Introduction

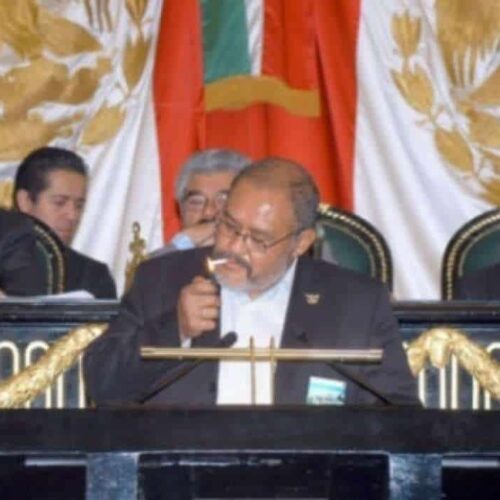

“Ladies and gentlemen,” interrupted Mexican congresswoman Ruth Zavaleta Salgado, as she called to order a legislative session in Mexico City in October 2007. “Whoever is smoking cigars or cigarettes: Please, please leave the room to smoke outside.”

Since 2000, smoking had not been allowed in federal buildings in Mexico – including the Congress. But seven years later, as lawmakers debated a tough anti-smoking initiative, the rule was attracting open protests among the body’s 500 legislators.

Lackluster legislative support for tobacco control is no surprise in a nation that consumes 38 billion cigarettes a year; and where two of three physicians and more than one-fourth of adolescents smoke.

Mexico is Latin America’s third-largest tobacco market. The country is important to big tobacco not only because of its market size but its political influence in the region.

Mexico rushed to be the first Latin American country to ratify, in May 2004, the World Health Organization’s Framework Convention on Tobacco Control, a global public health treaty that calls for tough controls on smoking and the tobacco industry. Mexico’s capital city today has the nation’s toughest no-smoking rules, which makes all inside public spaces 100-percent smoke-free. And the total number of smokers in the nation has declined in the past two decades, from 26 percent to around 16 percent of the adult population, according to government figures.

Despite those advances, Mexico has actually crawled toward tobacco control.

It took the Mexican government almost 30 years to restrict tobacco advertising; 20 years to ensure smoke-free public places; and nearly 10 years to agree on adding pictographic health warnings on cigarette packs. Tax hikes recommended by the WHO have faced tough opposition in the Mexican Congress. And oversight remains weak: Only 10 federal health inspectors monitor tobacco and other industries.

Mexico has 11 million smokers and, although consumption is down, revenues are up since sales have increased for higher-priced brands.

All this has frustrated public health experts, who predict up to 60,000 Mexicans will continue to die each year due to preventable illnesses caused by tobacco consumption. And Mexico’s go-slow approach to tobacco control, they warn, has set a bad example for other countries in the region. “I would not be surprised at all if what we saw in Mexico happens in other countries,” said Derek Yach, former top assistant to the WHO director general and now head of PepsiCo’s Global Health Initiative.

“A captured government”

Mexico’s tortuous path in the drive to reduce smoking emerged from an eight-month probe of global tobacco companies by the International Consortium of Investigative Journalists. The investigation found an unusually close relationship between the industry and government regulators; an industry that lavishes gifts and charitable donations on political allies; lobbyists who have played inside roles in weakening tobacco controls; and an industry legal assault that has won glaring exceptions to hard-won no-smoking rules.

“The government of Mexico has been a captured government that pushes the agenda of tobacco companies,” charges Alejandro Madrazo Lajous, a researcher with the Right to Health program at the Center for Economic Research and Teaching in Mexico City. Madrazo, who negotiated with the Health Ministry for tougher regulations, likened its lawyers to corporate counsel protecting their company. “I have never seen a corporate lawyer defend the interests of a company with such determination,” he said.

For many years, the government had reason to defend tobacco interests over public health: Between 1972 and 1990, a state-owned monopoly supplied the industry with tobacco leaf produced by thousands of peasants.

