Introduction

It’s the question buzzing around Washington and Wall Street this week: Will Sen. Christopher Dodd’s sudden retirement announcement further jeopardize his already thorny task of overhauling the nation’s financial regulatory system?

At risk in particular, some Capitol Hill observers say, may be a proposal to create a new consumer protection agency that President Obama has characterized as a must for financial reform.

Dodd, a Connecticut Democrat who announced Wednesday that he will not seek re-election in November after 35 years in Congress, is chairman of the Senate Banking Committee. As chair, Dodd is in position to rewrite the rules for Wall Street in the wake of the most debilitating financial crisis since the Great Depression. The U.S. House passed its own sweeping financial package last month with the consumer agency as the centerpiece.

There are two schools of thought on how Dodd’s planned departure will impact legislation. Financial industry insiders surmise that Dodd, short on political capital, will run out the clock on his last year in office or look for a quick bipartisan compromise. On the other hand, consumer advocates believe that Dodd, now free from the constraints of fundraising and campaigning, will want to burnish a legacy as the man who set the bankers straight.

In a press conference Wednesday, Dodd did not directly address the future of his reform package. But amidst staunch Republican opposition, some aspects of his broad effort, such as the proposed consumer agency, have seemed endangered for weeks. The new independent body would regulate financial products such as mortgages and credit cards.

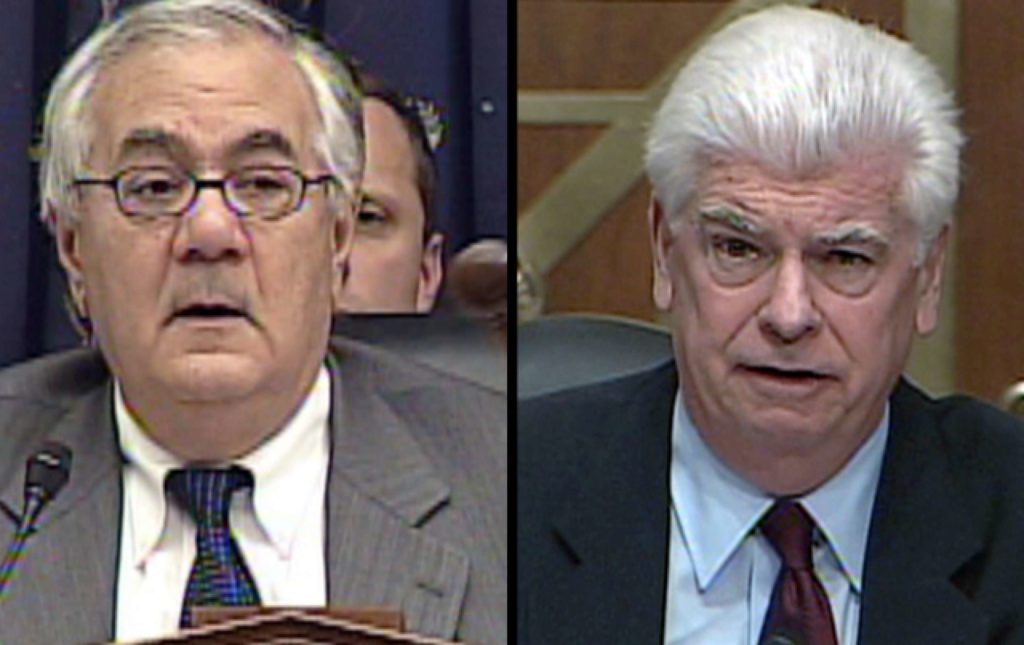

Days after the House approved a consumer agency, Dodd’s counterpart in the House, Rep. Barney Frank, expressed concern that the provision would not survive the Senate.

“The one [provision] that I am most worried about is the consumer agency,” Frank said in an interview with the Huffington Post Investigative Fund last month. “We have been talking to Senator Dodd,” Frank said, “but I am worried that he’s not going to be able to get Republican support or 60 Democrats for a vigorous consumer agency.”

Frank should know. He spent much of last year fighting Republicans, pro-business Democrats and industry lobbyists over the agency. (The Chamber of Commerce remains the fiercest opponent of the agency and has vowed to turn up the heat in the Senate battle.) Ultimately, no Republicans supported Frank’s plan even though it exempted some key sources of consumer loans–auto dealers, smaller banks and student lenders — from the agency’s oversight.

When Dodd first formally proposed the consumer agency in an 1,136-page draft bill last fall, the banking committee’s ranking Republican, Richard Shelby, lambasted the idea.

“An agency that requires financial firms to provide products to consumers repeats the same dangerous practices that led to unqualified consumers receiving mortgages they couldn’t afford,” Shelby said at a Nov. 19 committee hearing. The Alabama Republican added that he would be opposing Dodd’s bill, which he said needed a “complete rewrite.”

But on Dec. 23, in the spirit of the season, Dodd and Shelby released a joint statement saying they had made “meaningful progress” toward resolving their differences. A compromise, they said, might be reached by the end of January.

The sooner the better, reform advocates believe. If the Senate fails to pass a bill this year, Sen. Tim Johnson, a business-friendly Democrat from South Dakota would replace Dodd at the helm of the banking committee. Johnson was the only Senate Democrat last year to oppose new regulations of the credit card industry, which is largely headquartered in his state.

Whatever the end result, Frank said in a statement Wednesday that he anticipated Dodd would push ahead with the challenging political battle. “I will miss his leadership in future Congresses, but I do look forward to working closely with him for the rest of this year on finishing the job of significant financial regulatory reform, to which he is committed, and to which he has already worked to advance,” Frank said.

Read more in Inequality, Opportunity and Poverty

Finance

Wall Street quietly creates a new way to profit from homeowner distress

Large bank, hedge fund bundle small tax debts into private investments

Join the conversation

Show Comments