An abridged version of this story was co-published with USA Today.

Introduction

Feb. 12, 2016: This story has been clarified.

Debbie Mann can barely afford the drug that banishes the stabbing pain rheumatoid arthritis causes in her joints. Although Medicare helps cut the $40,000-per-year list price for prescription Enbrel, she said she still paid more than $3,800 last year.

She thought about going off of it but doesn’t want to return to what she was like before — sleeping most of the day.

“You just want to sit in a chair and not be part of life,” said the 56-year-old retired nurse from Goshen, Indiana.

Courtesy of Debbie Mann

Mann would love a cheaper alternative, but Enbrel, made by Amgen Inc., is a biologic medicine, among the most expensive and difficult type to make because they are derived from sources such as live cells rather than chemicals in a lab. Less costly drugs that function in much the same way — called “biosimilars” — are expected to hit American markets in the next few years.

Yet if an Enbrel biosimilar becomes available in the U.S., as it already is in Europe, Mann will face more hurdles to obtain it in Indiana. That’s thanks to the quick work done by the pharmaceutical companies that swooped in to lobby the legislature there. Drug lobbyists have helped push through bills limiting pharmacists’ ability to dole out biosimilars in more than a third of the states since 2013.

The biosimilar campaign is just one example of the wide-reaching power of state-level lobbying — a power that’s grown as Congress stalemates and federal lobbying declines.

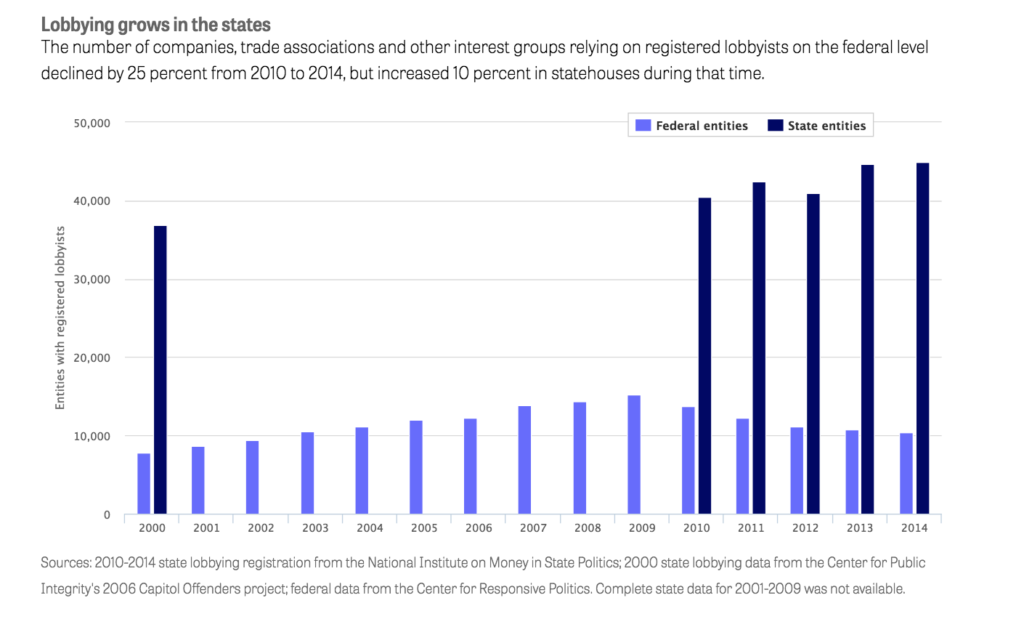

More companies and interest groups are pushing their agendas in the states, according to a Center for Public Integrity analysis of five years of lobbyist registrations from all 50 states gathered by the National Institute on Money in State Politics. Since 2010, the number of entities with either in-house lobbyists or part-time hired guns working in the states has grown more than 10 percent.

That means, on average, every state lawmaker was outnumbered by six companies, trade associations, unions or other groups angling for their attention from 2010 to 2014.

And more special interests are finding it worthwhile to scatter lobbyists in dozens of states — or even all 50 — to make sure increasingly important state legislatures don’t leave them out of the picture.

