Introduction

Gary Godelie has been a tobacco farmer most of his life, struggling to keep alive a family farm that produces what most everyone agrees is a death crop. Whacked by global competition undercutting his prices, not to mention a dwindling number of Canadian smokers, he often thinks of getting out of the business.

Nothing brought this thought home more clearly than a series of events that began one hot July day in 2006 when two men drove up to his southern Ontario farm and offered to buy his entire crop. That surprised Godelie because anybody in the tobacco business would know that Canadian growers are part of a tightly regulated quota system. Buyers have to be federally licensed and can buy only through the marketing board.

“I said, ‘Well no. I can’t sell you tobacco. I have to sell it to the legal system,’” Godelie recalled. “They kind of looked at me and laughed and like said, ‘Why would you want to do that when we’re offering you cash money, a deal here, you know.’ ‘Well, no, I’m not going to do that kind of stuff.’”

The two men drove off and Godelie thought that was the end of it.

Then a few days later he had to fetch some irrigation equipment from a barn where he had stacked 169 bales that were over quota from last year’s tobacco crop. He hoped to sell the surplus bales at auction that winter as part of the current year’s quota. The first clue that something was wrong came when he saw his hydraulic forklift sitting on the hood of his tractor. In his mind he blamed his son-in-law. But then he thought that that wasn’t typical, that his son-in-law wouldn’t have done something like that. Then he switched on the light and saw why he knew in his heart that something wasn’t right.

“I stood there kind of flabbergasted for a minute and then I scanned over the stacks and then it hit me, oh, no, they had cleaned out the barn completely.”

It had rained the previous night so Godelie hadn’t gone out to irrigate. That was the night they nailed him. He said he figured that at 40 pounds a bale it took them maybe 20 minutes to clean him out. “They stole all 169 bales, which… is (about) 8,000 pounds. It takes about 1.9 pounds to make 1,000 cigarettes. That’s more than 4 million cigarettes. That’s pretty significant. Now we’re talking some serious coin. For me it was about a C$20,000 loss” (or roughly US$18,000 at the time).

It wasn’t long before Godelie began hearing about other tobacco farmers getting hit. The thefts became so widespread that farmers began installing security systems, barring barn windows, and parking disabled tractors in front of their barn doors. But to little effect.

“Now they are so brazen they take chain saws and they cut the side walls out of the barn,” said Linda Vandendriessche, chair of the Ontario Flue-Cured Tobacco Growers’ Marketing Board and herself a tobacco farmer. “It’s no joke. You will not believe the intimidation that is going on with our farmers.”

A Runaway Black Market

The thefts are the result of a new brand of tobacco smuggling that has flooded the Canadian market with contraband cigarettes and cigarillos made by clandestine manufacturers in Canada and the United States. Over the last six years, as Ottawa and provincial governments began hiking tobacco taxes to curb smoking and raise funds, the smuggling business has grown “exponentially,” according to the country’s national police force, the Royal Canadian Mounted Police (RCMP). At a time when a crumbling economy has forced governments into deficit financing, Canadian smugglers — dominated by members of Indian tribes and in some cases their mob partners — are pocketing hundreds of millions in profits. The cheap cigarettes not only fuel the spread of smoking, which costs Canadians more than C$4 billion annually in health care, but also rob governments of money that otherwise would go into official coffers to pay for healthcare and other services. The federal, Quebec and Ontario governments alone claim the proliferation of untaxed cigarettes is costing them at least C$1.6 billion a year.

The size of this tobacco-fueled black market is huge. Both industry and government studies indicate that, across Canada, two to three cigarettes out of every ten sold are now contraband. According to the most recent study, by Physicians for a Smoke Free Canada, contraband in 2007 made up 27 per cent of the Canadian tobacco market. In Ontario and Quebec the figure climbs as high as four out of ten. This conforms with an earlier study done by the nation’s health ministry, Health Canada. “We’re making more cigarettes than Imperial Tobacco [Canada’s leading tobacco company],” boasted one Indian smuggler.

All those contraband cigarettes are fueling a black market conservatively estimated at C$1.3 billion, with profit margins rivaling those of narcotics. And the market is growing rapidly. Seizures of contraband tobacco in Canada jumped a whopping 16-fold between 2001 and 2006, according to the RCMP. The off-the-books smokes range from independently-produced cigarettes sold in plastic bags to expertly counterfeited packs of leading brands. In some cases cheap Indian brands have become so popular that rival Indian manufacturers are counterfeiting them.