Until a decade ago, Philip Morris, makers of Marlboro, and British American Tobacco (BAT), makers of Lucky Strike and Pall Mall, were roughly equal competitors in the Mexican market. Today, almost two thirds of the tobacco business in Mexico belongs to Philip Morris, and a third to BAT, according to Euromonitor market report. Neither is among the largest private companies in Mexico, but Philip Morris does have Carlos Slim.

Carlos Slim Helú is more than a tobacco baron —he is the world’s wealthiest person, worth an estimated $54 billion, according to Forbes magazine. As a telecommunications and retail tycoon, Slim’s unrivaled clout reaches deep into the Mexican political system. His early fortune fed off tobacco, and he remains a major player in the industry. His longtime tobacco company was Cigarros La Tabacalera Mexicana, and he holds a particular fondness for the Mexican brands Delicados and Faros. Although in 2007 his holding company reduced its stake in Philip Morris de Mexico from 50 percent to 20 percent, ICIJ estimates, based on public securities filings, that his tobacco business last year was worth $284 million. Between 1997 and 2006, Slim was a director with Philip Morris International’s former parent company, Altria. Today he serves on the board of Philip Morris International, whose Marlboro brand accounts for nearly half the Mexican market.

“Tell me, do you believe anyone in this country… will deny an audience to one of his aides?” asked Rafael Camacho Solis, a leading tobacco control advocate. “I think no one really wants to be in a fight with Slim in this country. In no other place is there another man who is so rich, and who has so much control over things that can affect an entire country.”

Slim declined to comment for this story.

Critics of Mexico’s slow pace on tobacco control say Slim’s clout in Mexico on behalf of Philip Morris, and a strong lobbying push by BAT, persuaded the government that it’s better to seek deals with the industry than fight it.

Evidence of this influence is in documents obtained from the Mexican Ministry of Health that show Philip Morris and BAT representatives attended at least 30 meetings with regulators between May 2003 and June 2004. At many, if not all, of these meetings, no other outside interest was represented, sources told ICIJ. Officials who attended the meetings recall them as more like friendly talks.

The government granted the industry latitude in forming tobacco regulations. For example, on June 24, 2003, regulators agreed with BAT and Philip Morris to set aside the WHO ban on use of words like “light,” “soft,” or “ultralight” on cigarette packs, and instead print a simple warning that no cigarette is safe. Regulators that year also left it to the industry to “assess” a proposal to cover 40 percent of the backsides of packs with health warnings, and later report its finding to the government.

A peso per pack

A year later, it took only 21 days after Mexico’s ratification of WHO rules for officials to break a key promise of the pact: to keep tobacco companies away from the process of how nations decide to implement the treaty.

In 2004, in Los Pinos — Mexico’s presidential residence — Carlos Slim, then-President Vicente Fox, BAT’s Mexico director, and Health Minister Julio Frenk struck a deal that tobacco control activistssay effectively postponed the WHO rules and the imposition of new tobacco excise taxes.

This agreement became known as the “peso per pack.” The industry agreed to charge a fee per pack to consumers which would go to a special fund at the Health Ministry. Frenk sought to raise $350 million dollarsto help cover the government’s care for people with tobacco-related illness. The government agreed not to impose even higher excise taxes on tobacco through the deal’s 29-month lifespan.

In return, the companies agreed to stop broadcast advertising, take down outdoor ads and suspend sponsorship of public events, among other measures.

Principals in the deal are proud of the accomplishment. María Vargas, a former lobbyist for BAT, remembers it was the company’s director of corporate affairs, Carlos Humberto Suárez Flores, who first presented the proposal. But the Health Ministry’s top tobacco regulator at the time, Ernesto Enríquez Rubio, takes credit for drawing up the plan after several trips and long discussions with his counterparts in Spain and Brazil. And at Philip Morris, a former executive says it was Francisco Espinosa de los Reyes, the company’s veteran government and corporate affairs director, who authored the deal. “He got the idea of gradual changes,” said a former Philip Morris executive who also worked with Espinosa. “That model, of a gradual implementation, was totally a Philip Morris discovery. The manner in which the law was to be negotiated had not been used anywhere else in the world.”

