Introduction

Republican candidates hammered each other for 2 hours in a lively Nevada confrontation — and often strayed from the facts.

- Cain denied that his tax plan would boost taxes for 84 percent of Americans, or fall heavily on those with lower incomes. A new study by the nonpartisan Tax Policy Center says just that.

- Santorum and Bachmann denounced Cain’s 9 percent “business flat tax” as a European-style “value-added” tax, which Cain also denied. The TPC study agrees with Santorum and Bachmann.

- Romney claimed his Massachusetts health care plan “[doesn’t] have a government insurance plan” and relies on private insurance. Actually, his plan expanded Medicaid, and relies on that state-federal government program to cover many of the state’s previously uninsured.

- Perry and Romney clashed on job creation. Perry was mostly right in claiming Texas saw a greater number of jobs created than Massachusetts. But he was wrong that his state created more jobs in the last two months than Massachusetts did in four years under Romney.

- Romney relied on a disputed study from an anti-immigration group when he said “almost half” the jobs created under Perry were for illegal immigrants. Perry called that “an absolute falsehood.” But more neutral estimates support the idea that some portion of the Texas job gains were due to illegal immigration.

- Perry accused Romney of hiring illegal immigrants, to which Romney said, “I don’t think I’ve ever hired an illegal in my life.” In fact, there’s no evidence that Romney knowingly hired illegal immigrants — but he hired a lawn service that did, and was slow to fire the contractor.

- Santorum and Perry were both off base in claiming that Romney once touted his Massachusetts plan as a model for the nation. He didn’t. He said it wasn’t necessarily right for all states.

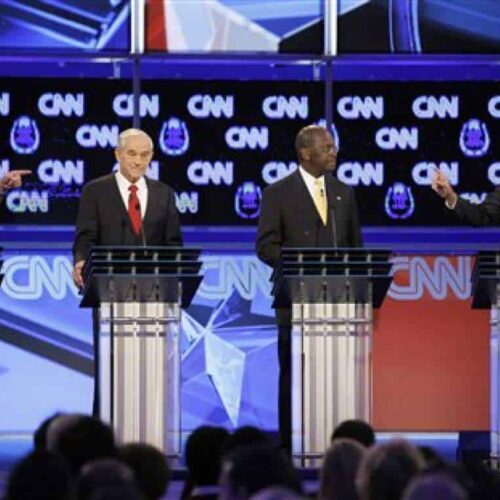

The Oct. 18 debate was held at the Venetian Resort Hotel Casino in Las Vegas, Nev. Seven presidential contenders participated: Rep. Michele Bachmann of Minnesota, former Godfather’s Pizza CEO Herman Cain, former House Speaker Newt Gingrich, Rep. Ron Paul of Texas, Texas Gov. Rick Perry, former Massachusetts Gov. Mitt Romney and former Sen. Rick Santorum of Pennsylvania. (Former Utah Gov. Jon Huntsman was invited but boycotted the event. He explained that he did so to “to show my solidarity with the Granite State’s first-in-the-nation primary status.” New Hampshire political leaders are irked because Nevada moved its presidential caucus date to Jan. 14.)

The debate was carried live on CNN. It was cosponsored by the Western Republican Leadership Conference.

Cain’s Tax Plan

Santorum said a new analysis shows Cain’s plan would increase taxes for a large majority of Americans, which Cain denied.

Santorum: “Herman’s well-meaning, and I love his boldness, and it’s great. But the fact of the matter is, I mean, reports are now out that 84 percent of Americans would pay more taxes under his plan. That’s the analysis. …”

Cain said that “simply is not true.” He also said his plan “does not raise taxes on those that are making the least.”

But Santorum is correct. An analysis posted a few hours before the debate by the nonpartisan Tax Policy Center concluded that Cain’s 9-9-9 plan (for 9 percent flat taxes on personal incomes, business transactions and retail sales of goods and services) would result in tax increases for 83.8 percent of all individuals and families, compared with what they would pay under current tax policy. Taxes would decrease for those making over $200,000 a year, with those making over $1 million a year paying 15 percent less in taxes than under current policy (which assumes the Bush tax cuts are extended). As for those “making the least,” the TPC analysis — which is based on a computer model of the tax system similar to the models used by the Treasury Department and the congressional Joint Committee on Taxation — concludes that those making less than $10,000 a year would see an average tax increase of $1,122, and those making between $10,000 and $20,000 would see taxes go up an average of $2,705.

