Introduction

Want to find out what Congress is about to vote on? Take a ride on the Washington subway.

If you’ve been on the Metro in recent days, you might have seen an ad designed to make you feel sorry for our poor health insurance companies. So sorry that you’ll call your congressman and demand he support a bill that would gut an important part of the health care reform law: the provision requiring that insurers spend at least 80 percent of the premiums they collect from us on our actual health care.

Back in the early 1990s, when most insurance firms were still nonprofits, they were spending on average 95 cents of every premium dollar paying medical claims. As they began to convert to for-profit status, though, that percentage dropped because of pressure from Wall Street. Now that the industry is dominated by a handful of investor-owned corporations, the average is around 80 percent. The members of Congress who drafted the Affordable Care Act felt that was as low as it should go. And so they inserted language in the bill requiring insurers to pay rebates to their policyholders if they go below that threshold.

Shareholders hate that provision because the less insurance companies spend on health care, the more is available for profits. And because job number one for any investor-owned company is to “enhance shareholder value,” industry lobbyists have been at work ever since the bill’s passage to get the provision repealed or weakened. One way of doing that is by getting Congress to exempt the commissions insurance firms pay agents who sell their policies from the equation used to determine that threshold. The House Energy and Commerce Committee is set to do that as early as today.

A key component of the industry’s ongoing campaign to convince lawmakers to gut the law is to convince us that they’re barely making ends meet. And for that they’ve enlisted the help of one of Washington’s pre-eminent spin doctors, Rick Berman.

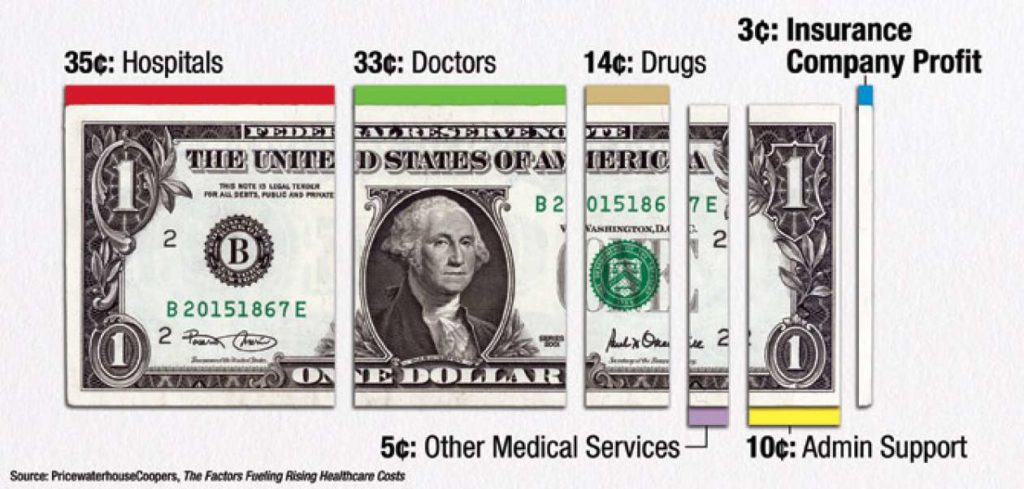

One of Berman’s industry-funded front groups, the Employment Policies Institute (EPI), is behind the D.C. subway ads featuring a dollar bill divided into segments that, we are asked to believe, reveals how insurance companies really spend our premiums (35 cents to hospitals, 33 cents to doctors, 14 cents for drugs, etc.). The five words above the dollar: “Where Your Insurance Dollar Goes.” The one word below it: “Surprised?”

We’re told that the sponsor of the ad is rethinkreform.com, meaning that it is the work of a front group within a front group. Berman’s “Institute” created the Committee to Rethink Reform in 2009 as a “project” of EPI to stir up opposition to the health care law.

Because it is a 501(c)(3) organization, the Employment Policies Institute does not have to disclose where it gets its funding — and it doesn’t. Neither does RethinkReform.com, which is a project of EPI. But knowing just what lobbying and PR group paid a consulting firm to create that divided dollar bill several years ago should give us a pretty good hint.

It was none other than — you guessed it — the lobbying and PR group for the insurance industry, America’s Health Insurance Plans.

Surprised?

AHIP has commissioned the consulting firm PricewaterhouseCoopers to develop a number of “studies” over the years to help advance whatever agenda AHIP felt needed advancing. With a tagline, “Your agenda is our agenda,” PwC has a proven track record of being a reliable agenda advancer for AHIP.

So reliable, in fact, that it put out a widely discredited AHIP-commissioned study a few weeks before the Senate voted on reform in 2009 in an attempt to get people to believe that certain provisions of the reform bill would raise premiums. PwC was forced to disavow the study’s conclusions when reporters figured out that AHIP had instructed it to ignore other important provisions of the bill that would help hold premium costs down.

I was still working for the industry when AHIP hired PwC to come up with that dollar bill that now graces Washington’s subway cars. Berman’s subway ad uses the exact numbers, down to the penny, that were featured on the AHIP/PwC dollar.

When we see that dollar and its cost breakdowns, what’s really supposed to surprise us is that just 3 cents go to health insurer profits. What AHIP/PwC and Berman’s groups don’t tell you is that the big for-profit insurers make far more than 3 cents profit off of every premium dollar they collect from us, and that the only way they were able to get the average down to 3 cents was by including several nonprofit insurers — the ones that cannot by law make a profit — in the equation.

AHIP thought up the dollar bill illusion to obscure the reality of just how profitable insurers really are. Over just the past two years, the five biggest insurers have reported more than $20 billion in profits. That’s money that could be used to provide millions of uninsured Americans access to needed care. Instead, a big chunk of our premium dollars are probably going into Rick Berman’s pocket.

Even though the Employment Policies Institute doesn’t have to disclose donors, it does have to tell the IRS how much money it takes in and how it spends it. According to the Form 1099 EPI filed in 2009, this “think tank” had only one employee and paid its officers and directors just $18,000 of the nearly $11 million it took in paying its staff to think, or do anything else for that matter, and $8.5 million for “advertising and promotion.” Most of the rest went to Richard Berman and Company, Inc. for “management services.”

Surprised?

Correction (April 20, 2012): This is a corrected version of Wendell Potter’s analysis, which was first published April 16, 2012. We have corrected four items: EPI is a 501(c)3 not a 501(c)4; Rethink Reform is a project of EPI; EPI paid $18,000 to its officers and directors, not staff; and, the name of the firm is Richard Berman and Company, Inc., not Richard Berman Associates.

Correction (April 27, 2012): An earlier version of this piece erroneously stated that Rethink Reform is a 501(c)4.

Read more in Health

Wendell Potter commentary

ANALYSIS: Putting our premiums into medical care, not profits

Rockefeller provision of health care law will require consumer rebates from insurers who didn’t spend enough on care

Wendell Potter commentary

ANALYSIS: Shareholders raising ruckus about CEO pay

Cigna chief enjoyed 25 percent raise

Join the conversation

Show Comments