Lobbying, protected by the constitutional right to petition the government, takes different forms and follows different rules in each state. By wining and dining legislators, pressing flesh and citing talking points, dishing out campaign contributions and gifts, lobbyists wrangle lawmakers for details large and small that serve their employers’ interests:

- AT&T Inc. lobbies against laws that require the company to provide land lines so it can cut infrastructure costs and expand its voice-over-Internet business.

- Apple Inc. pitches its computer technology as the gateway to classrooms full of A+ students.

- Tobacco companies back efforts to outlaw e-cigarettes for kids in exchange for regulators not treating the new smoking tools like normal tobacco products that face taxes and advertising limits.

- On-demand car booking service Uber Technologies Inc. jumped from no lobbying in the states in 2010 to having foot soldiers in 35 states by 2014. Its goal: avoid rules designed for the traditional taxi industry.

“Not a lot is happening in Washington,” said Lee Drutman, a senior fellow and lobbying expert at New America, a Washington-based think tank, and author of The Business of America is Lobbying. “If you’re stymied at the federal level, you start looking to the states.”

State-by-state lobbying on controversial issues may also be less visible than similar efforts in Washington, especially in light of widespread staff cuts among reporters covering statehouse news.

Drugmakers and the power of 50

Across America, lobbyists for drugmakers — including Enbrel’s maker Amgen — have worked at a feverish pace to push state laws that make it harder for pharmacists to substitute cheaper biosimilars for brand-name biologic drugs, as is commonly done with regular generic drugs.

The laws in many cases require the pharmacist to take extra steps before dispensing the cheaper drugs, including notifying the doctor, retaining extra records or, in some cases, getting patient consent.

Opponents say these laws make it less likely a pharmacist will substitute a biosimilar and more likely to instill doubt in patients about the alternate drugs. That could mean fewer patients get access to cheaper versions of specialty drugs that treat a range of diseases, including cancer, hepatitis C and Crohn’s.

“It’s going to cost some patients more money. It’s certainly going to cost the health care system more money,” said Diana Zuckerman, president of the nonprofit National Center for Health Research, a nonpartisan think tank that vets new medical treatments. “And it’s certainly going to benefit the brand-name companies. That’s the whole point.”

Pharmaceutical lobbyists say biosimilars are tricky to make and could be risky for patients, therefore pharmacists should take extra care when giving them out (though federal regulators are currently developing a system for confirming biosimilars as “interchangeable” with the original medicines). And lobbyists press state lawmakers to pass laws quickly, arguing pharmacists could not substitute the drugs at all without explicit authority. Amgen, for one, also said it is developing several biosimilars that it expects to launch in 2017.So far 30 states have considered bills on biosimilars, according to the National Conference of State Legislatures. Laws have passed in at least 18 states and Puerto Rico since 2013.

Though pharmaceuticals in the U.S. are primarily regulated by the federal Food and Drug Administration, states find plenty of places to jump in — as do lobbyists.

Drug companies ask state lawmakers to make sure Medicaid or other health plans cover their products. They ask for drugs to be distributed widely, such as Mylan Inc. asking states to allow schools to stow EpiPens for any child who has a severe allergic reaction — even without a prescription. Painkiller makers such as Purdue Pharma LP resist efforts to restrict prescriptions, as the opioid epidemic claims lives.

With broad reach in multiple states, the pharmaceutical and health products industry dominates the lobbying landscape, making up 21 of the Center for Public Integrity’s top 101 lobbying entities.

Big names Pfizer Inc., Bayer AG, AstraZeneca PLC and at least 18 other drug companies and their trade associations have each lobbied in 34 or more states since 2010.

Mylan, for example, jumped from having registered lobbyists in nine states in 2010 to 45 states by 2014 as its push for EpiPens took off.

Pharmaceutical Research and Manufacturers of America, the drugmakers’ main trade association, declined to comment for this article. It has said its members are committed to helping ensure “broad patient access to safe and effective medicines through a free market.”

In general, drugmakers favor laws that allow them to sell drugs widely at the price they set, often asking lawmakers to force insurers or government to pick up the tab.

“It is a rare day when we actually win a debate against pharma,” said Leigh Purvis, a health researcher for AARP, which lobbies about drug prices and profits from insurance sold under its name. “They are extremely well funded and extremely effective.”

