This story was produced in collaboration with Southern California Public Radio.

Introduction

It’s been nearly two years since Nadia Levine fielded the frantic calls — the first one from her husband, the next from a co-worker.

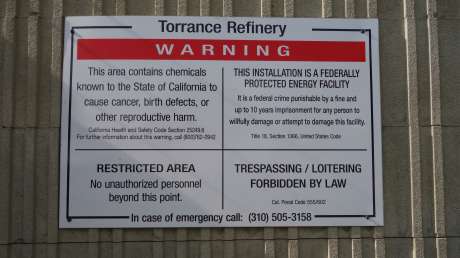

Panicked, Levine dialed both her children’s schools as she scrolled down the front page of CNN.com on Feb. 18, 2015. A fire raged blocks away from the Torrance, California, home her family had moved into only a month before. On a business trip nearly 3,000 miles away in Connecticut, Levine scrambled to find numbers for neighbors who could check to see whether the house was still standing.

“All I knew at that point was that my kids and husband were alive,” she said. As the smoke cleared, it became evident her worries were far from over.

Just before 9 that morning, pent-up gases at ExxonMobil’s Torrance refinery south of Los Angeles had triggered an explosion so massive it registered as a magnitude-1.7 tremor. A five-story processing unit had burst open, spewing industrial ash over a mile away that some mistook for snow and propelling a 40-ton hunk of equipment into the air. The debris had narrowly avoided piercing a tank containing tens of thousands of pounds of hydrofluoric acid, or HF — a gas so toxic it corrodes bone.

It was the first Levine had heard of HF. The chemical is used to make high-octane gasoline at about a third of the 141 oil refineries in the United States. If released HF forms a fast-moving, ground-hugging cloud that can cause lasting lung damage, severe burns or death. There are alternatives to HF, but only one U.S. refinery that uses it has voluntarily committed to switch, a process expected to begin this year.

Federal rules, which don’t require such changes, “haven’t kept up with the continuing challenge of preventing chemical incidents,” said Rick Engler, a member of the U.S. Chemical Safety Board, which issues recommendations but has no regulatory authority. He called HF “one of the most hazardous and potentially deadly chemicals used in the oil-refining process.”

Along with environmentalists and union leaders, the board has pushed unsuccessfully for a federal mandate that would require high-hazard industries to consider using safer processes and chemicals. A 41-page study by a consultant last year estimated it would cost roughly $100 million for the Torrance refinery to switch to sulfuric acid, an HF alternative that carries risks of its own but doesn’t pose a sizable threat to the public.

Courtesy of Nadia Levine.

While federal regulation has stagnated, local activism in the wake of the 2015 accident spurred Southern California regulators to revive a 27-year-old effort to ban HF. “Let’s see if we can phase this out to provide an extra level of protection for the public,” Philip Fine, a deputy executive director of the South Coast Air Quality Management District, said in an interview.

Separately, California officials have been working on a statewide rule, expected to become final this summer, that would require refinery owners to adopt “inherently safer designs and processes” and give workers a bigger voice in accident prevention. That effort began after another disaster that didn’t involve HF: a massive 2012 fire at the Chevron refinery in Richmond, north of San Francisco. More than 15,000 people sought medical treatment for respiratory and other symptoms related to toxic-smoke inhalation.

More than 100 refineries are among 1,900 facilities considered “high risk” by the U.S. Environmental Protection Agency, meaning they are prone to terrorist attacks or accidents that imperil surrounding communities. An EPA analysis found that oil and coal- products manufacturing, which includes refining, had the highest rates of chemical accidents. Many refinery owners, however, have postponed maintenance and equipment upgrades while ramping up production — increasing the odds of deadly mishaps.

The Chemical Safety Board, which is investigating the 2015 Torrance accident, called the blast at the 750-acre refinery a “near miss” that fell just short of a “catastrophe,” faulting poor maintenance by ExxonMobil, which had delayed repairs to cut costs.

ExxonMobil has challenged those claims. In an email, a spokesman wrote that “there was no evidence” the incident “posed any risk of harm to the community” from HF. He also wrote that there are “no safer or commercially viable alternatives” to the chemical and denied that ExxonMobil cut corners on maintenance.

The company is contesting more than a half-million dollars in state fines and has refused to fully cooperate with safety board investigators, even though it sold the refinery in September 2015 for $538 million to PBF Energy, a New Jersey company known for buying distressed properties at steep discounts. Like ExxonMobil, PBF has reassured Torrance residents that the operation is safe and that the company is “focused on continuous improvement,” despite a spate of recent problems.

