Introduction

A government initiative aimed at saving money by eliminating paper checks is hurting some recipients of federal benefits while earning the bank that operates the program millions in fees charged to consumers.

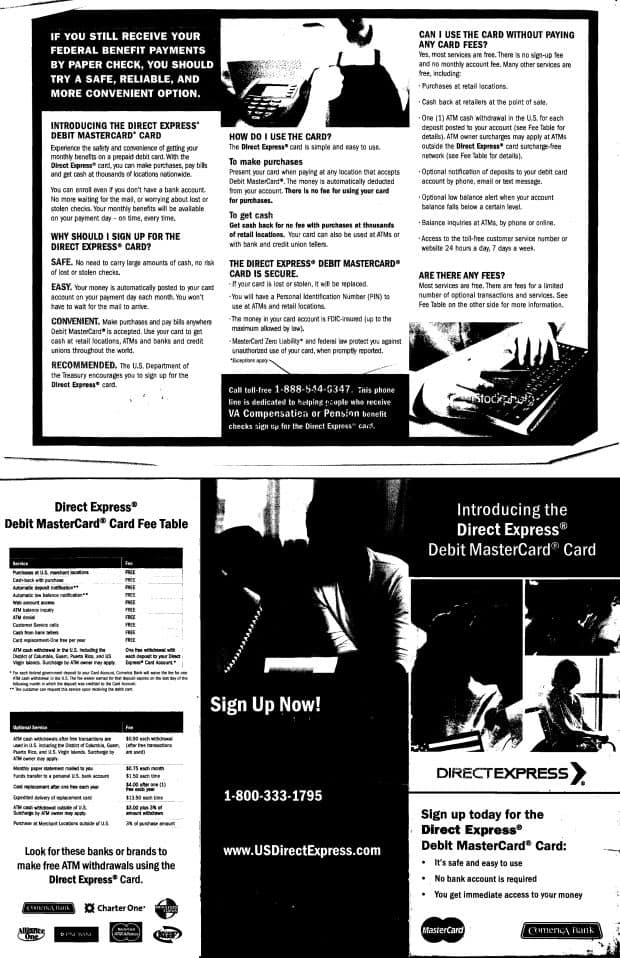

The U.S. Treasury Department has been urging people who collect Social Security and other benefits to switch to direct deposit rather than rely on mailed checks, to save millions of dollars a year in administrative costs.

But beneficiaries without bank accounts — and even some who do have accounts — are being pressured into using prepaid debit cards offered by Comerica Bank, an effort that is shifting costs to elderly people, veterans and other vulnerable consumers.

The Treasury Department launched the program in 2008, teaming up with the Dallas-based bank to issue the “Direct Express” debit cards in a deal that lacked the open competition or transparency of most federal contracts.

The exclusive agreement — whose financial details are not public — was then renegotiated to make it more lucrative for the bank while Treasury took over responsibilities that were originally Comerica’s.

Now millions of poor people who rely on Social Security and Supplemental Security Income are using debit cards that may be ill-suited to their needs and can cost them more than paper checks or direct deposit to a bank account.

Meanwhile, Treasury is saving money and Comerica is booking profits.

“To stand in the way of the purpose of the programs is appalling, and that’s really what they’re doing,” says Rebecca Vallas, a Philadelphia attorney who represents federal benefits recipients.

The Senate Special Committee on Aging is holding a hearing Wednesday on the Treasury program and Treasury’s inspector general, its independent, internal watchdog, is looking into the Comerica deal.

Paper or plastic?

It costs the U.S. government $1.05 to print and mail a check, compared with 9 cents for an electronic transfer, according to testimony last year by Richard Gregg, Treasury’s fiscal assistant secretary, who is set to testify at Wednesday’s hearing.

Congress in 1996 ordered Treasury to eliminate paper checks from the federal payments system within three years. That mandate, however, gave the department broad leeway to waive the requirement where it didn’t make sense or would impose hardship.

In 2010, more than 85 percent of all federal payments were electronic, and Treasury officials decided to make a final push to eliminate the remaining checks by March of this year. By then most people on Social Security or SSI were having their payments deposited directly into their bank accounts. Others received benefits on debit payment cards offered by private companies — a choice that can lead to heavy fees.

People who choose to keep receiving paper checks are generally elderly or poor or both, and don’t have bank accounts or access to bank branches. Some mistrust banks because of abuses and failures they observed during the Great Depression or the recent financial crisis. Others may not understand how electronic payments work.