So vast are the profits, and so poorly are the laws enforced, that the contraband tobacco industry has attracted an unholy alliance of Canadian Indians — who say they have the right to sell untaxed cigarettes — and members of various organized crime gangs, according to law enforcement officials and the smugglers themselves. At the center of the trade are about 20 Indian-owned manufacturers that produce millions of untaxed and unregulated cigarettes a day out of small and medium-sized factories at Indian reserves in Ontario, Quebec, and across the border in New York State. An investigation by the International Consortium of Investigative Journalists has found that outlaw bikers, Italian, Irish, Russian, and Asian mobs are also now involved in the manufacturing, distribution, and retailing of the illicit tobacco products. According to Indian smugglers and police, in some cases the capital to buy the equipment and set up operations was fronted by organized crime.

Recent joint U.S.-Canadian police investigations indicate that drug money has been used to finance the tobacco business. Tobacco profits are likewise used to buy cocaine and marijuana, which are smuggled across the border using the same networks as for tobacco. Large cash seizures are common at the border and along Highway 401 in Ontario, which has become a smugglers’ pipeline to Montreal and Toronto.

In March 2008, federal, provincial, and Mohawk police in three reserves — Akwesasne, Kahnawake, and Kanesatake — seized about C$2 million in cash after raiding a cigarette/marijuana smuggling operation. In just two seizures on Nov. 17 and Dec. 7 last year, Canadian Border Services agents seized C$636,467 in U.S. and Canadian funds hidden in vehicles driven by Indians from Akwesasne, the reserve that straddles the border between Ontario, Quebec, and New York. In addition, the RCMP on Feb. 19 seized US$260,000 from an Indian driving from Akwesasne to Quebec. Police believe that the cash is linked to drug sales into the United States.

Made in Canada

While Canadian officials have complained to their U.S. counterparts that most of the illegal cigarettes are produced on the U.S. side of the Akwesasne reserve, the Center for Public Integrity has found that this is no longer true. According to Indian sources and visits to manufacturing plants by the Center, the operations have shifted to Canadian reserves in Quebec and Ontario.

Ironically, it was a major tobacco company, Imperial Tobacco, that supplied Kahnawake with the reserve’s first cigarette making machines when the British American Tobacco subsidiary sold off surplus machines at its Montreal plant in 2003 and moved its operations to Mexico. “They not only supplied the machines, but they came on the reserve and showed us how to work them and blend the tobacco,” said one smuggler who didn’t want his name used. Imperial Tobacco admitted that it sold surplus machines to the Mohawks, but claimed the company later got them back. Only licensed companies can operate tobacco machines in Canada.

Some producers operate in clandestine warehouses and garages or makeshift shacks located along the back roads in Indian communities. Others are sophisticated plants sporting reconditioned British-made cigarette machines known as Mark-9s, each capable of producing 3,500 to 5,000 cigarettes a minute.

The illicit operations have in some communities become important local employers for both Indians and non-Indians alike. Workers daily earn C$100 and C$150 cash for bagging cigarettes and C$175 to C$200 a day for working the machines, several workers said.

In the Mohawk community of Kahnawake, which has a population of about 8,000 and is located just south of Montreal, Chief Rhonda Kirby, who is responsible for the Mohawk reserve’s tobacco industry, estimated that the business employs more than 2,000 people in manufacturing, distribution, wholesale, and retail. Many of the workers are non-Indian.

“We have so many non-native community members working here and then of course relationships start up, so now that’s another problem,” she said.

Both Kahnawake and Akwesasne are traditional Mohawk communities that bar non-Indians from living among them and jealously guard what they consider their ancient right as a sovereign people to freely cross borders, trade with whomever they want, and not collect or pay taxes.

A long history of racism against Canadian Indians — or First Nations peoples — has also played a role in hardening Mohawk attitudes and creating a climate of distrust. Kahnawake in particular has been quick to react when it believes Canada has violated these sovereign rights. The Mohawks have retaliated by blocking highways through their community as well as the Mercier Bridge, one of the main links between the island of Montreal and the mainland. Police generally won’t enter the Mohawk reserves without permission from the tribal council. To a degree, this has encouraged organized criminals to use the reserves as a safe haven and a trans-border pipeline, say law enforcement officials.