The Tax Policy Center analysis is the most extensive and sophisticated yet attempted by any independent group. It concludes that “the three taxes combined are equivalent to a 25.38 percent national sales tax,” which is a conclusion very close to one reached earlier by a former chief of staff of the Joint Committee on Taxation, Edward Kleinbard, who found Cain’s three taxes would have the same effect as a 27 percent tax on wage income, and would “raise the tax burden on many low- and middle-income taxpayers.”

Cain invited viewers to “read our analysis” on hermancain.com, but that was easier said than done. We found no analysis on his website at first, only the sketchy and incomplete description that had been there for weeks. A link to a “scoring report” appeared later, midway through the debate. But when we attempted to access it, we were greeted with a message saying “service temporarily unavailable … please try again later.”

Value Added?

Santorum and Bachmann both contended — and Cain denied — that his proposed 9 percent tax on business transactions amounted to a “value-added” tax. A VAT is used in European countries and is ultimately borne by consumers in the form of higher prices, like a hidden sales tax.

Bachmann: “[A]t every level of production you have a profit, and that profit gets taxed. … And ultimately, that becomes a value-added tax. It’s a hidden tax. …”

Santorum: “[Y]ou have a sales tax and an income tax and, as Michele said, a value-added tax, which is really what his corporate tax is. …”

Cain: “[Y]ou’re absolutely wrong. It’s not a value-added tax.”

Actually, Cain’s own website says he would replace the corporate income tax with a “9% Business Flat Tax” that would fall on “Gross income less all purchases from other U.S. located businesses, all capital investment, and net exports.” The Tax Policy Center concluded that this describes “a subtraction method value-added tax, sometimes called a business transfer tax (BTT).” So we score this one for Bachmann and Santorum. Whatever Cain wants to call it, his tax looks like a VAT and functions like a VAT.

For the record, the earlier analysis by Kleinbard, now a professor of law at the University of Southern California, takes a different view. He says the 9 percent business flat tax “operates in economic substance as just another wage tax,” like the employer’s share of Social Security and Medicare taxes. But whether the tax pushes down wages (as payroll taxes do) or pushes up prices (like a VAT), the effect is pretty much the same — a regressive levy that burdens low- and middle-income wage earners relatively more than affluent investors.

Romney Wrong On Massachusetts Health Care

Romney went too far in claiming that government insurance didn’t play a role in the health care overhaul he signed into law as governor of Massachusetts. The plan expanded Medicaid.

Romney: “[W]e don’t have a government insurance plan. What we do is rely on private insurers, and people — 93 percent of our people who are already insured, nothing changed. For the people who didn’t have insurance, they get private insurance, not government insurance.”

But some of the previously uninsured were indeed covered by “a government insurance plan” as a result of the law Romney signed. Of the 411,722 Massachusetts residents who have gained insurance since the law was enacted, 193,393 joined MassHealth, which is the state’s Medicaid and Children’s Health Insurance Program, as of Dec. 31, 2010. That figure is from the state Division of Health Care Finance and Policy. Not all of the expansion is specifically due to the law, however. The health care overhaul expanded Medicaid to children in families earning up to 300 percent of the federal poverty level, but the struggling economy also pushed others into Medicaid eligibility. The Massachusetts Medicaid Policy Institute says that 76 percent of the growth would have occurred without the health care law. The institute says 61,000 persons joined MassHealth programs because of the law.

The rest of the expansion in insured residents came from 77,330 buying their own private coverage, and 158,973 getting private insurance with the help of subsidies through the state insurance exchange.

Romney vs. Perry on Jobs

Perry was largely correct in comparing Texas and Massachusetts job figures during the four years, from January 2003 to January 2007, when Perry and Romney both served as governors. Perry was wrong, however, when he claimed that Texas created more jobs in the “last two months” than Massachusetts did in four years under Romney. However, exactly how wrong Perry is on that point depends on the data used to measure Texas job growth.

