Introduction

aside class=”relation packaged”>Who are lobbyists meeting?

The sweeping Dodd-Frank financial reform law was enacted by Congress last summer after the U.S. banking crisis and housing collapse of 2007-08.

But it left the details to more than a half-dozen agencies which are now drafting rules to regulate the multi-trillion-dollar derivatives market, set bank capital standards, designate systemically-important financial institutions, encourage whistleblowers, track credit rating agencies’ accuracy, and launch the Consumer Financial Protection Bureau.

These agencies post short summaries of their contacts with lobbyists:

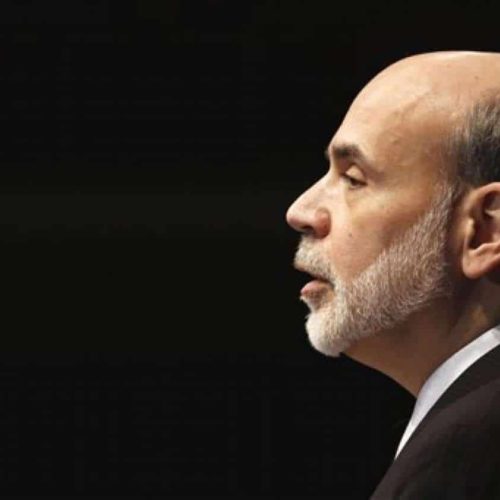

Fed chief Ben Bernanke and other top U.S. financial regulators may reveal more details on Thursday about how they plan to monitor systemic risk when they testify at a Senate Banking Committee hearing.

House Republicans have complained that regulators have yet to spell out how they will define which non-banks are “systemically important” and whether that designation will include big hedge funds or investment funds.

Major banks with at least $50 billion in assets and any other companies that are designated as systemically important will be subject to stricter regulation to protect the U.S. financial system from another meltdown. Texas Republican Randy Neugebauer, chairman of a House Financial Services subcommittee, last week urged regulators to delay their final rule “in the interest of transparency and fairness.”

The Democrat-led committee hearing is likely to give a friendlier reception hearing to the heads of the Securities and Exchange Commission, Commodity Futures Trading Commission, Federal Deposit Insurance Corp., and Office of Comptroller of the Currency.

Other Congressional hearings, rulemaking deadlines and events related to the Dodd-Frank financial reform law this week:

Monday, May 9

CFPB data — Deadline for comments on the Consumer Financial Protection Bureau’s plan to use online and paper forms to collect data and consumer complaints.

Risk-based capital — Deadline for comments on the Office of Thrift Supervision’s proposal to modify how risk-based capital requirements are calculated.The Treasury Department unit, which is being phased out under Dodd-Frank, is proposing a minimum Tier 1 risk-based capital ratio of 4 percent and total risk-based capital ratio of 8 percent.

Tuesday, May 10

FDIC meeting — Federal Deposit Insurance Corp. board of directors meets to discuss a proposal allowing FDIC-supervised banks to engage in forex off-exchange transactions with retail customers, as announced recently by the Treasury Department. Meeting begins at 0915 ET.Systemic risk — Securities and Exchange Commission Chairman Mary Schapiro holds a public roundtable discussion of how to mitigate systemic risk from money market funds. Other panelists include the heads of the Federal Deposit Insurance Corp., the Commodity Futures Trading Commission, and the National Credit Union Administration. Begins 1400 ET and will be webcast.Crisis Commission — Senate Banking Committee holds hearing to review the Financial Crisis Inquiry Commission’s final report, with testimony from commission chairman Phil Angelides. Begins 1000 ET and will be webcast.Capital formation — House Oversight and Government Reform Committee holdshearing on the future of capital reform. Begins 1230 ET.

Wednesday, May 11

Bank of America — Bank of America management holds annual shareholders meeting.

Risk retention — House Oversight and Government Reform subcommittee holds hearing on transparency as an alternative to the federal government’s regulation of risk retention in risky financial products. Begins 1400 ET and will be webcast.

SEC whistleblowers — House Financial Services subcommittee holds hearing on Republican proposals to “address the negative consequences” of the beefed-up whistleblower protections and payment required by the Dodd-Frank law. Begins 1400 ET and will be webcast.Small banks — The small bank advisory committee of the Federal Deposit Insurance Corp. meets to discuss policy issues. Begins 0830 ET and will be webcast.

Thursday, May 12

Systemic risk — The heads of the Federal Reserve, Securities and Exchange Commission, Federal Deposit Insurance Corp., Commodity Futures Trading Commission,and the deputy secretary of the Treasury Department testify at a Senate Banking Committee hearing on their efforts to monitor systemic risk. Hearing begins 1000 ET and will be webcast.

Mortgage servicing — Senate Banking Committee holds hearing on the need for national mortgage servicing standards. Testifying are officials from the Government Accountability Office, National Consumer Law Center, Mortgage Bankers Association, and Amherst Securities. Begins at 1400 ET and will be webcast.

Friday, May 13

Investor protection – House Financial Services subcommittee holds hearing on the Stanford Financial ponzi scheme and its lessons for investor protection. Begins 1000 ET and will be webcast.

Read more in Inequality, Opportunity and Poverty

Inequality, Opportunity and Poverty

The investment industry threatens state retirement plans to help workers save

States wrestle with impending retirement crisis as pensions disappear

Inequality, Opportunity and Poverty

As IRS crusades against Americans hiding money offshore, Latin American tax cheats flock to U.S. banks

IRS event today on plan to force banks to report foreign nationals’ accounts

Join the conversation

Show Comments