Introduction

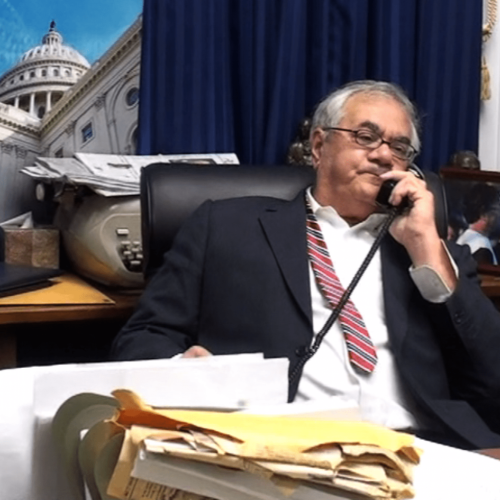

After deftly dodging federal regulation for years, the nation’s top credit rating companies now must get past the formidable Barney Frank.

Last week, as the U.S. House debated the Wall Street reform package crafted largely by Frank, the Massachusetts Democrat quietly slipped regulations into the bill that would force the most significant overhaul of the credit rating industry to date.

The top raters — Standard & Poor’s, Moody’s and Fitch — seemed ripe for regulation ever since they awarded inflated grades to investments that ultimately unraveled the economy.

If the provisions in the bill, passed by the House last Friday, make it through the Senate, investors who lost billions of dollars on those top-rated financial products would likely find it easier to sue the raters for fraud. Also, by no longer mandating that mutual funds buy only top-rated investments, the bill has the potential to squeeze the raters out of their special status in the financial system.

“This really sounds like progress,” said Lawrence J. White, an economics professor at the Stern School of Business at New York University and a specialist in the credit rating industry.

The credit raters have embraced some of Frank’s changes — an indication they’re not exactly frightened by the entire proposal. They are, however, engaged in a yearlong lobbying campaign, which has cost them about $2.7 million so far, a record for the rating industry, documents show.

The plan by Frank, chairman of the House Financial Services Committee, does not eliminate the conflicts of interest in the credit rating industry, an omission he said he regrets. And it does not contain another idea that has been gaining traction among critics of the raters – a ‘public option’ that would create an alternative government-run credit rating agency to compete with the private sector.

“The basic problem with the rating agencies is that they’re paid by the people they’re rating; there’s an inherent conflict of interest,” Frank said in an interview with the Huffington Post Investigative Fund. Curbing these conflicts, he said, is “one thing we’re still trying to get at.”

In the interview, Frank said the raters, on the whole, “hate” his bill. In particular, they have not taken kindly to the prospect of more lawsuits.

But Frank’s legislation faces an uncertain fate in the Senate, where lawmakers have struggled to rewrite rules for Wall Street. Frank’s counterpart in the Senate, banking committee chair Christopher Dodd (D-Conn.), has floated his own reform package. Dodd’s bill lacks some of Frank’s more forceful new regulations of the rating industry.

If Frank’s provisions die in the Senate, it would not be the first time the raters escaped an overhaul.

A three-part Investigative Fund series recently documented how the credit raters have repeatedly defeated government oversight by arguing that their ratings are opinions, protected by the constitutional right to free speech. With help from the First Amendment, the raters also remain undefeated in court against disgruntled investors.

Although Frank said the raters should enjoy some First Amendment cover, he argued “you do not have full First Amendment protections when you’re doing things for money.”

Standard & Poor’s already faces some 50 lawsuits from investors and state attorneys general, who argue that the raters should compensate the people and institutions who bought top-rated toxic securities. “The door has already been opened,” said Daniel Bacine, a partner at Philadelphia law firm that has investigated possible lawsuits against the raters.

But Frank said his bill would, for the first time, provide investors an explicit right to sue the rating companies. It also would change the standard for suing them. Instead of proving a rating company “knowingly or recklessly” issued a bogus rating, also known as committing fraud, investors would only have to show the raters were “grossly negligent.”

“We made it much easier for them to sue,” Frank said, which will “put the rating agencies very much on notice.”

Floyd Abrams, a storied First Amendment attorney who has represented Standard & Poor’s for more than 20 years, said switching to a so-called negligence standard could “be a very major threat to rating agencies being able to go about their business.”

In effect, Abrams said in an interview this fall, investors would need to show the raters merely acted unreasonably.

In a letter published in the New York Times this week, S&P’s president, Deven Sharma, warned that “singling out rating firms for increased and discriminatory liability standards is likely to result in more defensive, less robust ratings.”

Sharma, on the other hand, recently endorsed Frank’s plan to scale back the raters’ entrenchment in the financial system.

S&P and other companies anointed by the government as Nationally Recognized Statistical Rating Organizations, or NRSROs, are chiseled into many rules that regulate the financial industry.

One such rule allows big banks to leverage themselves based on how well their assets are rated by the NRSROs. Another requires mutual funds and other investment managers to buy only top-rated products.

The result: The government is essentially “outsourcing” its regulatory duties to the raters, said White, of New York University.

Frank’s bill would remove the raters from many of these rules, a decision that “could erode their market share,” White said.

Sharma seems to disagree. In a letter to the SEC this month, he said, “We believe investors will continue to view credit ratings as providing analytical insight and transparency even if they are not referred to in the various rules, statutes and forms where they appear today.”

Some rating companies also endorsed a few of Frank’s more modest measures, including one to beef up their compliance departments and another requiring them to follow their own rating methodologies.

Those changes alone don’t go far enough, said James Heintz, associate director of the Political Economy Research Institute at the University of Massachusetts, Amherst.

Heintz has another idea: create a public option. Had there been an unbiased, government-run credit rating agency operating five years ago, “it’s unlikely the crisis would have happened in this magnitude,” he said.

Heintz likens his independent agency to the Food and Drug Administration, which assess the health risks of drugs before the public can buy them. Likewise, before investors can buy a financial product, the public rating agency would have to evaluate its risk to the financial system. Bond issuers, he said, would still be free to get a second opinion from private raters.

Because the agency would not generate profits — any surplus would be transferred to the Treasury — it would be free of conflicts of interest. Without profits, he said, there’s no motive to please bond issuers or investors.

Frank said he has mulled a public option but is “skeptical that you could insulate a government-run rating agency from pressure from the people being rated.”

In that case, some argue, why not at least have an independent watchdog overseeing the rating industry?

The Congressional Oversight Panel, for instance, floated the idea of a Credit Rating Review Board that would audit ratings after the fact. The idea stems from the Public Company Accounting Oversight Board, an independent nonprofit created to oversee auditors of public companies after the Enron scandal.

A similar proposal, articulated by Demos, a liberal think-tank in New York, would have the watchdog act as a middleman between bond issuers and the rating agencies. To minimize conflicts, the watchdog would assign bonds to rating agencies at random. The watchdog would withhold assignments from, or even suspend, the least accurate raters.

This policy would “change these three rating agencies profoundly,” said James Lardner, a senior policy analyst at Demos.

The idea, first mentioned in an oversight panel report published in January, was initially well received on Capitol Hill. Two Democratic congressmen on Frank’s committee sought to include it in the bill, an effort that ultimately failed.

Read more in Inequality, Opportunity and Poverty

Finance

At top subprime mortgage lender, policies Were invitation to fraud

Long Beach Mortgage employees say firm routinely ignored warnings

Join the conversation

Show Comments