The scare in Torrance could have been avoided if federal rules had been stronger, said Rick Hind, legislative director at Greenpeace USA. After years of industry pushback, the EPA updated its Risk Management Program in December, requiring facilities like the Torrance refinery to report near-misses and urging communities to improve emergency response.

But the rule — which is subject to undoing by the Trump administration — didn’t address prevention, Hind said. “When you use the word ‘risk,’ just substitute the word ‘gamble’ and it takes on a different urgency,” he said. “We’re just again gambling with the future of millions of workers and community residents.”

Life in ‘a kill zone’

Courtesy of the U.S. Chemical Safety Board

Growing up in Contra Costa County, east of San Francisco, Levine, now 34, lived not far from two refineries. These days she works across the street from the Chevron El Segundo refinery, just south of Los Angeles International Airport. The only one that gives her pause, she says, is Torrance.

Saddled with a hefty mortgage, the Levines have remained in their house despite lingering concerns. Months after the near-miss, sirens sounded again when a small amount of HF leaked from a truck. Days before Thanksgiving last year, Levine watched another fire unfold near the same unit that exploded in 2015, which produces a crucial component of high-octane gasoline.

“Nobody told us we lived in a kill zone when we bought our house,” said Levine, whose home is within two miles of the refinery.

ExxonMobil’s “worst-case” chemical-release scenario filed with the EPA estimated that no more than 2 percent of its HF supply could escape, endangering more than 255,000 residents up to 3.2 miles away. The EPA is investigating whether that figure is accurate. Neither PBF nor ExxonMobil has explained why that scenario assumes a minor leak instead of a tank-emptying discharge. Each has declined to disclose the exact potency of “modified” HF used at Torrance, which is diluted with a secret additive they claim greatly curbs how much of the acid vaporizes.

The companies’ reticence stands in contrast to Valero, which operates a refinery eight miles away in the Wilmington neighborhood of Los Angeles and makes its modified HF recipe public. Valero’s worst-case scenario predicts its total HF supply, if released, would endanger more than 370,000 people as far as 4.3 miles away.

The composition of the modified HF in Torrance remains a mystery to federal investigators, too. ExxonMobil has not yet complied with several Chemical Safety Board subpoenas, including those seeking information on the refinery’s HF tank.

Absent federal rules, attempts to make processes less dangerous have fallen largely to companies like ExxonMobil — with mixed results.

The additive used in Torrance dates to a 1989 lawsuit filed by the city against ExxonMobil — then Mobil. At the time, Torrance was using pure HF, which officials warned could lead to a “disaster of Bhopal-like proportions,” referring to the 1984 gas leak in India that killed thousands.

The city’s complaint called the refinery a “public nuisance” and documented more than 127 incidents that had occurred in the previous decade, including a gas-fueled fireball that killed a stranded motorist and two workers, and a series of other fires and leaks.

In 1990, Mobil agreed that it would discontinue use of undiluted HF, and several years later a court-appointed safety advisor approved Mobil’s use of the acid tempered with at least 30-percent additive. Mobil claimed the additive, combined with other protective measures like emergency water cannons, would virtually eliminate toxic vapors in the event of a release, causing HF to fall to the ground like rain.

The nature of the additive remains secret to this day. In a statement, PBF spokesman Michael Karlovich wrote that the company is barred from speaking in detail about it because the supplier considers the information to be proprietary. The HF used at Torrance, he wrote, is diluted by approximately 10 to 15 percent.

That amount falls short of the 30-percent threshold to which Mobil committed all those years ago. The discrepancy — coupled with lingering concern over the 2015 near-miss — was the main reason the South Coast air district revived the idea of an HF ban, Fine said. The district was made aware of the change, he said, by the Torrance Refinery Action Alliance, which found that the city council agreed to Mobil’s plan in a closed-door meeting. The district’s original attempt to ban HF in 1990 was overturned in court because officials hadn’t allowed a sufficient period for public comment.

“We’re much worse off because of modified HF,” said retired scientist and alliance member Sally Hayati. She and others in her group support switching to sulfuric acid, which can still burn workers but doesn’t vaporize into fast-moving clouds. “If it wasn’t for modified HF, HF would have been gone.”

Sally Hayati is a member of the Torrance Refinery Action Alliance, an organization that has advocated for a ban against hydrofluoric acid, or HF, a dangerous chemical used in oil

Sharon McNary/KPCC Southern California Public Radio

HF is used in a refining process called alkylation, in which light hydrocarbons are fed into a reactor and transformed into a mixture of heavier ones by a catalyst — either HF or the primary alternative, sulfuric acid. The liquid part of this mixture, alkylate, gives high-octane gasoline its anti-knock properties.

