Introduction

A growing number of federal whistleblower laws has raised expectations that the government will be more aggressive in protecting workers who expose phony accounting and other financial frauds.

But corporate reformers worry that federal agencies still aren’t doing enough to enforce what’s on the books. Passing laws is one thing. Making them work in the real world is another.

A case in point is the federal Occupational Safety and Health Administration’s struggle to step up enforcement of whistleblower protections that were a centerpiece of the 2002 Sarbanes-Oxley corporate reform law. The law, passed in the wake of the Enron Corp. accounting debacle, gave OSHA the power to swiftly order employers to reinstate corporate whistleblowers with back pay.

Workers, however, have won few victories inside OSHA in the nine years since “Sarbox” became law.

From 2002 through May 20 of this year, OSHA found merit in only 21 whistleblower complaints under Sarbox and dismissed 1,211 others, according to agency data obtained by iWatch News. That translates into a win rate of less than 2 percent. During the same span, the agency oversaw 291 Sarbox settlements between employees and employers. Another 237 cases were withdrawn before the agency made a decision.

As an iWatch News investigation last year and federal audits have shown, OSHA’s whistleblower-protection programs have been handicapped by poor management, inadequate training and internal policies that reduced the number of workers who could qualify for whistleblower status. While policing workplace safety is OSHA’s main job within the U.S. Department of Labor bureaucracy, the agency is also responsible for enforcing 21 whistleblower laws, ranging from tipsters of corporate fraud to railroad workers and commercial sailors who report safety hazards.

Assistant Secretary of Labor David Michaels said OSHA has completed an in-depth review of its whistleblower protection program, which found that in some regions cases “had to go through managers who were not well-trained in whistleblower law.” He said the agency is working to reverse anti-whistleblower policies and improve training and staffing in the unit that investigates whistleblower complaints.

“We’re doing better,” Michaels told iWatch News this week. “We still have a ways to go.”

How far OSHA has to go may be seen in its latest data: From October 2010 through late May, OSHA didn’t give final approval to any Sarbox whistleblower claims. During the same span, OSHA dismissed 81 whistleblower complaints and oversaw 22 settlements between workers and their employers.

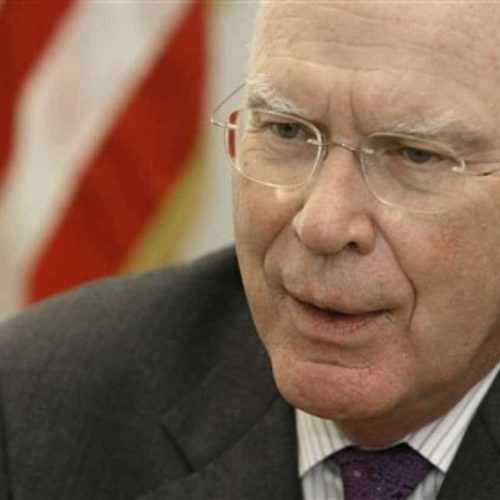

These new statistics indicate whistleblowers still face an uphill climb inside OSHA, complain senior lawmakers who co-authored Sarbox’s whistleblower provisions, Republican Sen. Charles Grassley of Iowa and Democratic Sen. Patrick Leahy of Vermont.

“I want to know why things haven’t changed,” Grassley told iWatch News in a statement. He said it appears that “it’s still business as usual at the Department of Labor in denying Sarbanes-Oxley whistleblower claims.”

Leahy said he was concerned that the 2 percent success rate showed “very little actual protection for the men and women who risk their careers” to report corporate fraud and misconduct. “If problems in implementation continue, I will seek ways to fix them,” he told iWatch News.

Michaels said there hasn’t been enough time yet for the Sarbox caseload to catch up with the efforts the agency has made to overhaul how it handles whistleblower complaints. And many improvements are still in the works, he said.

The agency is preparing to debut a new training program this fall for workers involved in whistleblower investigations, Michaels said. It is also seeking more money to expand the staff needed for its growing workload.

Last year, OSHA hired 25 more investigators, upping the number of agency staffers dedicated to handling whistleblower claims to over 100. President Barack Obama’s budget for fiscal 2012, which begins in October, includes a request for $20.9 million for OSHA’s whistleblower programs, an increase of $6.1 million over this year. If Congress approves the money, OSHA would hire an additional 45 staff to work on whistleblower investigations.

War over whistleblowers

Questions about OSHA’s handling of Sarbox complaints represent another skirmish in an escalating warfare over whistleblowers.

In a recent iWatch News article, whistleblower advocates charged that the Internal Revenue Service’s bounty program for rewarding informants who turn in big tax cheats had been hampered by excessive secrecy and hostility toward whistleblowers within the IRS’s entrenched bureaucracy.

A new Securities and Exchange Commission bounty program, approved in May to reward corporate insiders who expose securities fraud, has raised hopes among whistleblower advocates. But they question whether the SEC — which ignored a tipster’s repeated pleas to investigate Wall Street financier Bernard Madoff — has the commitment to make the rewards program work.

The SEC bounty program will run parallel to OSHA’s Sarbox whistleblower program. Thanks to last year’s Dodd-Frank financial reform law, whistleblowers who believe they’ve been abused by their companies now have three options for defending themselves, depending on the circumstances of their cases: they can go to OSHA, they can complain to the SEC, or they can sue in federal court.

