Introduction

JPay Inc., the biggest provider of money transfers to prisoners, has stopped charging fees to families sending money orders to inmates in Kansas, after a Center for Public Integrity report on the company’s fee structure.

The change that means inmates’ families can now send money for free in every state but one where the company does business.

The Center for Public Integrity reported last fall that families of hundreds of thousands of inmates were charged high fees to send their incarcerated relatives money for basic needs like winter clothes and doctor visits. JPay, which offers families the ability make deposits into inmates’ accounts online for a fee, also charged for deposits sent by mail in four states housing roughly 110,000 inmates. Mail-in payments were traditionally the only free way for families to send money.

The Center reported in November that JPay had eliminated deposit-by-mail fees in Ohio, Indiana and Oklahoma. Kansas was the lone holdout.

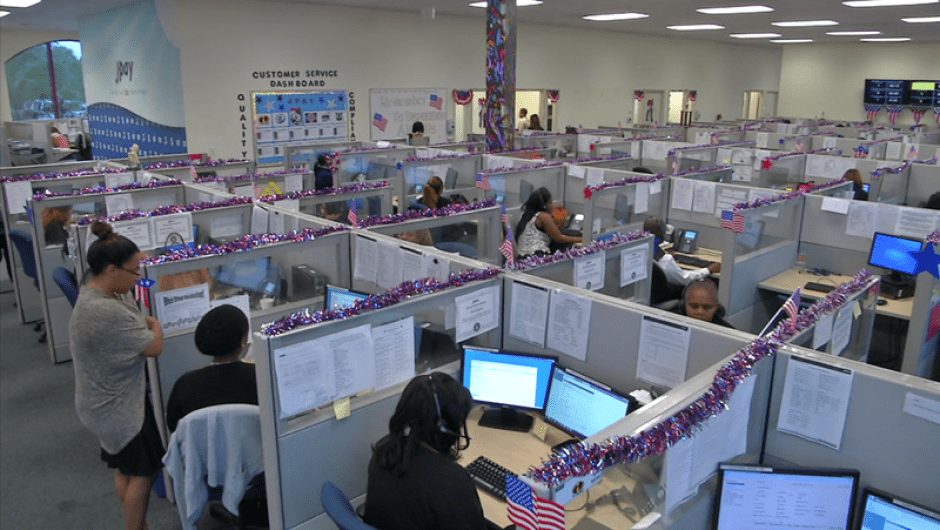

JPay is the biggest of the prison bankers, companies that provide financial services to inmates and their families, often charging high fees and sharing their profits with the agencies that contract with them. JPay handled nearly 7 million transactions in 2013 and expected to transfer more than $1 billion in 2014.

The company’s marketing literature urges families to send money by phone or online. Fees for those services can exceed 45 percent of the deposit amount. Families who didn’t like the system could always choose to mail a money order, JPay CEO Ryan Shapiro said in an interview last summer. He did not know at the time where JPay was charging fees for mail-in deposits.

Shapiro later said that The Center’s questions about money order deposit fees caused him to consider the impact of JPay’s policies on its poorest customers. He said he would seek to convince all states to provide families with a free deposit option.

Kansas Department of Corrections spokesman Jeremy Barclay last week confirmed that the $2 fee has been eliminated. Although the change occurred on Jan. 1, the agency’s website still states that there is a fee to deposit money orders through JPay. The department will update its website with the change “within days,” Barclay said in an email.

JPay did not respond to a request for comment on the elimination of Kansas’ money order fee.

JPay and other prison bankers have become central players in a multi-billion dollar economy that shifts the costs of incarceration onto the families of prison inmates, according to The Center’s earlier reports. Families must send money to help relatives buy basic necessities like toilet paper and boots that are no longer provided by corrections agencies.

JPay handled money transfers and other services for 1.7 million offenders, including nearly 70 percent of the inmates in U.S. prisons, the company said last year. Two states, Missouri and Nevada, stopped accepting money transfers through JPay in the months since The Center first reported on the company.

There remains one state, Kentucky, where JPay is the exclusive provider of money transfers and does not offer a free deposit option. Kentucky does not accept deposits by mail and allows JPay to charge fees for deposits made online, by phone and in person at prisons.

The fees that inmates’ families pay to send money vary from state to state. Electronic transfers using credit or debit cards typically incur steep fees charged by JPay or another vendor. Most states that accept money orders or checks by mail deposits by mail allow vendors to deduct a fee from deposits sent by mail but most offer these money order deposits as a free option.

Before JPay popularized electronic payments to prisons, inmates’ families typically mailed money orders directly to the facility where their relative was locked up. Many found the process faster and more convenient than going through JPay.

JPay grew rapidly in the past 12 years by offering to save states time and money by handling deposits into inmates’ accounts and providing other services, such as high-fee prepaid debit cards issued to inmates when they are released. In exchange, states allow JPay to deduct fees from every electronic transfer.

JPay now processes money orders for free in 14 states. One of them, Florida, charges its own fee for accepting deposits by mail.

Seven states still lack a free way for inmates to receive money: Arizona, Colorado, Florida, Kentucky, Mississippi, Utah and Wyoming.

Read more in Inequality, Opportunity and Poverty

Inequality, Opportunity and Poverty

Why Mark Zuckerberg’s Senate hearing could mean little for Facebook’s privacy reform

Analysis: The social media company’s big lobbying and campaign investments could shield it from talk of significant regulations

Inequality, Opportunity and Poverty

The investment industry threatens state retirement plans to help workers save

States wrestle with impending retirement crisis as pensions disappear

Join the conversation

Show Comments