Introduction

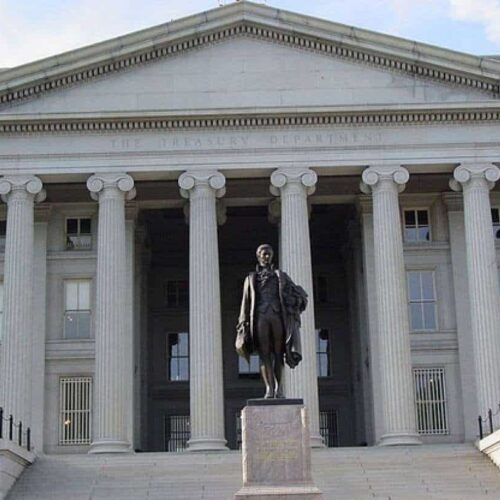

The Department of Treasury’s management of the Troubled Asset Relief Program, the multibillion-dollar initiative by the government to buy up risky assets from financial institutions, is under scrutiny by the Government Accountability Office for repeated inaccuracies on its financial statements.

The Office of Financial Stability, within Treasury, is charged with managing TARP. Under congressional direction, the GAO audits the financial statements from OFS periodically, to ensure Treasury is managing TARP sufficiently.

While the most recent audit shows improvements, the GAO still found uncorrected errors, which the watchdog labeled an “a continuing significant deficiency in OFS’s internal control over its accounting and financial reporting processes.”

The previous GAO audit of OFS found 15 instances of deficiencies in internal controls, while the most recent only found three. But the watchdog continues to find incorrect and inconsistent information in OFS financial statements that went unnoticed by OFS staff.

GAO found instances where OFS documentation was incomplete, specifically for asset valuation. The tool OFS used to calculate value for certain TARP assets resulted in multiple errors.

“Without an effectively implemented review and approval process for preparing financial statements…an agency is at risk of presenting information that is inaccurate, inconsistent, or not in conformity with generally accepted accounting procedures,” the GAO said in its report.

Past audits have also found incomplete documentation for its asset valuation process and in 2010, OFS changed its methodology for assessing the value of assets held under the Automotive Industry Financing Program, but did not document the change or indicated why the alteration was made.

FAST FACT: As of January, the TARP program has $179.2 billion in outstanding loans and investments, most of which is expected to be repaid to Treasury.

Join the conversation

Show Comments