The drug companies are part of a broader trend — more companies or interest groups are finding it necessary to spread out to all 50 states or close to it.

“These presumably are companies that to some extent are doing business in all 50 states and believe that state policies are increasingly going to be important to their bottom line,” said Thomas Holyoke, a professor of political science at Fresno State University who studies interest groups. “They tend to want more uniformity across the states because it’s a lower compliance burden for them.”

Back in 1997, according to research by a team of political scientists at the University of Iowa, not a single entity had lobbyists registered in all 50 states.

However, in 2013, according to the Center for Public Integrity’s analysis, at least nine companies and interest groups lobbied in every state: AARP, the American Heart Association, AstraZeneca, AT&T, Express Scripts Holding Co., the National Federation of Independent Business, the National Rifle Association of America, Pfizer and PhRMA.

Differing registration rules in the states mean that direct comparisons among them are difficult. Lobbying registrations also likely represent a minimum threshold for the lobbying taking place nationwide.

While some states even require government employees to register if they lend expertise to lawmakers or push for a bill, in other states the rules are looser. New York requires that lobbyists register only if they earn or spend at least $5,000 a year. In Texas, part-time lobbyists aren’t always required to register and report their activity. Lobbying in Nevada is only reported when the legislature, which ordinarily meets every other year, is in session.

Federal decline

Even federal lobbyists are getting in on the state action. Nearly all of the top 20 lobbying firms in the National Law Journal’s 2015 ranking indicated that they are active at the state and local level.

McGuireWoods, a top 20 firm headquartered steps from the Virginia Capitol in Richmond, has said state and local lobbying is its biggest moneymaker. In recent years, D.C.-based firms such as Cornerstone Government Affairs and Summit Strategies bolstered their rosters of state-focused influencers.

It’s all happening at a time when federal lobbying is on the decline. From 2010 through 2014, the number of companies and organizations with registered federal lobbyists declined by 25 percent, according to a Center for Public Integrity analysis of data collected by the Center for Responsive Politics.

To be sure, federal lobbying rules have changed over time, including a 2007 federal law signed by President George W. Bush that tightened rules on lobbying, so more entities are using other tools to influence government outside of formal registered lobbying. Yet in that same five-year period, the number of entities sending lobbyists to state capitals increased 10 percent.

States, meanwhile, are pushing out many more new laws than Congress. Federal lawmakers passed 352 bills and resolutions in 2013 and 2014, according to CQ Roll Call. States passed more than 45,000 bills in that same time period.

Large insurers such as Aetna have long been major players in state lobbying, because insurance is largely regulated at the state level. So is alcohol. As a result, Anheuser-Busch InBev SA has had a steady presence in state capitols, with lobbyists in 49 states in both 1997 and 2013.

But some interest groups are pivoting to the states rather than focusing on Washington, where partisan differences seem to have slowed policymaking. The Consumer Healthcare Products Association, which went from lobbyists in 24 states in 2010 to 34 states in 2013, started pushing for state laws blocking sales of certain cough syrups to minors while it waits for a national ban to prevent teens from abusing the medicine, which can induce hallucinations. They’ve been successful in nine states so far, a spokesman said.

Experts say states also are picking up even more regulatory responsibility as more states expand Medicaid, for example, or are asked to decide specific rules for how to administer certain federal programs, such as welfare.

“If I’m either in favor or against more spending on welfare, I’m now going to spend more time targeting the states rather than just Washington.” said Adam Newmark, a political science professor at Appalachian State University.

Companies that have something to sell to states, such as Xerox Corp. with its speed camera and electronic tolling programs, also spread out to many statehouses. And others play defense against lawmakers seeking new revenue sources: Tobacco company Altria Group Inc. regularly fends off cigarette tax hikes.

In Idaho, Dennis Lake, a Republican state representative at the time, introduced a bill in 2011 that called for increasing the state’s cigarette tax. But he couldn’t get it past the committee he chaired.

He blames heavy lobbying by tobacco companies. Altria had five lobbyists roaming the statehouse halls that year and spent more than $165,000 on lobbying, according to a review by Idaho Falls’ Post Register.

Indeed, one of Altria’s in-house lobbyists, Amanda Klump, spent $2,500 to host two members of Lake’s committee and the speaker of the House at a gubernatorial inauguration party in January that year, according to state records and the Post Register.