Perry: “Mitt, while you were the governor of Massachusetts in that period of time, you were 47th in the nation in job creation. During that same period of time, we created 20 times more jobs. As a matter of fact, you’d created 40,000 jobs total in your four years. Last two months, we created more jobs than that in Texas.”

Perry is correct, as we wrote before, that Massachusetts was 47th in the nation in job creation under Romney. During that time, from January 2003 to January 2007, Texas created nearly 835,000 jobs compared with about 46,000 jobs in Massachusetts — which is not quite 20 times more, but close. It’s a little more than 18 times. However, as we have pointed out before, Texas is a much larger state with a growing population, and it has other natural advantages that Massachusetts does not have.

As for the claim that Texas created more jobs in the last two months than Massachusetts did in Romney’s entire four years, the most recent Bureau of Labor Statistics figures show that total non-farm jobs in Texas increased by about 24,500 in July and August, which is a little more than half the number of jobs that Massachusetts created in Romney’s four years. By that standard, Perry would be wrong. However, the Federal Reserve of Dallas calculates that Texas created 43,000 in July and August, which puts Perry closer to the truth — but still 3,000 short.

In response, Romney correctly said Massachusetts’ unemployment rate “got down to 4.7 percent” while he was governor. It went from 5.6 percent in January 2003 to 4.6 percent in January 2007, although at the same time the nation’s unemployment rate fell at a slightly faster rate (from 5.8 percent to 4.6 percent).

Perry vs. Romney: Jobs for Texas Illegals

Romney said “almost half” the jobs created under Perry were for illegal immigrants, which Perry said was “an absolute falsehood.” In fact, Romney based his claim on a disputed study by an anti-immigration group.

Romney: “[O]ver the last several years, 40 percent, almost half the jobs created in Texas were created for illegal aliens, illegal immigrants.”

Perry: “That is an absolute falsehood on its face, Mitt.”

Romney: “It’s actually…”

Perry: “That is — that is absolutely incorrect, sir.”

Romney: “Well, take a look at the study.”

Perry: “There’s a third — there’s been a third party take a look at that study, and it is absolutely incorrect.”

Romney’s claim is based on a September report from the Center for Immigration Studies, a think tank that advocates for lower immigration. According to the report, “Of jobs created in Texas since 2007, 81 percent were taken by newly arrived immigrant workers (legal and illegal).” And, the report states: “Of newly arrived immigrants who took jobs in Texas since 2007, we estimate that 50 percent (113,000) were illegal immigrants. Thus, about 40 percent of all the job growth in Texas since 2007 went to newly arrived illegal immigrants and 40 percent went to newly arrived legal immigrants.”

But just as Perry said, the study has come under fire from some who claim it is based on flawed methodology.

Pia Orrenius, an economist and immigration expert at the Federal Reserve Bank of Dallas, told the Dallas Morning News the methodology is “misleading” because, “[y]ou’re comparing gross inflows to net job creation. You have to compare net to net.”

Chuck DeVore, a visiting senior fellow at the Texas Public Policy Foundation, also wrote an analysis critical of the CIS study:

DeVore: Put simply, CIS compared a net increase in jobs in Texas over a four year period with agross increase in employed newly arrived immigrants in Texas. This is truly an apples to oranges comparison that should be thought of in the same way as if a report claimed that Google is a larger company that Apple because its market capitalization of $162 billion exceeded Apple’s annual revenues of $100 billion.

CIS stands by its study, but one of the study’s authors, Steven Camarota, told us if people prefer the “net to net” figures, those are included in the CIS study as well. And those figures are much more modest than the numbers given by Romney in the debate. Since the second quarter of 2007, the employment of foreign-born immigrants in Texas increased by 150,000 compared with an increase in employment for native-born workers of 130,000. By that calculation, immigrants counted for 54 percent of the net increase — not 81 percent.

DeVore called that “a more supportable contention” and an “apples to apples comparison.”

But not all of those immigrants were illegal immigrants. Camarota said he did not have figures on how many of that 54 percent were illegal immigrants, but he said, “I would guess it’s less than half.” That puts the percentage of job growth taken by illegal immigrants somewhere closer to 20 percent, he said. That’s still a “very big number,” Camarota said. But it’s a far cry from the “nearly half” cited by Romney.