Another Philip Morris Mexico executive recalled that there were smiles and hugs at the company’s offices the day the agreement was signed. Espinosa and another PM executive, Antonio Sánchez, received the company’s President’s Award. “The agreement provided a check for three years against the increase in taxes,” said the former aide.

“There was agreement, and that was what was also very satisfying,” Espinosa de los Reyes said. “Far from encountering barriers … there was always a basis for dialogue and understanding.”

Tobacco control advocates say the industry quickly found loopholes in the deal. As late as 2009 there were extensive Camel advertising campaigns in the streets, and a festival of young musicians sponsored by Marlboro. They also criticize the delay in implementing controls and the lack of transparency regarding how industry money would be used.

“For me [the agreement] was negative because it limited fiscal policy, softened advertising controls. There was clearly a loss of our governing capacity,” said Mauricio Hernández Ávila, who at the time headed the government’s National Public Health Institute, and is now Mexico’s undersecretary of health.

Outside Mexico, the agreement was controversial enough that it derailed a bid by Health Minister Frenk to lead the WHO, according to former officials of the global health body. “He was the best candidate. He should have won, but that [agreement] hurt him,” said Gro Harlem Brundtland, former director-general of the WHO.

Frenk went on to become president of Slim’s new Carso Health Institute, a foundation that would promote health campaigns. Today, Frenk is dean of the School of Public Health at Harvard University. He declined a request for an interview, citing scheduling problems.

The Slim connection

Key to the industry’s efforts in Mexico is gaining access to government officials. And industry experts say no one has enjoyed greater access than Carlos Slim and his associates.

It is difficult to verify the Slim group’s ties to government agencies involved in tobacco regulation. ICIJ filed more than a dozen information requests for government records of meetings, mail, and talks with Slim or tobacco executives. The ministries of Economy, Agriculture, Health and Treasury said no such documents exist, while the Procuraduría Federal del Consumidor — Mexico’s consumer protection agency — advised ICIJ it had destroyed boxes containing archived memos and communiqués in 2009 after deeming the material obsolete. Mexico’s freedom of information law allows for the destruction of records deemed no longer pertinent.

Other documents, made public during U.S. tobacco litigation, do suggest that Slim’s people enjoyed a direct dialogue with government officials. In 1997, for example, weeks before Slim was named to the board of directors of Philip Morris International, the company received a copy of a hand-written note from Mexico’s top government attorney for consumer affairs, which addressed looming tobacco controls:

“Carlos,” begins the note from Francisco Lerdo de Tejada. “I think what’s most convenient for the consumer and the industry would be for us to anticipate the reactions that these measures can produce in Mexico. Taking intelligent and timely action could save many headaches and serve consumers.”

Tobacco control advocates say this text is an example of the too-close relationship between Slim and government regulators. The government at the time was considering more than a hundred separate measures restricting tobacco advertisement and consumption.

Lerdo de Tejada disagrees. “The interpretation that they want to give is a malicious interpretation,” he said in an interview. “It’s a very visionary note,” he added. “What I wanted to tell the industry is: Gentlemen, get updated on what’s happening internationally. … I sent these letters to many industries.”

Lerdo de Tejada went on to found Estrategia Total (Total Strategy) a lobbying firm that now advises the Mexican Council Against Tobacco, sponsored in part by pharmaceutical company Pfizer, maker of a smoking cessation drug. His cousin, Sebastián Lerdo de Tejada, is a congressman and former lobbyist reportedly close to the tobacco industry.