The smuggling of drugs, aliens, and guns, as well as the establishment of internet gambling services, casinos and bingo halls, have all become contentious issues not only between Indian and non-Indian communities but also within the Indian communities themselves. Tobacco, however, is different. The Mohawks believe their right to trade this legal substance is sacrosanct. What’s more, it brings wealth to otherwise poor communities. “The government’s upset because we are punching out millions of cigarettes a day, and of course he wants his piece of the pie,” said one contraband seller. “If they come in, we’ll close the bridge again.”

Four centuries after Europeans took control of the Indian tobacco trade, the First Nations are taking it back.

The Gangs Move In

In the early 1990s, when tobacco smuggling on Indian reserves was at record levels, the product came from the major manufacturers such as Imperial Tobacco, which is owned by British American Tobacco; RJR MacDonald, which at the time was owned by RJ Reynolds and is now owned by Japan Tobacco; and Rothmans, Benson & Hedges. The RCMP effectively shut down that pipeline by charging RJR and its executives with aiding and abetting smuggling. Rothmans and Imperial paid C$1.15 billion (US$1.12 billion) in fines and penalties to Canadian governments last year for their part in the early 1990s smuggling. RJR and some of its executives still face criminal charges.

With the major players out of the contraband game, the Indians have moved in and created a fully integrated business. The only part they don’t control is tobacco farming. The success of Indian cigarettes, says tobacco farmer Godelie, reflects a sea change in market dynamics brought on by high taxes, which now make up about 75 percent of the cost of a legal cigarette.

“That really started to send a message to everyone in the world of tobacco that the consumer in Canada went from taste-sensitive to price-sensitive,” he said.

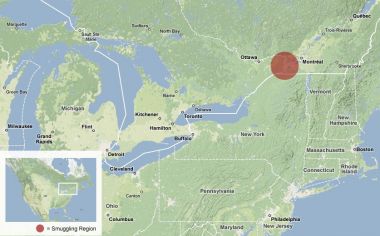

But as Godelie learned three years ago, the tobacco business can be organized crime at a worrisome, reckless level. At the heart of it all is the 12-mile stretch of the U.S.-Canada border that runs through Akwesasne. It is a major security soft spot with marijuana and cocaine flowing south while tobacco and, sometimes, weapons come north. The fact that goods can pass from the Mohawk community of St. Regis on the U.S. side to Akwesasne on the Canadian side and then enter non-Indian communities unchecked is a major problem for authorities. When the St. Lawrence River ices over, smugglers take a winter road between the two communities. When the ice melts, the speedboats come out. In one February case, U.S. authorities arrested 10 people, alleging they were part of a ring that smuggled 50,000 pounds of marijuana through Akwesasne and into the United States from 2003 to January of this year. One of the ringleaders has a tobacco manufacturing license from the Canadian government.

In a 2008 report on tobacco enforcement strategy, the RCMP found that the “current trend of manufacturing, distributing and selling contraband tobacco products, which has exponentially developed over the last 5 years, involves organized crime networks exploiting Aboriginal communities.” The RCMP claims there are “approximately 105 organized crime groups of varying levels of sophistication” involved in tobacco smuggling. The agency defines organized crime as three or more people conspiring to commit a serious criminal offense for financial or material benefit.

Indian leaders have taken exception to the allegation, claiming that it implies that their community members are all criminals. Yet Mohawks involved in the tobacco business told the Center said that organized crime plays a major role in the contraband tobacco. “Everybody knows we do have organized crime here,” said Chief Kirby. In fact, some smoke shop owners want to get out of the business, she added, but have been forced by the gangs to stay put. “The mob is involved with some of the individuals — the Mafia and the Irish mob and the Russian mob and the Chinese mob.”

The Hells Angels have financed several manufacturing operations in Kahnawake, Indian sources told the Center. This month, the RCMP ended a year-long investigation in Quebec with the arrest of 22 people, including two Hells Angels and two Mohawks from Kahnawake. They are charged with conspiracy and trafficking in contraband cigarettes and drugs, including cocaine, ecstasy, marijuana, and methamphetamine.

