Introduction

When Pennsylvanians agreed to a massive increase in natural gas drilling in the state, they were told that the economic benefit would outweigh any potential risk to the environment.

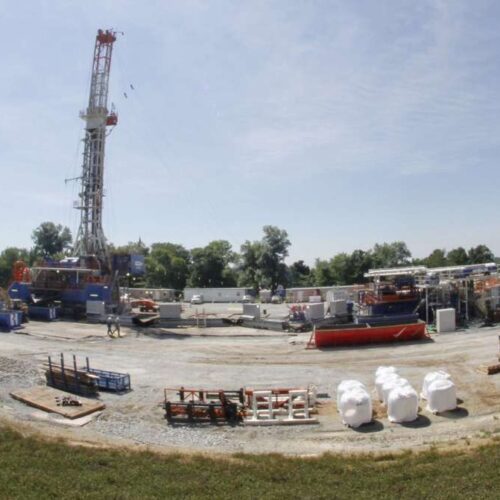

The drilling employs a controversial technology known as hydraulic fracturing, or fracking, that backers say will help the nation become energy independent and provide jobs and lower heating costs for Pennsylvanians.

But with gas prices collapsing thanks to an unforeseen glut, energy companies are pushing for permission to export the commodity to countries such as Japan and South Korea. Exports will lead to more drilling, more damage to roads and the environment, and higher, rather than lower, gas prices, say critics.

Pennsylvanians are “surprised, stunned, angry and upset” about the export push, said Delaware Riverkeeper Maya van Rossum. “And that’s whether or not they’re supportive of fracking.”

Some history

Fracking involves injecting millions of gallons of water, sand and toxic chemicals into holes drilled into underground shale deposits.

The technology, which became popular in Pennsylvania around 2008, enabled drilling companies to access enormous, previously unreachable supplies of natural gas — and brought hope to a state long-mired in a recession.

Despite its economic potential, fracking has a dubious environmental record. Exempt from the Clean Water Act, the Safe Drinking Water Act and the Clean Air Act, it has been blamed for contaminating residential wells and sparking explosions.

Drilling rigs don’t make great neighbors, either. The fracking process — which requires trucking in billions of gallons of water — is unsightly and tough on roads. But those concerns took a backseat to drilling in Pennsylvania, where a pro-fracking governor, Republican Tom Corbett, was elected in 2010.

Natural gas production in the U.S. has been so prolific that the price of gas has fallen to approximately $2.50 per million British thermal units from a previous high of about $15.

Low prices were great for consumers, who were able to heat their homes at record-low cost, but not so great for natural gas producers, whose profits and stock prices spiraled downward.

Shares of Chesapeake Energy, for example, the No. 1 producer in Pennsylvania and No. 2 nationwide, reached nearly $70 in 2008 but are now trading around $17.

New markets, more profits

Gas companies are now seeking authorization from the Department of Energy to export the gas overseas, where demand is higher.

They already have permission to export the gas to the nation’s free trade partners, which are not major potential customers. Many are obtaining permits to build the massive facilities that convert the gas to liquid by chilling it to minus 260 degrees Fahrenheit, which allows it to be shipped overseas.

To realize big profits, they need permission to export to non-free trade agreement countries such as South Korea, India, China and Japan, where the price of natural gas has reached more than $18 per million British thermal units.

Requests from 16 gas producers to export to such countries are currently in limbo. Approval may hinge on the conclusions published last month in an Energy Department report on exports. The status of the permits will remain undecided until the closing of a public comment period and additional department analysis.

If the agency approves the permits, natural gas companies would be allowed to export upward of 21 billion cubic feet of liquefied natural gas (LNG) per day — more than one-quarter of current U.S. consumption.

The report claims that although such large-scale exports would cause a slow rise in domestic prices, they would benefit the nation’s economy overall by improving the balance of trade, encouraging foreign investment in the U.S. and creating more income for natural gas producers.

But the macroeconomic benefits of exports don’t mean much to those who have to deal with gas rigs, potholed roads and contaminated water supplies.

“If you think, ‘That’s where we are today and the markets couldn’t be more deflated,’ what happens if the markets open up and the industry is allowed to go hog wild?” asked David Masur, executive director of the Pennsylvania-based environmental advocacy group PennEnvironment.

Masur estimates that approximately 6,000 wells have been drilled in Pennsylvania so far, and said that as many as 50,000 wells could be drilled as the industry grows.

“I think we will continue to see many of the effects we’re seeing now, many-fold over,” he said.

One town’s story

In the beginning, fracking brought a much-needed economic boost to Dimock, Pa.

“There were preachers in church saying this was God’s work, this is a gift from heaven,” said Victoria Switzer, a retired teacher who lives in Dimock.

But the town’s water became so contaminated with methane gas that a private well exploded. Water taps became potential flamethrowers. Fifteen families in the town filed a lawsuit against Cabot Oil & Gas, alleging the company’s drilling practices had contaminated their water supply.

Cabot was barred from drilling in the Dimock area, fined $120,000 and ordered to deliver water to the residents. That hasn’t stopped other drillers.

Switzer, who was one of the plaintiffs in the lawsuit, said the sky is lit up at night by natural gas flares. Roaring natural gas compressors make sleeping difficult. And these problems continue for days, sometimes weeks, on end, she continued.

“Let’s just plunder and glut the market. How is that going to benefit us?” Switzer asked. “I can’t even heat my home with natural gas.”

Dimock may be a major source of natural gas, but there’s no pipeline to Switzer’s house.

Van Rossum said the drillers’ promise that fracking would be good for Pennsylvania was simply “messaging.”

“It’s not truth,” she said. “It’s not reality.”