Slim’s reach within Mexico is legendary. According to philanthropic data analyzed by professor Michael Layton of Mexico’s Autonomous Technical Institute, 41 percent of all charitable donations made in 2007 in Mexico came from Slim’s foundations. Among the recipients: the government’s Ministry of Health. Slim’s Telmex — Latin America’s largest telecommunications firm — paid for public transplant and surgery programs through its Telmex Foundation, according to Mauricio Hernández, Mexico’s undersecretary for health. The government’s National Public Health Institute, which ironically does research into tobacco-related illness, received $816,633 from Slim foundations in 2008 and 2009, according to documents obtained through Mexico’s federal Access to Information Institute. The money funded work on breast cancer and bioethics. Hernández said the Slim foundations have assured the ministry that the funds do not come from tobacco profits. He added, however, that it would be difficult to independently ensure a non-tobacco source for the contributions.

Computers and car races

The road to Mexico’s 2007 law was not a smooth one. The earlier “peso per pack” agreement was a stop-gap measure, in effect delaying more far-reaching changes mandated by the WHO agreement Mexico had signed on to. Now came the hard part of mandating higher cigarette taxes and no-smoking areas.

In October 2005 a congressman from the conservative National Action Party claimed the tobacco industry was bribing legislators. Miguel Ángel Toscano, then actively pushing far-reaching controls on the industry, singled out BAT lobbyists María Vargas and Karem Caballero. He claimed that BAT had invited at least 30 lawmakers to Formula One car races in Brazil, Hungary and Barcelona, at a time when they were considering new tobacco laws.

Toscano produced no evidence of the gifts, but the claim stuck and for a while cast a shadow of mistrust on tobacco lobbyists and their allies in Mexico’s Congress.

Vargas no longer works for BAT. She responded to ICIJ via e-mail from Spain, where she now lives.

She confirmed that tobacco companies had invited legislators to an auto race while traveling overseas. “They (BAT) organized a trip to Paraguay and Brazil with legislators and Customs officials to present the problem of smuggling and piracy,” Vargas related. “And another, I think to China, organized by Philip Morris for the same purpose … One of those trips coincided with a Formula One race and the company offered complimentary tickets to attend, that’s all.”

Mexican authorities never investigated whether legislators or the companies acted improperly in taking these trips. Toscano was isolated, and the tougher tobacco controls he pushed were defeated — but they would resurface two years later.

Congressional lobbying is relatively new in Mexico. For 68 years, the Mexican Congress was dominated by the president’s party, the Institutional Revolutionary Party, which acted as a rubber stamp for the executive branch. That finally changed in 1997, when the opposition finally won significant blocs. Ten years later, in 2007, as the tobacco control law neared passage, industry marshaled its forces in the legislature. Congresswoman Ruth Zavaleta, who chaired the chamber’s procedural work in late 2007, found it odd that commissions on the judiciary, education and finance — which don’t address public health matters — were asking her for hearings on the tobacco control bill. Such requests for additional analysis can be a death sentence for legislation. Behind the request, Zavaleta says she learned, were tobacco industry representatives.

Congressman Tonatiuh Bravo Padilla, of the Education Committee, recalled that Daniela Ortiz, then deputy director of government relations for Philip Morris, visited him while the tobacco bill was being debated. Ortiz offered to donate, on his behalf, computers to the public school of his choosing. A year later, Bravo Padilla said, he and representatives of Philip Morris attended a ceremony christening 15 used computers at a school in Guadalajara.

That year Philip Morris gave computer equipment to 10 public schools across Mexico. Between 2006 and 2008, the company’s gifts of computers to Mexican public schools totaled $52,000, according to Únete, an NGO that promotes these donations among companies. Other legislators have denied receiving offers like Bravo Padilla’s.

In the end, Bravo Padilla voted for the law. But the legislation included a clause he proposed minutes before the vote, forcing universities to keep open public smoking areas.

The new law also underwent another, more mysterious last-minute change.

The original version said public spaces could open areas designated exclusively for smokers. But in its final version the law stated they should create exclusive areas for smokers; the interpretation now is that food and drinks may be served there.

Many restaurants now use that clause to attract patrons to smoking-only balconies, lounges, and terraces.

