Introduction

Wayne Coons felt a sense of panic when he realized that the $350 payday loan he got over the Internet was costing him hundreds of dollars more than he thought.

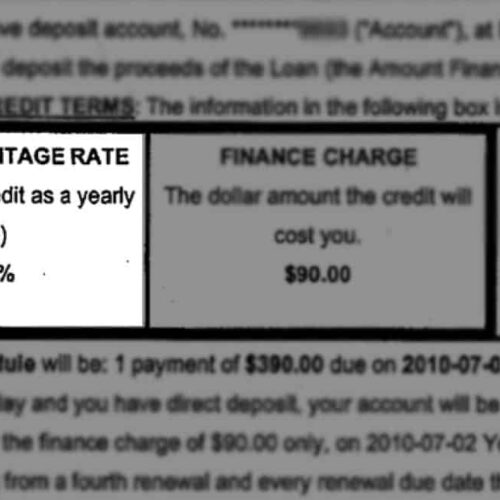

Having borrowed from a storefront payday lender once, Coons thought online loans worked the same way. The man from Puyallup, Wash., expected the lender, Ameriloan, to deduct $457 from his bank account on his next payday to pay off the loan.

But when Coons checked his account two weeks after getting the loan last February, he was shocked to discover that Ameriloan had withdrawn only $105 and that he still owed $450 on his $350 loan. Coons, like many borrowers, had not carefully read the fine print. In fact, Ameriloan was allowed to “renew” the loan every two weeks, withdrawing $105 several more times without a penny of it reducing Coons debt. In all, the $350 loan could cost Coons more than $1,000.

Coons was fortunate. He quickly got in touch with the state Department of Financial Institutions and was told that Ameriloan is not licensed in the state of Washington to make payday loans.

As a result, Ameriloan could not make Coons pay back the loan. He closed his bank account and is off the hook.

“It’s illegal to make a loan without a license,” explained Deborah Bortner, the department’s director of consumer services. “If you’re not licensed, it (the loan) is not collectable and it’s not enforceable.”

The dirty little secret among online payday lenders who violate state laws is that they cannot win in state court, regulators say. Indeed, Bortner said she’s never seen a case where an online payday lender took a borrower to court.

Regulators in some states that license payday lenders routinely advise borrowers to follow Coons’ example. Check with state authorities to see if the loan is illegal, and if it is, close your account.

“If someone makes you a loan that’s illegal, either because they don’t have a license or they violate usury laws, you’re not under any obligation to pay it back,” said Norman Googel, an assistant attorney general in West Virginia.

Googel advises all borrowers who might be tempted to get a payday loan online, “Just don’t do it.”

Rick Brinkley, the head for Better Business Bureau of Eastern Oklahoma, agreed. He’s heard from more than 2,000 consumers who were caught off guard by the terms of online payday loans. When they can’t keep up with the payments, Brinkley said, “They’ve just entered a new world of hell that they weren’t prepared for.”

One problem is that many online payday lenders claim that state laws don’t apply to them. Some lenders say they are beyond the law because they’re based offshore. Others claim to be owned by Indian tribes, giving them the cloak of tribal sovereign immunity. Still others hide their ownership behind an impenetrable curtain of shell companies.

That means that some online payday lenders make loans even in 18 states that essentially ban the practice.

The industry defends this position, arguing that state laws don’t necessarily apply to them. Lisa McGreevy, the president and chief executive officer of the Online Lenders Alliance, said members of her organization utilize “an array of legal business models” and argues that consumers should have a variety of choices when borrowing.

“As the Kansas City Federal Reserve stated in a recent report, restricting short-term loans ‘could deny some consumers access to credit, limit their ability to maintain formal credit standing, or force them to seek more costly credit alternatives.”

The Miami tribe of Oklahoma , which claims to own several online payday lenders, say its loans help people in desperate situations from possibly losing their cars or homes.

Angela Vanderhoff skoffs at this notion. She says she stupidly borrowed $400 from one of the tribe’s lenders and almost lost her car as a result.

“It was the biggest nightmare I’ve ever gone through in my life,” Vanderhoff said.

Because the lender could draw directly from her bank account, Vanderhoff felt she had no control. When she was in an accident, she says she called them to arrange to delay a payment. But instead, the lender tried to withdraw the money anyway – four times in a single day. She ended up having to pay $200 in overdraft fees on top of the interest.

Vanderhoff said she called the lender to try to pay off the loan in full, but her requests were ignored.

Brinkley of the Better Business Bureau says the lenders make it difficult to pay off the loan early. A typical contract will tell the borrower to contact the lender three full business days in advance if you don’t want the loan renewed. Vanderhoff said she’d do that but then later be told that they didn’t have any record of her request or that she didn’t put it in writing.

Borrowers complain that when they fall behind in the payments, they receive constant phone calls from the lender. The lender will even call friends and the boss, names that are required when you fill out a loan application.

The Federal Trade Commission recently got a preliminary injunction order against Western Sky Financial and other tribal payday lenders in South Dakota that were sending letters to employers insisting that they had the right to garnish wages without a court order. FTC attorneys say that tribal lenders “do not have legal authority to garnish the pay of consumers who owe an alleged debt without first obtaining a court order.”

The suit also says it’s a violation of federal law to require automatic debits from a bank account as a condition of getting a loan.

Online payday lending is big business, and it’s grown rapidly as people hard hit by the recession struggle to pay their bills. In 2010, the industry made $10.8 billion in loans, up nearly 90 percent from 2006, according to Stephens Inc., an investment firm that tracks the industry.

The FTC encourages people considering payday loans to consider alternatives, such credit unions or small-loan companies.

Even the Online Lenders Alliance offers consumers advice, such as be sure to read the terms of the loan and don’t agree to any loan that you cannot afford.

Read more in Inequality, Opportunity and Poverty

Debt Deception?

Courts debate validity of Indian-owned payday lenders

Race car driver’s business under scrutiny

Debt Deception?

IMPACT: Credit union swaps payday loans for friendlier offering

Credit union drops controversial loan offering after iWatch News investigation

Join the conversation

Show Comments