Introduction

The latest debate among Republican candidates for president was a tame affair that produced few factual claims needing correction. Candidates stuck mostly to promises and expressions of their conservative faith in free markets, and their disdain for government.

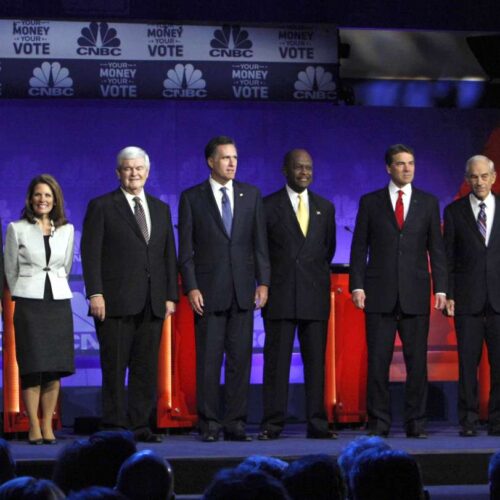

The debate was held Nov. 9 at Oakland University in Rochester, Mich., and included eight candidates: Minnesota Rep. Michele Bachmann, businessman Herman Cain, former House Speaker Newt Gingrich, former Utah Gov. Jon Huntsman, Texas Rep. Ron Paul, Texas Gov. Rick Perry, former Massachusetts Gov. Mitt Romney, and former Sen. Rick Santorum of Pennsylvania.

We won’t go into the audience booing when Cain was asked about the sexual-harassment issue that has dogged him for the past week, or Perry experiencing a brain freeze when trying to remember the third federal agency he intended to eliminate upon becoming president. (He later remembered that it was the Department of Energy, which is responsible for the nation’s nuclear arsenal, among other things.) Our job is to look for false or misleading factual claims. And this time we found only minor quibbles. Here’s the sort of thing we mean:

Cain: $430 Billion Compliance Costs

Cain said Americans spend $430 billion a year to comply with the tax code. But that is just one estimate, by a conservative group. The nonpartisan Government Accountability Office said in a 2005 report that estimates for the cost of tax preparation are unreliable and vary greatly.

Cain offered his estimate when making a pitch to eliminate the current tax code and replace it with his 9-9-9 plan.

Cain: “My proposal is the only one that solves the problem by throwing out the current tax code, which has been a mess for decades, and we need to put in something different that I proposed, 9-9-9. It satisfies five simple criteria. It is simple. The complexity costs us $430 billion a year.”

That estimate comes from a study by the Laffer Center, which was founded by supply-side economist Arthur Laffer.

There is no question that compliance is costly and time-consuming, but the actual expense is not known. The Taxpayer Advocate Service of the IRS estimated in its 2010 report to Congress that Americans spent 6.1 billion hours a year complying with tax requirements, although it did not put a price tag on that amount of time. The Laffer study, citing the Taxpayer Advocate Service, says the number of hours actually has declined because of software programs.

The GAO’s 2005 report said that “estimates of compliance costs are uncertain because taxpayers generally do not keep relevant records” on how much time and money they spent. It also said “many important elements of the costs are difficult to measure because, among other things, federal tax requirements often overlap with recordkeeping and reporting that taxpayers do for other purposes.”

Although declining to offer an estimate, the GAO took the number of hours spent on tax preparation and provided a range of $100 billion to $200 billion.

GAO, August 2005: Treasury has estimated that during fiscal year 2004 individuals, businesses, and exempt organizations spent a total of 6.4 billion hours on Treasury’s forms. Treasury does not convert this time estimate into a monetary value. If this time burden were monetized at rates between $15 per hour and $30 per hour (the range used for individual taxpayers in the studies that we found), the total cost would amount to between about $100 billion and $200 billion.

However, the GAO was quick to follow that with this caveat about the Treasury’s data: “Many analysts within Treasury and outside believe that the ICB estimates are not very accurate.” The ICB is the Information Collection Budget, which provided the 6.1 billion hour estimate.

The GAO reviewed and summarized the available academic research and concluded that compliance costs are — not surprisingly — “large, even though the total remains uncertain.”

It said “combining the lowest available (and incomplete) estimates of individual and corporate compliance cost yields a total of $107 billion (roughly 1 percent of GDP) per year; however, other studies estimate costs 1.5 times as large.”

However, for the average taxpayer who hires an accountant, the cost of tax preparation is $233. The National Society of Accountants says its survey of “nearly 8,000 tax preparers showed the average tax preparation fee for an itemized Form 1040 with Schedule A and a state tax return was $233 for the 2011 tax season.”