Perry vs. Romney: ‘You Hired Illegals’

Perry recycled an old chestnut, accusing Romney of hiring illegal immigrants to do landscaping work, and saying that Romney “knew about it for a year.” Romney said, “I don’t think I’ve ever hired an illegal in my life.”

The truth is that there’s no evidence that Romney knowingly hired illegal immigrants. But he hired a lawn service that did. And Romney kept the company on for a year after the issue was highlighted in a 2006 Boston Globe story — only to find out the company was still employing illegal workers.

During a 2007 presidential debate, then candidate Rudy Giuliani chastised Romney for having “illegal immigrants working at your mansion.” We wrote about the issue then, and highlighted theBoston Globe story a year prior that documented that several illegals worked at Romney’s home off and on over an eight-year period. The workers were employed by a contractor, Community Lawn Service with a Heart.

But that wasn’t the end of it.

After the debate, the Globe wrote a follow-up story, noting that the company was still employing illegal immigrants, and that the company was still being used by Romney.

Boston Globe, Dec. 4, 2007: Standing on stage at a Republican debate on the Gulf Coast of Florida last week, Mitt Romney repeatedly lashed out at rival Rudy Giuliani for providing sanctuary to illegal immigrants in New York City.

Yet, the very next morning, on Thursday, at least two illegal immigrants stepped out of a hulking maroon pickup truck in the driveway of Romney’s Belmont house, then proceeded to spend several hours raking leaves, clearing debris from Romney’s tennis court, and loading the refuse back on to the truck.

After being questioned by Globe reporters, Romney issued a statement saying that he had just learned that the company was still hiring illegal immigrants and that he had fired the company.

The statement said: “After this same issue arose last year, I gave the company a second chance with very specific conditions. They were instructed to make sure people working for the company were of legal status. We personally met with the company in order to inform them about the importance of this matter. The owner of the company guaranteed us, in very certain terms, that the company would be in total compliance with the law going forward.

“The company’s failure to comply with the law is disappointing and inexcusable, and I believe it is important I take this action,” Romney said.

Santorum & Perry Misrepresent Romney

Santorum and Perry were both wrong in claiming that Romney said in his book that he wanted to impose his state’s health care plan on the rest of the country.

The three-way exchange started when Santorum said the former Massachusetts governor didn’t “have credibility” when promising to repeal the federal health care law, because Romney signed a bill requiring his state’s residents to buy health insurance.

Romney: “I was asked, is this something that you would have the whole nation do? And I said, no, this is something that was crafted for Massachusetts. It would be wrong to adopt this as a nation.”

Santorum: “That’s not what you said.”

Romney: “You’re — you’re shaking — you’re shaking your head.”

Santorum: “Governor, no, that’s not what you said.”

Romney: “That happens — to happens to be …”

Santorum: “It was in your book that it should be for everybody.”

Romney: “Guys …”

Perry: “You took it out of your book.”

Santorum: “You took it out of your book.”

Like Romney, we have been over this, too. We wrote about it after the Fox News debate. It is true that Romney revised his book No Apology when it was re-released as a softcover. As he acknowledged in a Sept. 15 interview with CNN’s Wolf Blitzer, Romney removed a sentence in the hardcover version that said: “We can accomplish the same thing for everyone in the country.” But in the context of the book the phrase “the same thing” was a reference to the goals addressed by the state law: “portable, affordable health insurance.” Romney made it clear in interviews after he signed the legislation that he didn’t think his state’s health care law was necessarily right for all states or the nation.

Asked if his state’s health care law will “work for the country,” Romney told MSNBC’s Chris Matthews on April 12, 2006: “There are certain aspects of it that I think would work across the country, perhaps better in some states than others. Of course the great thing about federalism is you let a state try it and see how it works before you spread it out.”

– Brooks Jackson, Eugene Kiely, Robert Farley and Lori Robertson

Read more in Money and Democracy

Money and Democracy

FACT CHECK: Romney’s ‘magnet’ charge attracts scrutiny

Republican presidential front-runner referred to a number of U.S. policies as ‘magnets’ for illegal immigration

Money and Democracy

FACT CHECK: Biden inflates Michigan crime figures

On a U.S. tour promoting the American Jobs Act, Biden bungles a few statistics on crime, sexual assualt

Join the conversation

Show Comments