Introduction

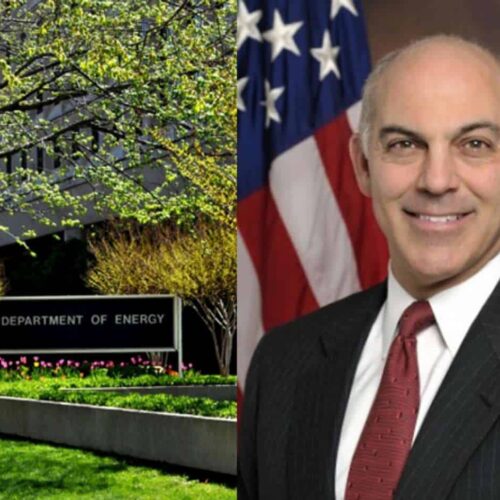

The head of the Energy Department’s embattled loan program, Jonathan Silver, resigned Thursday after a tumultuous month during which the program’s first loan recipient, the solar panel manufacturer Solyndra, declared bankruptcy, leading to a wave of scrutiny for his agency.

Energy Secretary Steven Chu confirmed in a statement emailed to iWatch News and ABC News that Silver had stepped down, but said his departure had long been expected.

“Under his leadership, the loan program has demonstrated considerable success, with a broad portfolio of investments that will help American companies compete in the global clean energy market,” Chu said. “Because of my absolute confidence in Jonathan and the outstanding work he has done, I would welcome his continued service at the Department, but I completely understand the decision he has made.”

Silver’s departure came on the same day that President Obama was forced to defend his administration’s decision to lend $535 million to Solyndra, a decision that came despite deep misgivings among professional budget analysts inside the government. His administration was facing intense scrutiny over the loan decision, both from Republicans in Congress, but also from inspectors general at two agencies, and from the Justice Department.

Last month, the California solar panel manufacturer filed for bankruptcy. Days later, the FBI raided its headquarters in what sources have said is a probe to determine whether the company misled officials in order to obtain federal support.

The Center for Public Integrity’s iWatch News, working in partnership with ABC News, first reported on simmering questions about the loan program in March. Already, government auditors had begun questioning whether the Energy Department was giving favorable treatment to some applicants – including Solyndra. At the time, Silver strongly defended the loan to Solyndra, promising that the company would be delivering thousands of new American jobs.

Energy Department officials and the White House have maintained that politics never entered the equation when loans were being considered. But critics of the administration questioned whether there was political influence, noting that a top investor in Solyndra was also a major fundraiser during Obama’s 2008 campaign.

Silver defended the program last month in an appearance before Congress, but deflected questions about the Solyndra loan, telling members he had arrived at the department after the loan had already gained approval.

“Support for innovative technologies comes with inherent risks,” Silver testified.

Obama said Thursday that his administration has loaned billions to start-up high tech firms like the now-bankrupt solar firm Solyndra based not on political influence, but “on the merits.”

“I have confidence decisions were made based upon what’s good for the American people,” Obama said in a press conference Thursday in response to questions from ABC News senior White House correspondent Jake Tapper. “There were going to be some companies that did not work out. Solyndra was one of them.”

“All I can say is the Department of Energy made these decisions based on their best judgments,” Obama said, defending the decision to make Solyndra the country’s first loan guarantee recipient.

When Silver joined the Department in late 2009, he was touted for his venture capital experience — a critical need for a department that had been tasked with handing out billions of dollars to start-up companies in the alternative energy space. Energy Department officials said that during his tenure, the loan programs he oversaw were supporting 38 projects that include the world’s largest wind farm and several of the nation’s largest photovoltaic solar generation facilities.

Energy officials said Silver is leaving to become a Distinguished Visiting Fellow at Third Way, a Washington think tank.

For months, Silver had portrayed the Solyndra financing as a good bet for the public even as the company was falling apart financially behind the scenes.

In May, as iWatch News and ABC News investigated how the Energy Department took shortcuts in approving the loan in 2009, Silver came to the project’s defense. He downplayed the company’s financial troubles even as the Energy Department refinanced its loan this year to give Solyndra more time to pay off its debt. Silver was not with the department when the loan was issued in 2009, but was when it was refinanced.

“That was an effort on our part to ensure we had the tightest and best structured project,” Silver said in the May 9 interview with iWatch News and ABC News.

Yet that loan restructuring has triggered widespread criticism, as investors who raised $75 million for the company – including companies affiliated with Obama bundler George Kaiser – will stand in line before taxpayers in bankruptcy court.

In the interview, Silver placed little significance in the fact that Energy Secretary Steven Chu announced a conditional commitment for the $535 million financing in March 2009 before all outside due diligence was completed, saying all sign-offs came before it closed that September.

“I have never seen a company go straight up without a bump along the way,” said Silver, a former venture capitalist. “I have no doubt they will continue to hire more people.”

By late 2010, however, the Energy Department knew Solyndra faced a major cash flow crisis. As part of the government’s loan restructuring, DOE earlier this year began sitting in on board meetings of the California solar panel firm – getting an up close view in the crucial months before its collapse, bankruptcy and raid by the FBI and Energy Department Inspector General.

Records show the due diligence shortcuts were one of a cascading series of warning flags the Energy Department ignored or bypassed in rushing to announce Obama’s first green energy loan guarantee.

Energy officials have said they backed Solyndra as a potential game-changer in the effort to spur innovative clean technology projects.

Republicans who are heading the congressional probe – Reps. Fred Upton (Mich.) and Cliff Stearns (Fla.) – released a statement Thursday saying they do not believe Silver’s resignation will keep them from seeking more answers.

“Mr. Silver’s resignation does not solve the problem,” the congressmen said in a joint statement. “American taxpayers are already on the hook for the half billion dollar Solyndra bust – what other shoes does this Administration expect to drop?”

Read more in Money and Democracy

Money and Democracy

FACT CHECK: Recycled spin at New Hampshire GOP debate

The Republican presidential candidates reused more than a few false claims during the roundtable discussion

Money and Democracy

FACT CHECK: Did Rep. Darrell Issa run ‘political interference?’

Fox News Sunday’s Chris Wallace suggests Rep. Issa may have advocated for a Solyndra-like green company

Join the conversation

Show Comments