No legislator or staff member involved in the law’s drafting can remember who authorized that final piece of editing. When health officials tried to enforce the original intent of the law, the Mexican president’s legal office intervened.

“They didn’t say, ‘Don’t,’” said Justino Regalado, manager of the National Office on Tobacco Control, who was among the presidential lawyers who participated in the last-minute discussions. “They just said, ‘Let’s see who is going to pay for the lawyers to defend us.’”

The politicking leading up to the 2007 vote also featured an unusual twist to the lobbying process. Legislators from Mexico’s small but influential Social Democratic Party approached BAT officials with a request: the company should finance a “campaign to protect smokers’ rights” by the lawmakers, in which they would file legal challenges against the new tobacco law. BAT rejected the request for funds, but the company´s outside attorneys offered to review the text of the challenges, according to former Congressman Jorge Carlos Diaz Cuervo, who had made the funding bid to BAT on behalf of his party.

BAT rejected the request for funds, but the company´s outside attorneys offered to review the text of the challenges, according to former Congressman Jorge Carlos Diaz Cuervo, who had made the funding bid to BAT on behalf of his party.

Fighting the new law

The 2007 law finally passed with 308 votes in favor, six against and 22 abstensions in December of that year. Tobacco control advocates consider the measure weak — especially compared with a law passed by the capital city that same day which mandates that public spaces be 100-percent smoke-free. Opponents filed some 50 legal challenges against the federal law, claiming it failed to do enough to protect Mexicans´ right to a healthy environment.

But now comes the real test, say tobacco control advocates: implementation. Already, there are political signs that its main clauses will be ignored or delayed. The Ministry of Health’s chief attorney, Bernardo Fernández del Castillo, took a year to publish rules for the 2007 law — twice as long as the legal limit. It has now taken two years to send written authorization to state governments, so that local officials can enforce the law. As late as September 2010, inspectors in Nayarit state, for example, could only pass out copies of the law and make recommendations to restaurants and building managers, but could not force anyone to comply. The government has also failed to enforce the placing of pictographic warnings of tobacco dangers on cigarette packs, as required by the law.

In the legislative void, BAT and Philip Morris have been introducing an array of new brands in Mexico with new flavors, designs and colors, and even cigarettes seasoned with chili. At the same time, the industry and its allies have mounted a legal assault on the anti-smoking laws. Currently, the government faces 13 lawsuits from tobacco companies and their allies. A few months ago, two chains of casinos in Mexico’s northern states won an injunction against no-smoking laws. And TvNotas, a showbiz magazine with one of the nation’s largest readerships, won another injunction that allows it to publish tobacco ads. Another legal challenge has come from Sanborns, a national restaurant chain owned by Slim.

Still, there’s a sense that progress has been made in Mexico.

On October 19 this year, lawmakers contended with some unfinished business from previous attempts at reform: raising taxes on cigarettes. At 7:30 a.m. lawmakers started talks on a new rate of up to 16 pesos per pack. (A pack of Camels costs 30 pesos in Mexico).

In Congress that day, tobacco-control activists outnumbered industry lobbyists.

“They talk about tobacco’s great lobbying, when it’s the NGOs — financed by who knows who — with at least three times more people here,” complained Philip Morris lobbyist Blanca Romano in a Twitter feed that day. Philip Morris and BAT threatened to cancel future investments in Mexico if cigarette taxes increased.

By midday, a 6.2-peso increase had wide support.

“It’s a good step forward,” observed Juan Núñez, director of Aliento, a tobacco-control group. “We saw congressmen who opposed the idea change their minds.”

“Excuse me, I’ll go smoke my last cheap cigarette,” said congressman Sebastián Lerdo de Tejada, when he noticed strong support for a tax hike. His colleagues laughed as he walked out to a corridor shrouded by tobacco smoke.

Alejandra Xanic von Bertrab is an independent investigative journalist based in Mexico City. Julieta Gutierrez contributed to this report.

Join the conversation

Show Comments