Treasury didn’t have a good option for them, so it sought a low-cost payment card, eventually selecting Comerica to provide Direct Express.

Government prepaid cards are a fast-growing industry. At least $100 billion was distributed in 2011 on cards for 158 federal, state and local governments’ payment programs, according to a Federal Reserve study published last July. The cards are similar to those issued with checking accounts, but don’t always offer the same consumer protections.

Comerica has issued 9 million government payments cards, including more than 4 million Direct Express cards, making it the second-biggest issuer, according to recent investor presentations. Other top issuers of cards used by states and other governments to deliver payments to consumers include Bank of America, J.P. Morgan Chase, U.S. Bancorp and Citigroup.

Comerica offered to issue the Direct Express cards at no cost to Treasury, spend millions to market them and charge consumers lower fees than most privately issued prepaid cards.

Comerica offered one free ATM withdrawal per month.

Treasury pressure

In January 2011, the government began an all-out push to move the 10.4 million people who were still receiving paper checks to electronic payments, an effort that could eventually save $119 million per year.

Treasury resorted to tactics that advocates for the elderly and disabled say were too pushy and sometimes misleading. Notices papered the walls of Social Security offices and advertisements looped on the offices’ closed circuit televisions, urging people to go electronic, according to Vallas.

A large countdown clock dominated the government’s main webpage for people seeking information about the change, indicating down to the second how long people had before their benefits “may be delivered on Direct Express.”

Government fliers and websites said anyone who failed to use the card or arrange direct deposit would be on the wrong side of the law. “Switching to an electronic payment is not optional — it’s the law,” said David Lebryk, commissioner of Commissioner of the Bureau of the Fiscal Service, in a January press release titled “Time is Running Out.”

In January and February, Treasury mailed thousands of the cards to poor, elderly and disabled people who had not requested them, hoping they would activate them anyway.

A Treasury official, speaking on condition of anonymity to discuss the program candidly, said the department tried to send cards to people living in low-income neighborhoods, because they are less likely to have bank accounts.

People who received cards without requesting them had already received two written notices urging them to pick an electronic payment method. The high-pressure appeals were necessary, Treasury officials say, to get the attention of Americans who cling to paper checks despite decades of opportunities to embrace direct deposit.

Customer service employees were trained to get people to accept Direct Express, regardless of whether it was the best option for them, according to interviews with call center employees who spoke on condition of anonymity and a Center for Public Integrity review of transcripts and recordings of calls to Treasury’s call center.

Operators provided inaccurate information on seven of 10 calls placed in February by a former call center worker who conducted a personal investigation because he was unhappy with how the call center was operated. The worker spoke on condition of anonymity because he had agreed not to discuss it as a condition of employment.

On at least five calls, operators denied that certain groups were allowed to keep receiving paper checks. Several said people who failed to switch to electronic payments would be mailed a card automatically after the March 1 deadline. One told the caller that using direct deposit to a bank account “would incur more fees” than enrolling in Direct Express.

A February memo instructed the call center workers not to offer waivers to callers, allowing them to continue to receive paper checks, “unless they specifically ask for one.” When callers insist they qualify and want to obtain a waiver, operators should transfer the call to a group that would provide that information “ONLY AS A LAST RESORT,” says the memo.

The aggressive campaign worked. By the agency’s self-imposed deadline of March 1, 2013, it had cut the number of paper checks to 3.5 million, saving the government about $79 million per year. If the remaining holdouts went electronic, the government could save another $40 million per year.

Juliet Carter was one of the people who were persuaded to enroll in Direct Express. The 57-year-old former cook, who was living on government disability benefits after being hit by a car five years ago, was spooked by the notices that accompanied her checks urging her to sign up for Direct Express or risk being “out of compliance with the law.”

She phoned the number listed on the flyers and switched to the card. Within months, identity thieves had redirected her benefits to a different account and stolen six months of her income. She was evicted from her apartment and has spent the past few months renting rooms in houses or staying with her sister.

“I’ve learned I can’t trust those cards,” said Carter. She says she prefers a paper check because “it comes direct from Social Security to the mailbox to me, and I feel safer.”

Treasury says the cards are far less susceptible to fraud than paper checks.

In a prepared statement, Treasury spokeswoman Suzanne Elio said, “Electronic payment provides federal beneficiaries a safer, more secure, and convenient method of receiving their benefits as compared to paper check payments, which are considerably more vulnerable to fraud.”