One prominent tobacco seller, who calls himself Splicer, agrees with the RCMP that the mob has infiltrated the illicit tobacco business. “I agree with them 100 percent that, yes, there is mafia in our community,” said Splicer, who has moved contraband tobacco for 20 years. Organized crime, he explained, finances manufacturing plants and many of the retail smoke shops, most of which are little more than plywood shacks or converted shipping containers.

Contraband Baggies

More than 150 Indian smoke shops crowd the nine-kilometer strip of Highway 138 that runs through the heart of the Kahnawake reserve. With names like Mega Butts, Get ’n’ Go, and Another Dam Cigarette Store, they serve the relentless flow of commuters between Montreal and its southern suburbs. They sell predominantly re-sealable bags of no-name cigarettes and Indian brands such as Native, Montcalm, Broncos, and DK’s, most of which, Splicer said, are made on the reserve.

The price of a carton of legal cigarettes in Canada varies between C$60 and C$80, depending on the province. Indian-made brands cost from C$12 to C$35, and no-name brands, which come in re-sealable bags, sell for as low as C$8 for 200 cigarettes. (Competition in Kahnawake grew so intense last year that baggy prices sank to C$6 before the Kahnawake Tobacco Association imposed price controls with a C$10 minimum. Still, the Center found some retailers selling for C$8.)

In addition to Kahnawake, police claim about 11 Indian manufacturers are operating on the Canadian and U.S. side of the border at Akwesasne. The Center tried to track down these operations but could locate only two that were still in operation. Officials say there are also manufacturers on the Six Nations Reserve near Brantford in southwestern Ontario and the Tyendinaga reserve near Belleville, Ontario.

Many of the tobacco manufacturers have their own websites on which they advertise their products and where they can be purchased. Jacobstobacco.com, the website for the Jacobs Tobacco Company on the U.S. side of Akwesasne, for example, boasts of a “state of the art facility” producing three “premium brands” under the name of “dis COUNT.” The website states that the company regularly donates to community youth programs and health services.

Some cigarette manufacturing plants, such as Brand U Media, which is owned by Burton Rice, are surrounded with security fences and cameras. Credit: William Marsden, Montreal Gazette. The company’s cigarettes line the shelves of Canadian smoke shops and are considered contraband by the Canadian government. Jacobs Tobacco is owned by CEO Rosalie Jacobs and her family, according to an affidavit she filed in a U.S. federal court. Her son Al Jacobs, known on the reserve as the “40-million-dollar man” and a veteran tobacco smuggler with convictions dating back to 1994, was indicted July 17, 2008, with five other men for the robbery and murder of a marijuana dealer in Stockholm, New York. Jacobs is in prison awaiting trial. His mother’s business, which has addresses in both Pennsylvania and Akwesasne, still operates out of a new 47,000 square foot factory employing 72 Indians full time with a payroll of US$2 million, according to an affidavit signed by Rosalie Jacobs in U.S. federal court.

Jacobs Tobacco in 2007 opened an account at the Bank of Montreal on the Canadian side of the reserve. It is the only bank on either the Canadian or U.S. side of the reserve. In an affidavit, Jacobs said she opened the account to wire payments to her U.S. wholesale tobacco suppliers. On August 20, 2007, for example, she declared US$15,000 to border authorities and was allowed to take the cash into Canada where she deposited it at the Bank of Montreal. Three days later, she tried to take US$64,000 across the border into Canada. This time, however, when she declared the money to a U.S. border guard, he seized it and gave it to the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF), which initiated a seizure proceeding.

Jacobs sued the U.S. government to get the money back, claiming that it was legally acquired from tobacco manufacturing and that she had at all times complied with U.S. law. The ATF, in turn, argued that Jacobs Tobacco’s operations were illegal because the company had no license. The case was settled last year when Jacobs agreed, without admitting or denying guilt, to forfeit half the money — US$32,000 — while the ATF agreed to return the other half.

Rosalie Jacobs continues to deposit cash at the Bank of Montreal, according to police, and declares her funds to both U.S. and Canadian officials. Her company does not have a Canadian or U.S. license to manufacture and sell tobacco, although it says it has applied for one with U.S. authorities. It does, however, have a license from the St. Regis Mohawk Tribe. The tribal license is not recognized by Canadian or U.S. authorities.

