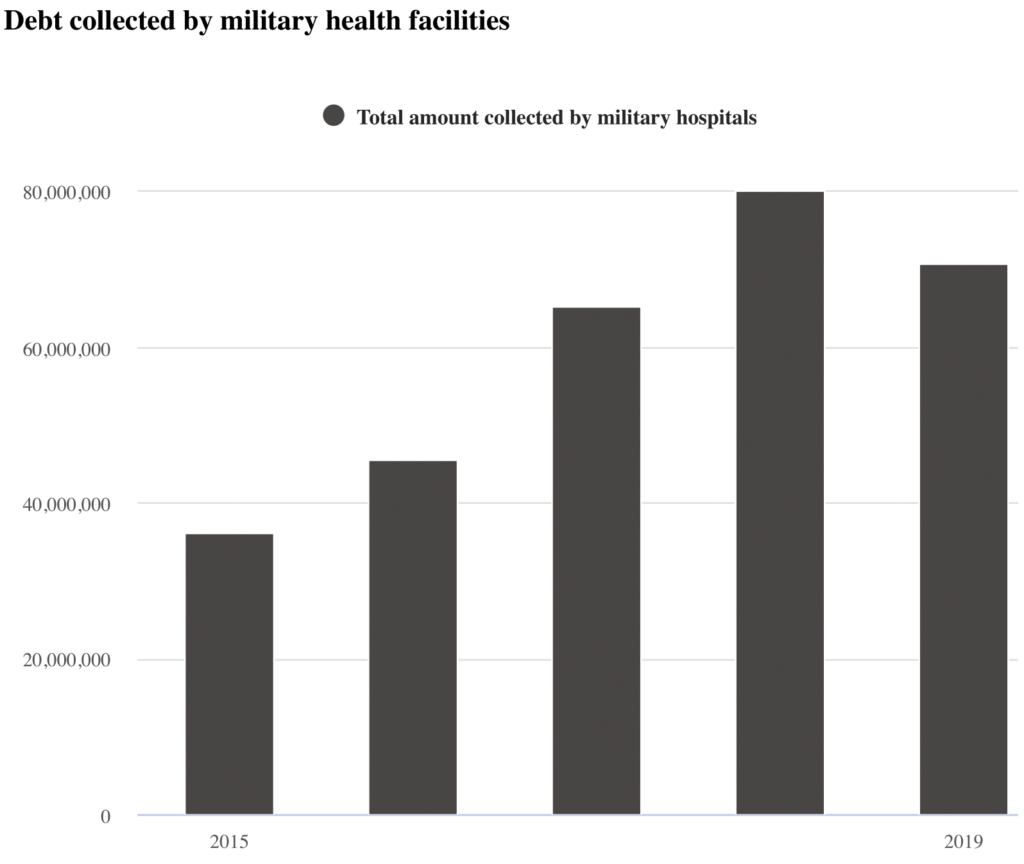

Military health facilities have collected millions of dollars each year since the audits, up to $80.2 million in the 2018 fiscal year and $70.6 million last year. Collecting on the remaining delinquent accounts at BAMC is listed as a “high priority” recommendation from the inspector general’s list of open recommendations as of March 2019.

| Facility | Total debt discovered by audits |

| Brooke Army Medical Center | $73.1 million |

| William Beaumont Army Medical Center | $857,003 |

| Naval Medical Center Portsmouth | $817,399 |

| Landstuhl Regional Medical Center | $4.6 million |

| David Grant U.S. Air for Medical Center | $769,385 |

| Total from first audits | $77.7 million |

| Total | $80.2 million |

Medical debt is always a burden, but in most cases, debtors are afforded at least some protections to safeguard them from predatory practices. Private debt collectors have to follow strict debt-collection laws and obtain permission from a judge before taking extreme measures like garnishing wages. But once a military-hospital debt is transferred to the U.S. Treasury, the government can withhold wages, tax refunds, or 15 percent of a person’s Social Security income without a court order. Unpaid balances are subject to interest payments, administrative fees, and other penalties.

Mandi Matlock is friends with Gonzalez Jurado, but she also worked as an attorney at Texas RioGrande Legal Aid until recently and has seen the same process unfold with legal aid clients who have visited military hospitals.