Kim Nibarger of the United Steelworkers, a union that represents workers in Torrance, said that both modified and regular HF pose lethal risks. “For our workers it’s not really going to matter if it’s modified or not, they’re going to be in the middle of it,” he said. The union’s 2013 report on the dangers of HF, “A Risk Too Great,” urged refiners to commit to safer options.

While sulfuric acid — used at about 50 U.S. refineries — is less menacing to the public than HF, Nibarger said it’s not much of a step up for workers. He’s hopeful that two emerging technologies — solid acid alkylation, being tried at a refinery in China, and ionic liquid alkylation, to be phased in at a Chevron refinery in Salt Lake City, beginning this year — will catch on.

In a statement, the American Fuel and Petrochemical Manufacturers stood behind HF, used by many of its members, from refiners to pharmaceutical companies. “Refiners have safely and responsibly operated hydrofluoric acid units for more than 70 years,” the trade group wrote in an email, adding that “a ban of HF could threaten California’s fuel supply and lead to higher consumer fuel costs.” PBF officials expressed the same sentiment and said a transition to sulfuric acid would be a massive undertaking that would take several years to plan.

For years, refiners claimed pure HF would liquefy if spilled — a theory physicist Ron Koopman disproved in the 1980s with industry-sponsored tests in the Nevada desert.

“But there was no liquid to collect,” said Koopman, formerly of Lawrence Livermore National Laboratory and now an independent consultant. “All of it went downwind as a vapor cloud.”

Based on his experience with pure HF, Koopman is skeptical of industry claims about the modified form. Outside of research by companies, he said, there have been no peer-reviewed studies confirming the efficacy of modified HF.

“No one has any idea if it works,” said U.S. Rep. Ted Lieu, D-Calif., a longtime Torrance resident whose children sheltered in place at school the day of the 2015 blast. “We’re flying blind here.”

‘Again and again and again’

Since PBF took over the Torrance refinery in July, it has pushed production rates at the nearly century-old complex beyond ExxonMobil’s historic outputs. The refinery is PBF’s most expensive and most recent purchase, producing a tenth of California’s gasoline.

Sharon McNary/KPCC Southern California Public Radio

When the “gasoline machine,” as the company describes it, virtually shut down for over a year following the 2015 explosion, it caused a spike in regional gas prices that cost motorists $2.4 billion.

As companies like ExxonMobil exit refining in search of heftier profits from oil and gas exploration, smaller and newer companies like PBF have taken the helm — buying up aging plants for “10 cents on the dollar.” Within eight years, the New Jersey company went from owning no refineries to being the country’s third-largest independent refiner, with five facilities.

PBF’s brief track record at Torrance has been marred by problems. The refinery has been beset by power outages that set off tall columns of black smoke from safety flares. “You’re sitting or playing outside and all of a sudden there it goes,” said Levine, who has spent nearly $1,000 on home air purifiers. “It’s starting to become normalized, and I don’t like that. That scares me more than anything.”

On Jan. 4, she got a city of Torrance alert about an “unidentified odor” from the refinery. While PBF officials were quick to assure residents that the rotten-egg smell was innocuous, a hazardous-spill report suggests otherwise.

Local fire officials reported traces of sulfur had leaked along with an unknown amount of naphtha — a highly flammable gas and a nose, throat and eye irritant. In an interview, Jeff Dill, president of PBF’s western region, said the incident was minor and “there were no materials released from any equipment.”

It took only 90 gallons of naphtha to spark a 1999 fire at the Tosco Avon refinery in Martinez, California, that burned four workers to death and critically injured another. PBF founder Thomas O’Malley was CEO of Tosco at the time. That disaster was considered preventable by the Chemical Safety Board, whose report revealed “a pattern of serious deviations from safe work practices” that went uncorrected by management.

Tosco paid $21 million to settle three wrongful-death claims, $2 million in criminal fines, and a state fine of more than $800,000. O’Malley apologized but faulted workers for disregarding safety protocols. Before the fire, Tosco had finished a round of layoffs and was preparing to downsize its staff of health and safety inspectors.

The 1999 fire wasn’t O’Malley’s first run-in with regulators at Tosco, which he transformed from a one-refinery company to the country’s largest independent refiner between 1990 and 2001. Two years earlier, a 1997 fire at the same refinery killed one worker and injured 46 others.

The EPA fined Tosco $600,000 after an investigation found “management tolerance of safety hazards and risky operator practices” like “operating with unreliable or malfunctioning equipment.”

“The U.S. refining industry is not a learning culture,” said Mike Wilson of the BlueGreen Alliance, a coalition of union officials and environmentalists. Wilson, a former chief scientist with the California Department of Industrial Relations’ Division of Occupational Safety and Health, was part of a team working on the state’s pending refinery rule. “It’s the same kind of incidents that happen. They happen again and again and again.”