“A Big, Complex, Nasty Issue”

Meanwhile, business on the Kahnawake reserve is growing so fast that the community now appears to have surpassed its cousins in Akwesasne. The Center found that Kahnawake has at least nine manufacturers. One worker, who didn’t want his name used, said production varies but overall his shop processes about 5,000 pounds of tobacco each day using two Mark-9 machines — enough to make about 2.5 million cigarettes, or 125,000 packs worth.

Until recently the raw tobacco has been smuggled up through Akwesasne from North Carolina. But with the emergence of Kahnawake as a force in cigarette production, Splicer, the veteran tobacco dealer, said a lot of tobacco is coming through the Port of Montreal and the St. Lawrence Seaway, which goes right through Kahnawake. “We have all kinds of ways of getting tobacco here,” Splicer explained. “We have the borders beat. We have customs beat. The international waters go right through our community… Take a ride up the riverfront and take a look, and you’ll figure out how we get it in. We built our own docks. We can load and unload.”

Just a few years ago, Indians hired companies in North Carolina such as the Timcorp Group of Charlotte to supply turnkey cigarette manufacturing plants, plus raw tobacco, filters and tips, say police. The company’s website now says that it is out of business. A call to the firm, however, found it still operating. A receptionist said company President Dennis Makepeace would not reply to questions about his business with the Indians.

On March 14, 2006, St. Regis tribal police on the U.S. side of the Akwesasne reserve stopped three Bulgarian nationals in a vehicle owned by a prominent Akwesasne company, Mitchell Construction. According to the RCMP, one Bulgarian named Stoyan Ivanov Darzhonov, 34, told police they worked for Timcorp and had come to St. Regis to set up cigarette machines in a warehouse behind Mitchell Construction. Darzhonov also told police that two months earlier they had set up manufacturing operations for three companies, including Jacobs Tobacco and Native Trading Associates.

Native Trading’s brands crowd the shelves of smoke shops in reserves in Ontario and Quebec. Its owner, Susan Jesmer of Cornwall, Ontario, has a U.S. license to manufacture her Native brand cigarettes. Through her Washington, D.C., lawyer Bill McGowan, Jesmer refused an interview. “It’s a very sensitive subject. It’s a big, complex, nasty issue,” McGowan said in trying to explain why he didn’t want his client to talk to the media. “The whole issues of Canada, etc., etc. … She just wants to follow the rules and not everybody is doing that.”

Indian tobacco is mainly a cash business. During a reporter’s visit to the offices of Native Trading in St. Regis, several people came in, were handed large wads of bills, and then quickly left. On February 19, 2006, St. Regis police stopped one South Carolina tobacco dealer and found a shoebox filled with US$70,000 in his car. According to the RCMP, the man said he got the money from Patrick Johnson, who is part owner of MHP Manufacturing, a St. Regis cigarette manufacturing company. Johnson’s partner in the business is William Hank Cook.

Later that year, on November 20, a joint police task force arrested Johnson and Cook for tobacco and drug smuggling. Police claim they used profits from contraband cigarettes to buy Canadian-grown marijuana, which they smuggled into the United States. The drug profits were then laundered through MHP Manufacturing, police claimed. Cook pleaded guilty to charges related to drug trafficking and money laundering and was fined C$280,000. Johnson pleaded guilty to one smuggling charge and money laundering. He was fined C$350,000.

A Failure of Enforcement

The RCMP strategy for combating cigarette smuggling is to target the ringleaders — those primarily responsible for manufacturing and distribution. At the same time police have tried to disrupt the flow of contraband by arresting couriers. So far, even officials admit this strategy hasn’t worked.

Tribal councils won’t shut down manufacturers because they don’t regard them as illegal. Some have been shut down but only because their owners have also been arrested for drug smuggling. Since 2007, there have been 480 tobacco seizures in the region of Akwesasne and Valleyfield, just west of Montreal, netting 443 vehicles plus a number of firearms that include two AK-47 assault rifles, two M-16 machine guns and three grenade launchers.

In theory, penalties for smuggling tobacco in Canada can be quite severe. Federal fines range between 17 cents per cigarette and 25.5 cents, which adds up when you’ve got thousands of cigarettes jammed into a van. Added to that are provincial penalties that can double the fines. Failure to pay means up to 18 months in jail.

