Introduction

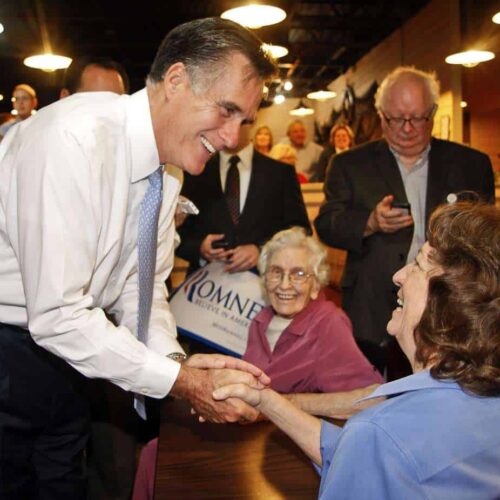

Poor Mitt Romney has taken a lot of heat since he said during a discussion about health care shortly before the New Hampshire primary that, “I like being able to fire people who provide services to me.”

Most of the criticism has been in connection with his tenure as CEO of Bain Capital, the firm that invests in ailing businesses and, while he was there, oversaw the firing of thousands of people who worked for those businesses as part of Bain’s efforts to return them to profitability.

While Romney’s opponents had a field day with that comment, what bothered me most was the former Massachusetts governor‘s naïve suggestion that anyone but him and his rich friends could actually do what he was suggesting — fire a health insurer on a whim and hire another one that might provide better service.

Come to think of it, I’m betting that even Mitt Romney might find it difficult to switch from one health insurer to another because of a bad experience with a customer service rep—unless, of course, he bought his own insurance firm.

One of the things Obamacare haters try to make us believe is that the reform law will reduce “choice and competition.” The implication is that in our free market system Americans have a plethora of insurers competing vigorously to sign them up. But the world of health insurance doesn’t operate that way — and it never will without government intervention.

I have met hundreds of people since I started talking and writing about how the insurance industry really operates who would dearly love to fire their insurance companies and enroll in a plan that would provide a better value for their money and really cover what they need.

Just yesterday a friend told me that her brother John was notified earlier this week that, effective February 1, his premiums will increase 41 percent unless he switches to another plan with premiums that will be only (only!) 33 percent higher than what he is paying now. The plan is through his employer, which only offers coverage provided by one insurer.

His employer is not absorbing a nickel of the increase, meaning that John and his coworkers will have to pay the entire amount of additional premium. And if they opt for the plan with premiums that will increase only 33 percent, their deductibles will be much higher. The copayment for outpatient surgery will jump from $100 to $250, for example.

John does not have the option of choosing a plan offered where he works by another carrier, like Aetna or CIGNA or Kaiser, and he really cannot go shopping for a policy on the individual market. That’s because he has a pre-existing condition. John knows the chances of his finding a single insurer that would take him on are slim to none—at least until 2014 when Obamacare will make it illegal for insurers to refuse to sell coverage to adults with pre-existing conditions.

Even if he were able to find an insurer willing to enroll him, John’s premiums and out-of-pocket expenses undoubtedly would be far higher—and consequently, far less affordable — than his employer-sponsored options. So he’s stuck. Yes, he might elect to fire his insurer, but being able to hire a replacement is nothing more than the remotest of possibilities the way things stand today.

John is facing a predicament similar to the one my son faced a couple of years ago. Alex, who was also enrolled in a plan by the same insurer, got a notice that his premium would be increasing more than 65 percent unless he switched to a plan with much higher deductibles. Like John, he couldn’t afford such a hefty premium increase, so he switched. His annual deductible had been $500. Now it is $5,000. And also like John, Alex has a pre-existing condition, meaning his other options were essentially nonexistent.

Romney the presidential candidate was trying to distance himself from the Romney who, as Massachusetts’ governor, oversaw the implementation of health care reform that requires all state residents to buy coverage. Although he is loath to admit it, his plan was the model for Obamacare, which has a similar mandate.

“You know, if someone doesn’t give me a good service that I need,” Romney said in New Hampshire, “I want to say, ‘I’m going to go get someone else to provide that service to me.’ I want individuals to have their own insurance. That means the insurance company will have an incentive to keep you healthy. It also means if you don’t like what they do, you can fire them.”

Romney clearly is living in a fantasy world where free-market competition among insurers actually exists and, presumably, would somehow flourish if he were in the White House. Here’s hoping a reporter or two covering his campaign will ask him how he plans to pull that off.

John and Alex and a few million other Americans would really like to know.

Read more in Health

Health

Video: PCMA launches new E-prescribing video

Wendell Potter commentary

ANALYSIS: Park City vantage point puts tragedy of American health care in vivid relief

Grieving family of fallen Canadian skier Sarah Burke faces massive hospital bill it wouldn’t face at home

Join the conversation

Show Comments