Bachmann: 47 Percent

Bachmann was awfully close when she said that nearly half of Americans pay no federal income taxes — but there’s more to the story.

Bachmann: “When you have 53 percent of Americans paying federal income taxes, but you have 47 percent of Americans who pay no federal income taxes, you have a real problem.”

According to the nonpartisan Tax Policy Center, it’s true that 46.4 percent of families and individuals won’t pay federal income taxes this year. But whether that’s “a real problem” or not is a matter of opinion. The center projects that about two-thirds of that group are workers who will pay Social Security and Medicare payroll taxes, for one thing. The rest are nearly all either elderly, poor or almost poor.

The center says that the 18.1 percent who pay neither income taxes nor payroll taxes includes 10.3 percent who are elderly and 6.9 percent who are younger but still have incomes under $20,000 a year. For most of the country, the official poverty guidelines this year classify a family of four as poor if they have less than $22,350 in income. For a single person, the guideline is $10,890.

Romney: Federal Workers Overpaid?

As part of his plan to cut government spending, Romney said he’d reduce compensation paid to “federal bureaucrats” because “public servants shouldn’t get more money than the taxpayers that they’re serving.”

Romney: “I want to make sure we link the compensation of our federal bureaucrats to that which exists in the private sector. People who are public servants shouldn’t get more money than the taxpayers that they’re serving.”

It’s true that federal workers, on average, are compensated more in pay plus benefits than the average private sector worker. But Romney fails to mention factors such as occupation, skill level, age and education.

Claims that federal workers are overpaid compared with their private sector counterparts are nothing new. Back in December 2010, we took an in-depth look at claims from several Republican leaders that the average federal worker makes twice as much as the average private sector worker. We concluded the comparison was misleading because the average federal civilian worker is better educated, more experienced and more likely to have management or professional responsibilities than the average private worker. Also, a government trend in recent years toward privatizing lower-skilled, lower-paid positions has raised the average pay of federal employees. And another thing: President Obama announced nearly a year ago that he would freeze pay levels for federal civilian workers for two years.

Gingrich ‘Off Budget’

Gingrich (again) said that Social Security should be “off budget” as it once was, before Lyndon Johnson changed the treatment of the program for budget purposes.

Gingrich: “In 1968, in order to fake a balanced budget, Lyndon Johnson brought Social Security in the general budget. And ever since, politicians have hid behind Social Security. Now it’s going to become a disadvantage to do so. I think the first step is you take Social Security off the federal budget.”

The fact is, as a technical matter at least, Social Security was taken “off budget” again in 1985, according to the Social Security Administration. But that’s an arcane issue with little practical impact one way or the other. The important fact is that after many years of generating surplus funds that the government borrowed and used for other purposes, Social Security payroll taxes now fall short of covering the benefits the system is obliged to pay. Whatever governmental bookkeeping conventions are used, the Treasury will need to keep borrowing to meet its obligations to the Social Security trust funds until they are exhausted (in about 2036), at which point the system’s trustees say benefits will have to be cut 23 percent, or taxes increased, unless Congress acts beforehand.

Gingrich and Freddie Mac

Gingrich defended his lobbying for the Federal Home Loan Mortgage Corporation (“Freddie Mac”) by saying he merely advised the agency that history would prove its policies “insane”:

Gingrich: “I offered advice. My advice as an historian when they walked in and said we are now making loans to people that have no credit history and have no record of paying back anything but that’s what the government wants us to do. I said at the time, this is a bubble. This is insane. This is impossible. It turned out unfortunately I was right.”

Perhaps so. But the former speaker’s account is contradicted by what The Associated Press reported in 2008. An investigative article by AP reporter Pete Yost stated:

The AP, Dec. 8, 2008: Freddie Mac enlisted prominent conservatives, including Gingrich and former Justice Department official Viet Dinh, paying each $300,000 in 2006, according to internal records.

Gingrich talked and wrote about what he saw as the benefits of the Freddie Mac business model.

We’ll leave it to readers to judge whether Gingrich was hired for his advice as a history professor, or his influence as a former speaker of the House.

As usual, we’ll be going over the transcript of the debate later and will post any additional findings as appropriate.

– Brooks Jackson, Eugene Kiely, Robert Farley and Lori Robertson

Read more in Accountability

Accountability

U.S. deportees to Haiti, jailed without cause, face severe health risks

Obama administration continues deporting Haitians despite knowing many will be illegally jailed and risk cholera exposure upon arrival

Join the conversation

Show Comments