Most retaliation cases are expected to still start at OSHA, whistleblower attorneys say, because the SEC isn’t likely to get involved unless the retaliation claims are part of a larger securities fraud investigation, and because litigation in federal court can be more costly than other options.

The Commodity Futures Trading Commission, meanwhile, is preparing regulations to cover its own whistleblower bounty program, also mandated by the Dodd-Frank reform law.

Companies worry that the SEC bounty program and the proliferation of other whistleblower laws could undermine corporate efforts to police themselves by encouraging workers to file claims with various government agencies rather than reporting problems to internal compliance offices and working from within to fix problems.

“I certainly expect employees to look for multiple ways to get windfalls,” Steven Pearlman, a Chicago attorney who has represented Caterpillar Inc. and United Air Lines Inc. in Sarbox whistleblower cases.

Changing data

When iWatch News first examined OSHA’s handling of Sarbox whistleblower cases one year ago, agency data showed it had issued merit findings in 25 cases in the history of the program – a higher number than the 21 cases OSHA data now shows. Asked how the number of merit findings had dropped to 21 from 25, an OSHA spokeswoman said the lower number may reflect the agency’s efforts to “enhance the accuracy and timeliness of its information database.”

The agency says settlements between employees and their employers – which total nearly 300 in the nine-year history of the program – should be counted as findings of merit in favor of whistleblowers. In many cases, Michaels said, OSHA lets employers know it is going to find in favor of the worker, which prompts the company to make a settlement offer.

Whistleblower advocates counter that settlements aren’t always clear wins for whistleblowers. Rather than reinstating a fired employee, a settlement might involve an agreement to provide the worker with a letter of recommendation, or be a small “nuisance” settlement.

Companies say workers rarely win protection from OSHA because, more often than not, their complaints simply didn’t hold up to scrutiny. Most Sarbox claims, corporate attorneys say, involve trivial workplace issues or involve small-dollar issues that don’t affect shareholders’ investments.

“You have a tremendous number of cases that are filed that don’t have merit,” Pearlman said. “I think it’s a real mistake for the senators and plaintiffs’ attorneys to jump to the assumption that the law isn’t strong enough or isn’t being enforced rigorously enough.”

Whistleblower advocates, on the other hand, believe that a lack of effective enforcement has indeed been the problem. They say years of policy decisions by OSHA officials have excluded many workers from qualifying for protection.

The Dodd-Frank Wall Street reform law, passed last summer following the global financial meltdown, reversed some the whistleblower policies put in place by labor officials during President George W. Bush’s administration.

Sen. Leahy successfully pushed, for example, to include language making it clear that Sarbox protections apply to employees of subsidiaries of publicly traded companies, reversing what he said was “an overly restrictive interpretation of the original law . . . that had led to the unfair denial of protections to many whistleblowers.”

Will recent ruling reverse the trend?

Under Sarbanes-Oxley, workers who lose their claims within OSHA can appeal the case to an administrative law judge. If they lose there, they can appeal a step higher to the Labor Department’s five-member Administrative Review Board.

(After filing an initial claim with OSHA, workers also have the option of pulling out the OSHA process and going straight to federal court.)

During the Bush administration, whistleblower advocates complained that the Administrative Review Board was the source of many of the policies that made it hard for workers to gain Sarbox protection. But the board – now filled with Obama administration appointees – has reversed many of the policies of previous years.

A recent decision by the board has “gutted” many of the defenses companies had used to knock down claims that they had retaliated against whistleblowing employees, Pearlman said.

The May 25 ruling involved two workers who claimed they’d been fired by Paraxel International, a firm that tests drugs for pharmaceutical companies, after reporting that data from clinical trials had been falsified. After both OSHA and an administrative law judge rejected their claims, the Administrative Review Board took up the case.

The board not only overturned the judge’s decision against the two workers, it issued a 50-page ruling that reduced the legal and evidentiary requirements for whistleblowers and shot down some of the defenses that employers had frequently used to defeat Sarbox claims.

The board said, for example, that workers seeking whistleblower protection do not have to conclusively prove fraud. Instead, workers only need to show they reasonably believed securities laws were being broken or were about to be broken.

The board also said that workers do not have to quantify the impact of the wrongdoing involved in their complaint. In the past, companies had succeeded in getting some cases dismissed by arguing that, even if some wrongdoing had occurred, it wasn’t significant enough to damage the company’s stock price and hurt investors. The board said, though, that a “wide range of conduct may be important to regulatory bodies or a reasonable investor that falls short of satisfying the rigorous requirements for securities violations.”

The new ruling has brought applause from whistleblower attorneys, who say it could help break down barriers that workers have faced inside OSHA.

David Marshall, a Washington, D.C., whistleblower attorney, said the ruling “helps put the teeth back into the Sarbanes-Oxley Act’s whistleblower provisions as Congress intended when it passed this historic law in 2002.”

Read more in Inequality, Opportunity and Poverty

Finance

Few celebrations for year-old Dodd-Frank reform law

Your Wall Street reform reading list for today

Finance

What’s your experience with short-term or payday loans?

Help inform iWatch’s reporting through the Public Insight Network

Join the conversation

Show Comments