For its part, the Marcellus Shale Coalition, an energy industry trade association focused on Pennsylvania, said in a statement that it supports “common-sense natural gas export policies” that “could be a major economic boost for our nation.”

As environmental groups push to regulate fracking and manufacturers seek to keep natural gas prices low in America, producers are primarily concerned with getting back in the black.

More than $170 million has been spent so far lobbying on a variety of liquefied natural gas issues, including transportation and facility siting. At least $6.5 million of that sum was spent specifically to support or oppose LNG exports. The actual figure is probably much higher because of vague lobbying disclosure laws.

From shortage to glut

In the early 2000s, the U.S. was on track to become an importer of natural gas as resources ran low.

Energy companies built multibillion-dollar LNG import facilities up and down the country’s coastlines. But the advent of widespread fracking by companies such as Exxon Mobil, Chevron and Chesapeake Energy made the facilities unnecessary.

The industry invested “tons of money in building these re-gasification terminals, and in less than five years, they’re barely operating,” said Bill Cooper, president of the Center for Liquefied Natural Gas.

Exporting, however, would not only solve the price problem, it would mean the idle import facilities might become useful if energy companies converted them to export terminals.

But the energy companies’ gain could come at a loss for consumers.

A study that the Energy Department’s Energy Information Administration published in January 2012 concluded that domestic natural gas prices would rise dramatically if the U.S. began exporting.

Other LNG export studies, from the Brookings Institution and the Baker Institute Center for Energy Studies at Rice University, also concluded that prices would rise but that increases would be moderate and manageable.

“We do have an astronomical amount of natural gas and the demand predictions in the future will not cause that to go away, even if we do export,” Cooper said.

Dow objects

In addition to consumers, some petrochemical, manufacturing and utility companies have expressed reservations about large-scale exports because of their potential impact on domestic natural gas prices.

Petrochemical companies such as Dow Chemical are among the largest consumers of natural gas in the country, and they use it both as a primary material for products and as a fuel.

Dow CEO Andrew Liveris blasted the Energy Department’s recent pro-export report, saying it “offers the baffling conclusion that the U.S. would be better off using its domestic natural gas advantage to fuel growth and jobs in other regions [of the world] versus strengthening the U.S. economy through manufacturing and benefiting consumers with lower energy costs.”

Scott Morrison, government affairs manager for the American Public Gas Association, says his organization opposes exporting LNG, because doing so will make natural gas less affordable for the consumers and manufacturers served by APGA’s members. APGA represents local, publicly owned gas utility companies.

Exporting LNG will also negatively affect the affordability of natural gas vehicles and run counter to the goal of U.S. energy independence, Morrison said.

But most trade associations and companies have been loath to speak out, either because their members don’t take a uniform view or for fear of appearing anti-free market.

The National Association of Manufacturers, for instance, wouldn’t say whether it supported or opposed natural gas exports, only that it supports “free trade and open markets” and believes “policies that accommodate growth in domestic natural gas production” are important.

Legislative issue

The release of the most recent Energy Department report sparked a response from Capitol Hill.

Sen. Ron Wyden, D-Ore., the incoming chairman of the Energy and Natural Resources Committee, has called for the Energy Department to develop a national energy strategy and to further clarify its criteria for approving pending permits.

In response to the report, Wyden said in a statement that he will continue working to make sure that “unfettered natural gas exports don’t harm U.S. consumers and manufacturers.”

Rep. Ed Markey of Massachusetts, the ranking Democrat on the House Natural Resources Committee, has been one of the most vocal opponents of jumping into large-scale LNG exports and says that more careful study and debate on the economic and environmental effects of the practice are needed.

Markey introduced two bills, the North America Natural Gas Security and Consumer Protection Act and the Keep American Natural Gas Here Act, that are likely to be reintroduced in the new Congress, said Eben Burnham-Snyder, a committee spokesman.

Markey also blasted the study.

In a letter to Energy Department Secretary Steven Chu, he wrote that the study contains “fundamental flaws” that cause it to “severely underestimate the negative impacts of large-scale natural gas exporting,”

In addition, there are long-standing concerns that LNG facilities would become terrorist targets. A fire resulting from an LNG spill could severely burn people up to 1 1/4 miles away, according to a Government Accountability Office report.

Sens. Mary Landrieu, D-La., and Lisa Murkowski, R-Alaska, both support exports.

Louisiana is home to Cheniere Energy’s Sabine Pass facility, the first newly proposed LNG export terminal the Energy Department has approved. Alaska is home to a 40-year-old facility that is the only currently operating LNG export terminal in the U.S.

Lengthy debate expected

The Energy Department’s new report is just one factor in deciding the future of the natural gas exports.

Gaining permission to export natural gas isn’t easy.

First, a potential exporter needs permission to export to free-trade agreement countries. Next, the company needs to get permission from the Federal Energy Regulatory Commission (FERC) to build a facility. FERC in turn works closely with the Environmental Protection Agency, the Coast Guard, the Department of Transportation and the states.

If the applicant is given the green light to build a terminal, it can go back to the Energy Department and request permission to export to non-free trade countries, such as Japan, South Korea and India.

Even if their requests are approved, they will have to spend $6 billion to $10 billion on each new or converted facility, and construction is likely to take several years.

Once the facilities are up and running, Pennsylvania and other gas-producing states can expect to see a big increase in drilling, a prospect that has left some in the state fearful that its history of natural resource exploitation will repeat itself.

“Pennsylvania has been the dumping ground for so long,” Switzer said. “I taught history, and people don’t learn from history.”

Read more in Money and Democracy

Money and Democracy

Internet ammunition sales draw scrutiny

Legislation aims at cracking down but NRA says regulation has proven ineffective

Join the conversation

Show Comments