The PBF refinery in Paulsboro, New Jersey, which uses HF, is a case in point. Sixteen students and two teachers at the high school next door were hospitalized in 2015 for exposure to naphtha, which can contain carcinogenic benzene. A lawsuit filed last year claims PBF failed to detect the leak for two days. The company declined to comment on the case.

It was the second time schoolchildren were sickened by emissions from the Paulsboro refinery since PBF purchased it in 2010. In 2012, several nearby schools reported sick students after 6.3 million gallons of oil spilled from a large tank.

Under New Jersey law, PBF must evaluate safer alternatives every five years. The company’s 2012 report to the Department of Environmental Protection concluded that switching to sulfuric acid was “not feasible,” in part because conversion would cost $200 million to $250 million. PBF was unenthusiastic about moving to modified HF as well, saying it would cause “increased corrosion” of equipment and cut the refinery’s efficiency by 10 percent.

According to a PBF filing with the EPA, the Paulsboro refinery stores 250,000 pounds of undiluted HF on site, endangering more than 3.2 million people up to 19 miles away.

Just across the Delaware River from Paulsboro is PBF’s first property, the Delaware City Refinery, plagued by even more problems. Last year, state regulators cited the refinery for dozens of violations stemming from multiple leaks and excessive flaring that released thousands of pounds of pollutants into the air.

The refinery is also under a safety board investigation for a string of worker injuries. In November 2015, a worker was severely burned on the face and neck. Months earlier, two incidents a week apart led to a fire and chemical leak that sent three workers to the hospital.

O’Malley has bought the Delaware City Refinery twice — first as head of Premcor in 2004, and then as dealmaker for PBF in 2010. In the latter transaction, the refinery had been shuttered for two years under Valero, which reported it was losing $1 million a day in 2009.

While the PBF purchase was celebrated by Delaware Gov. Jack Markell, it came at a steep cost to the public. Once the deal was announced, state regulators quickly settled with Valero for $1.95 million, a fraction of the penalties that could have been collected for nearly 200 environmental violations in the past decade. Delawareans have also handed out nearly $55 million in grants and tax breaks to PBF to resurrect the refinery.

When PBF bought another Valero refinery later in 2010, New Jersey regulators also quickly settled. The state recovered less than $800,000 from Valero — a third of the proposed $2.3 million in environmental fines the company racked up over six years.

PBF is also in negotiations with Louisiana’s Department of Environmental Quality over violations dating to 2009 at the Chalmette refinery — a former ExxonMobil property the company bought in 2015. Like Torrance and Paulsboro, Chalmette also uses HF. According to an ExxonMobil filing with the EPA, the refinery has 620,000 pounds of the acid, which could endanger more than 880,000 people as far as 25 miles away.

Companies like PBF are “flippers”—acquiring refineries at rock-bottom prices only to sell them a few years later for profits. The business model has paid off for O’Malley, an early pioneer of the tactic who sold Tosco in 2001 for $7 billion. He replicated the success with Premcor, which was sold to Valero in 2005 for $8 billion. PBF declined multiple requests by the Center for Public Integrity to make O’Malley available for comment.

While O’Malley’s knack for turning around unprofitable assets has won him both praise and billions on Wall Street, it has earned him disdain from some in the labor community, who tell of severe cost-cutting at the expense of workers. Bob Wages, a longtime union leader, once told The Wall Street Journal that O’Malley’s success, in part, meant “taking a knife to all parts of the business.”

O’Malley’s strategy, moreover, hasn’t always worked. His model sent Switzerland-based PetroPlus deeper into a financial hole after it bought three European refineries. He led the company until shortly before it filed for insolvency in 2012.

O’Malley officially retired from PBF in June following the Torrance deal but remains a paid consultant to the company. But the company still follows his vision. CEO Thomas Nimbley worked as O’Malley’s number two at Tosco, and two of O’Malley’s nephews have served as vice presidents.

PBF officials said they are committed to running their refineries “safely and reliably in an environmentally responsible manner,” but noted that the company also bears a responsibility to its shareholders. “We pay one of the higher dividends in our industry,” Dill said.

Nadia Levine, meanwhile, says conditions at the refinery — and communication about incidents — don’t seem to have improved since PBF took over.

“It all seems to be cloaked in secrecy,” she said.

Read more in Environment

Carbon Wars

Big Oil’s grip on California

In America’s greenest state, the industry has spent $122 million in the past six years to shape regulation and legislation. It wins more than you think.

Carbon Wars

‘A little too cordial’

Emails suggest cozy relationship between California regulators, oil industry

Join the conversation

Show Comments