“They were everybody’s friend,” Lake said. “Idaho is an anti-tax state, so whenever you try to do something with any of the sin taxes, they come out in force and say, ‘Oh this is a tax increase.’ ”

Altria spokesman David Sutton said the company lobbies on tobacco taxes because they affect its business. “We get engaged when we need to,” he said.

“I don’t think it’s hyperbole to say that the oil and gas industry in New Mexico is essentially self-regulating.”

Eric Jantz, attorney with the New Mexico Environmental Law Center

State dominance

About every two weeks last summer, former Navajo National Councilman Daniel Tso took his white Nissan truck on a tour of oil wells and fracking sites in northwest New Mexico. What he saw there concerned him. Oil was spilled onto the ground, he said, and former fracking sites were not filled in with soil and replanted as promised.

Tso worried about damage to the lands his people hold dear, damage alarmingly near Chaco Culture National Historical Park and its sandstone ruins of the ancient Pueblo peoples.

“We’re tied to the land,” he said. “There’s nothing like walking the land and touching the earth.”

Tso doesn’t trust state agents to regulate the oil and gas drillers. First, Tso pointed out, there aren’t enough inspectors — only 14 to oversee 60,000 active wells in the state, according to a report by Inside Energy, a journalism initiative funded by the Corporation for Public Broadcasting.

And even if it had enough inspectors, the state has little authority to enforce its own regulations. The penalties for spills and other violations haven’t been updated since the 1930s, thanks in part to the influence of the powerful oil and gas industry.

In 2013, lawmakers and environmentalists tried to update the state’s rules to increase penalties for spills and other infractions from $1,000 per day to $10,000 per day.

Oil and gas lobbyists swarmed the statehouse during hearings and votes on the bill.

“I’ve never seen so many suits in my life,” said Viki Harrison, director of Common Cause New Mexico, which lobbies for tighter ethics rules. “People were just lined up outside. They couldn’t even fit in the committee room.”

Thirty-six oil and gas lobbyists representing 23 companies and five trade associations worked to sway lawmakers to nix the bill, her organization later reported.

Among them was Kent Cravens, who started a job as the lead lobbyist for the New Mexico Oil & Gas Association one day after resigning from the state Senate. He did not return requests for comment.

State records show his boss at the oil association, president Steve Henke, picked up the $17,638 tab after lawmakers dined at The Bull Ring, an upscale steakhouse an 11-minute walk from the State Capitol in Santa Fe, 10 days after the bill was introduced. The association declined to comment.

The bill failed in the New Mexico House by a vote of 32-36. Since then, state regulators have made no formal attempts to seek penalties on oil companies in New Mexico.

It’s one example of the formidable power industries that band together can wield in particular regions or statehouses. While some industries, like pharmaceuticals and telecommunications, seek influence in all 50 states at times, others, such as energy in the West or agriculture in the Great Plains, dominate one particular part of the country. And through their lobbyists, they fight to ensure tax and regulation schemes benefit them as much as possible.

“Right now I don’t think it’s hyperbole to say that the oil and gas industry in New Mexico is essentially self-regulating,” said Eric Jantz, an attorney with the New Mexico Environmental Law Center who worked on the failed bill. “Oil and gas brings out its lobbyists and gets people from the oil patch to come and testify and spreads money around.”

The energy industry wields incredible influence in states whose coffers are filled with oil tax money, such as North Dakota.

“There’s almost no deception. It’s almost completely transparent,” said Democratic Rep. Ben Hanson, who represents the city of West Fargo in the state Assembly. “They want you to pass these laws because it will make it easier for their companies to operate.”

The North Dakota Petroleum Council, which represents 575 oil and gas companies in the state, did not return calls for comment.

Individual organizations can wield incredible power in particular states as well. An average of 29 lobbyists per year roamed Montgomery on behalf of the Alabama Education Association teachers union from 2010 to 2014, according to state records.

Fidelity Investments averaged 18 lobbyists in the Massachusetts Statehouse, less than a mile from its global headquarters.

The Walt Disney Co. relied on an average of 30 registered lobbyists each year to represent it and its subsidiaries in Florida.

Join the conversation

Show Comments