Introduction

The 50 states and the District of Columbia award $12 billion a year in subsidies to businesses each year, but fewer than a quarter of 246 incentive programs disclose how many jobs were created or how many workers were trained, according to a new study.

Fewer than half of those that do report disclose wages paid to workers, according to Good Jobs First, an economic subsidy watchdog group. The report notes that disclosure of subsidies has improved, with all but four states posting at least some information online.

Critics of tax breaks, low-interest loans, grants and other corporate subsidies say government officials should do more to prove the subsidies are needed and ensure promises about jobs and other taxpayer benefits are delivered.

“Taxpayers have the right to know exactly what they are getting in return for their economic development investments,” said Greg LeRoy, executive director of Good Jobs First, which gets about 90 percent of its funding from foundations and also receives some union contributions.

Scrutiny of subsidies is especially important when state budgets are tight, said Phineas Baxandall, senior tax and budget policy analyst for the U.S. Public Interest Research Group, a consumer advocacy organization. “The misperception is this is free money, especially if gets given out as tax breaks. Every subsidy dollar has to be offset by some cut to another public priority or higher taxes,” he said.

Subsidies are popular with politicians because they can help them get elected in two ways: by scoring points with companies that bankroll campaigns and with voters for promises of jobs.

Take Washington, which successfully clinched a deal to have Boeing build its planned 777X airplanes in-state thanks in part to an $8.7 billion tax deal, which Good Jobs First says is “by far the largest in U.S. history.”

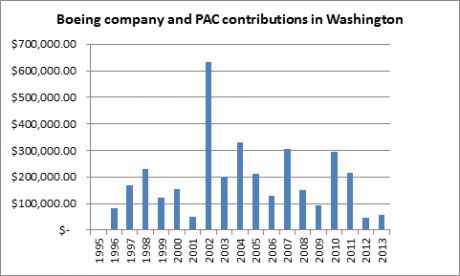

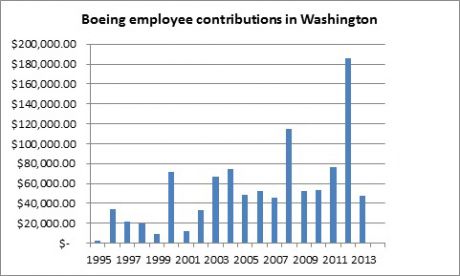

Boeing has contributed millions of dollars in campaign contributions the past few decades to state officials and candidates, and two of the top three state subsidies over time have gone to Boeing from Washington.

Gov. Jay Inslee, a Democrat who pushed for the recent tax deal, received $58,718 in contributions for his 2012 campaign from the Boeing’s political action commiteee and its employees — second most among companies and their employees, according to a Center for Public Integrity analysis of Washington State Public Disclosure Commission’s online campaign finance records.

The analysis also showed campaign contributions from Boeing and its PAC, voluntarily funded by employees, to all candidates and groups spiked in 2002 and contributions from individuals identifying themselves as Boeing employees spiked in 2012 — the election years before the legislature approved the subsidies, $3.2 billion in 2003 and the recent one in 2013.

“There’s just a lot of potential for these kinds of campaign contributions by contractors to be unduly influencing decisions,” said Baxandall, of PIRG. He said there should be restrictions on campaign contributions from contractors or companies receiving subsidies and state disclosures about subsidies should include campaign finance data about groups winning deals.

A spokesman for Boeing declined to comment.

It’s too early to say how many jobs have been generated from the recent tax deal

But the 2003 pact, where Boeing agreed to build 787s, generated 14,000 jobs, $2.3 million in wages and benefits, and $13.9 million in tax payments in 2012, according to an economic impact study commissioned by Washington Aerospace Partnership, a coalition of business and labor groups and elected officials.

A spokeswoman for Inslee said he has publicly defended the Boeing subsidy.

“For every dollar we put into that, we’re going to get $3 back in increased tax revenue. So it’s a fair thing for taxpayers and it’s a great incentive package for Boeing,” Inslee told TVW, a nonprofit television network in Washington.

The state invested an estimated $1.4 billion from 2004 to 2012 in tax incentives and other investments supporting the aerospace industry, according to the Washington Aerospace Partnership report.

Over that time, the industry generated more than $4 billion in tax revenue for the state, meaning “every $1 of state resources committed to aerospace over this period is associated with more than $2.90 in tax revenues,” according to the report.

Read more in Inequality, Opportunity and Poverty

Finance

Meet the Banking Caucus, Wall Street’s secret weapon in Washington

Lawmakers help industry donors beat back tougher rules

Finance

Treasury to Comerica: Take our money, please!

IG report says government officials handed bank millions for problem-plagued debit cards

Join the conversation

Show Comments