“It’s like a steamroller with all the might of the federal government behind it collecting unjust, inflated amounts from people’s Social Security,” she says.

This relentless form of debt collection is especially harsh for the poor who rely on government services. For instance, Mark Crandall visited the San Diego Naval Medical Center twice in 2012 and once in 2015, a time period during which he was often homeless and living in the park that surrounds the medical center. He accrued debts now totaling more than $24,308, including interest. The government deducts $140 from his Social Security check every month, bringing his income down from $936 to $796. Crandall suffers from a litany of health issues: epilepsy, schizophrenia, and complications from diabetes, and he says the extra Social Security funds could help him live more comfortably.

Crandall, who is on Medicare, submitted his bills to the state’s Medicare contractor last year, but Crandall’s case workers at the Legal Aid Society of San Diego say the claim was rejected because it was submitted more than 12 months after the service dates. Mike Alvarez, a spokesman for the San Diego Naval Medical Center, told us the hospital does not bill nonmilitary patients’ medical insurers for their treatments — patients are responsible for filing their own claims. He added, “Patients can request to have their debt waived by the Secretary of the Navy by sending a letter to the address listed on their invoice.”

In some cases, patients risk losing thousands of dollars in wages even if their insurer ultimately agrees to pay their military-hospital bill. When 82-year-old Frank Hooker fell on his driveway and fractured his skull in 2015, he was airlifted to BAMC. He had little choice: Hooker lives in Devine, Texas, a town 40 miles southwest of BAMC with no hospital. His daughter, Jana Gentry, who manages the family’s finances, says she never heard from BAMC after his treatment and assumed Hooker’s insurance provider paid the remainder. But last year, Gentry was notified that her father owed more than $59,000, and the U.S. Treasury would begin withholding Hooker’s tax refunds and 15 percent of the $1,465 from Social Security he receives every month until the debt was paid.

Gentry says that BAMC gave conflicting answers as she attempted to stop the government from garnishing her father’s income. “We were given so many different excuses, told so many different stories,” she says. (BAMC said that it “strives for accuracy and timeliness in its responses to all billing concerns.”) Meanwhile, Hooker’s insurance company, Humana, at first refused to cover the bill. Humana declined to comment on specific cases for privacy reasons, but the company eventually settled the debt. In the meantime, the government had withheld about $3,500 from Hooker’s Social Security checks. Earlier this month, BAMC staff told Gentry that the payments will be refunded.

Gonzalez Jurado, meanwhile, was still working to resolve his BAMC bill as 2019 came to a close. As the debt changed hands, it had grown significantly, and his avenues to contest it were narrowing. At one point, when he called the Treasury Department again, he said someone told him the hospital had sent his account to a collections agency called Coast Professional. He said he tried to reach the collections agency by phone, but each time he called, he got a prerecorded message, waited on hold, and got no answer.

In November, Coast Professional sent him a letter saying he owed $36,661 — about $8,000 more than his original bill — after including late fees and interest. But Coast appears to have reported $73,218 — roughly twice that amount — on two different accounts to the credit bureaus. Gonzalez Jurado sent the company a letter to dispute the charge. (Coast did not respond to multiple requests for comment.)

More than seven years after his fall, the outstanding medical balance was still on Gonzalez Jurado’s credit report, lowering his credit score. His $1,700 tax refund from 2018 was claimed by the IRS, he said.

In a confusing moment of hope, the Treasury Department sent Gonzalez Jurado a letter shortly before this story was published that appeared to indicate the agency had cleared his debt. But after publication, he received a second letter telling him to “please disregard” the previous one. He still owes $35,416, the new letter said. (We’ve reached out to the Treasury Department for comment and will update this story if they respond.)

The experience has taught him “a lot about how good the medical service could be if we had a different system,” he told us. “Because it’s definitely not working, the one we have.”

Update: This article was updated Feb. 10, 2020, at 5:21 pm.

Correction: This article has been updated to reflect that 85 percent of all trauma patients treated at BAMC last year were civilians.

Read more in Inequality, Opportunity and Poverty

Inequality, Opportunity and Poverty

As protests grow, big labor sides with police unions

The latest in an historically fraught relationship among police, labor and civil rights movement

Join the conversation

Show Comments