Trouble is, prosecutors say, smugglers often don’t bother to show up in court, which means police have to go looking for them. And when the smugglers eventually do come to court and receive stiff fines of tens of thousands of dollars, they don’t pay them. “In my four years doing these cases I have never seen anybody incarcerated for failure to pay a fine,” Cornwall public prosecutor Ron Turgeon said, adding that nobody pays the fines. “Now I’m asking for prison for a second offense, but I’m still not getting it.”

The province of Ontario funnels all the Akwesasne cases through a small courthouse that sits behind a beer store in the rural town of Alexandria, which is about half an hour from Cornwall. The Center tried to follow one person accused of smuggling, Oren Bigtree, through the court system, but he never showed up. “They get fined hundreds of thousands of dollars and nobody actually pays that money,” said Sergeant Michael Harvey of the Cornwall detachment of the RCMP. “They pay maybe $100 a month. It’s just crazy. We seize loads every day but there are 13 factories pumping out millions of cigarettes so it doesn’t make any dent.”

Chasing smugglers is a dangerous occupation. Last month a smuggler from Akwesasne tried to run over a Quebec police officer with his truck. The officer shot out a tire, arrested the man, and found an AK-47 in his cab. In November, an elderly couple from Massena, New York, was killed when a tobacco smuggler, chased by two Mohawk police officers, rammed their car. The smuggler also died in the collision that engulfed both vehicles in flames. In February, the police officers were charged with criminal negligence causing death and with dangerous driving.

Since the accident, tobacco seizures have declined because police are reluctant to chase smugglers, Sergeant Harvey said.

Big Profits, Big Demand

The weak enforcement, willing suppliers, and big demand suggest how hard it will be to change what has become a billion-dollar black market. Worse, with penalties and punishment modest at best, and profits rivaling those of narcotics, the biggest challenge may simply be the huge profits to be made. Individual smugglers, or runners, can cash in big. One 17-year-old runner testified at her bail hearing that she made three trips a day, six days a week, and earned about C$6,000 a week. She said she used the money to finance her cocaine habit.

Retailers also can make a good living. Splicer said his retail operation clears about C$130,000 a year selling contraband. Still, it’s not easy, he says. Splicer complains that he can’t hold any assets in his name or the government will seize them. He has no bank account and is forced to keep large amounts of money handy to pay his workers and suppliers in cash. “I can’t put my name up front because the government is going to come kicking my door in. That car I own out there? It belongs to my last girl friend. I pay for the car payments but I can’t own it in my name. And my business is not in my name. I burn all my stuff. We don’t keep records in the stores. We burn paper. At the end of the day I log into a special computer and hide it on a chip. … The house I live in is not in my name. That’s how I live. I’m nobody.”

But he’s someone to the Quebec government.

Tax collectors have assessed Splicer for an impressive C$25 million in unpaid taxes dating back to the early 1990s, when he ran millions of cartons of cigarettes into Kahnawake. Splicer said he reached a settlement agreeing to pay the government a mere C$150 a month against the debt. “They told me to sign an agreement to pay or go to jail for two years,” he said. “I pay.”

It’s hard to believe that will make much of a dent in what has become a booming business. Throughout the conversation with Splicer, there is a constant flow of customers in and out of his smoke shop. They buy mostly the low-end discounted cigarettes that come in re-sealable bags. Twice during the afternoon, suppliers brought in fresh boxes each containing 50 cartons, or 10,000 cigarettes.

“I have been in this business since I was 16 years old,” Splicer said, taking a drag from a premium brand cigarette. “When they rolled the first cigarettes into this community I was there on the water smuggling them in. I was armed with a machine gun in the bush to protect our loads. I remember all this. I ran the river. I did all that. Because this is what I do. This is who I am.”

CORRECTION: The original version of this article reported that the company Brand-U Media is a tobacco manufacturer. Canadian government records, however, indicate that its activities involve publishing and combat sports. The Center also reported that Burton Rice is president of Mustang Distribution Ltd. Government records indicate that its president is his father, Peter Rice. Burton Rice is not listed as an officer or shareholder of the company. The errors arose out of a misreading of the corporate documents. The article posted on the Center’s website has been revised accordingly

William Marsden, author of Stupid To the Last Drop, is a member of the International Consortium of Investigative Journalists and an investigative reporter with The Gazette in Montreal, Quebec.

Join the conversation

Show Comments