The agency “took great care” in implementing the electronic payment system and sought to provide “strong consumer protections” for people without bank accounts, Elio said.

Social Security and SSI are meant to provide people with secure and accessible income, says Vallas. “They don’t exist for the sake of administrative efficiency or meeting arbitrary number targets.”

Fees mount

Direct Express’ fees are lower than those on most payment cards. Still, they can eat into the benefits of people like Juliet Carter who are living on fixed incomes, often far from banks or ATMs that participate in the Direct Express network.

To get a month’s worth of cash can require three or four ATM transactions because of limits on how much money can be withdrawn at a time. At ATMs participating in Direct Express, customers get one free withdrawal a month before Comerica charges a 90 cent fee. ATMs outside the network can tack on fees of $2 or more.

Direct Express may be a good option for people who don’t have a bank account, as Treasury argues, but almost certainly increases costs for those who do have accounts. Users pay Comerica for most ATM withdrawals, online bill payments and money transfers — services that many banks provide for free.

Yet Treasury and Comerica have pushed the card with such vigor that as of June 2012, more than a million people with bank accounts had nonetheless signed up for Direct Express, according to Gregg’s congressional testimony last year.

Comerica spokesman Wayne Mielke declined to comment for this story. Comerica’s contract with Treasury bars it from discussing the program without Treasury’s permission.

Fees benefit bank

Both Treasury and Comerica have strong incentives to push the Direct Express card. For Treasury, each conversion saves money and moves the government closer to its aim of eliminating checks.

Comerica receives $5 from Treasury for each card it issues, according to several people with direct knowledge of the contract. Treasury redacted this information from copies of the contract provided in response to a Freedom of Information Act request.

Treasury had made direct payments to Comerica totaling more than $22 million as of August 2012, including the $5 fee and other charges, according to data disclosed in response to the FOIA request. The bank stands to collect millions more through ATM withdrawal fees, payments from Visa and MasterCard and the interest earned on money that people haven’t yet withdrawn, which Comerica keeps.

Comerica initially was chosen because it offered to issue cards and provide customer support at no cost to the federal government. After it had won the deal, Comerica reversed course, saying that it was having trouble making money off Direct Express, in part because of the high cost of providing telephone support for people who sometimes call to check their balances multiple times a day, according to two people with knowledge of the matter. The people spoke on condition of anonymity because they were not authorized to discuss it.

Without reopening bidding, Treasury agreed in March 2011 to give Comerica $5 per card, paying retroactively for enrollments since December 2010. Comerica received millions more to beef up its call centers and prepare for additional users. The exclusive contract runs until January 2015.

Treasury’s inspector general wants to k now if the Department acted improperly when it added the $5 per-card fee and other payments. The original contract specified that the government would not guarantee “ANY MINIMUM VOLUME OF BUSINESS, OR LEVEL OF COMPENSATION TO [Comerica] AND SHALL NOT ADJUST THE COMPENSATION ON THE BASIS THAT VOLUME LEVEL DID NOT MEET [Comerica’s] EXPECTATIONS.” (Emphasis in original.)

A spokesman for the inspector general declined to comment. The office does not discuss ongoing audits.

Treasury officials declined to speak on the record about the contract.

Comerica’s contract also required it to enroll people in the program and provide customer service including helping prevent fraud. However, Treasury took over these responsibilities, setting up a parallel call center at the Federal Reserve Bank of Dallas, about a mile from Comerica’s headquarters. Treasury didn’t reduce Comerica’s compensation.

Between October 2011 and the end of August 2012, the Social Security inspector general received more than 18,000 reports of unauthorized changes or suspected attempts to make unauthorized changes to payments. Treasury says it put new procedures in place in January 2012 to reduce fraud. Yet early this year, the Social Security inspector general’s office said it was still receiving more than 50 such reports a day.

Juliet Carter says Comerica failed to root out the fraud and reissue her lost payments despite several requests. At one point, she says, a Comerica representative threatened to investigate her for fraud if she continued to pursue the matter.

Comerica declined to comment on her case. Mielke, the bank’s spokesman, said it does not comment on individual cases, to protect customers’ privacy.

Carter got rid of her Direct Express card, and switched back to paper checks last year. The repeated notices from Treasury continued to scare her, however, and earlier this year she signed up to get her payments on a Rush Card, a private payment card that carries higher fees than Direct Express.

Vallas, her lawyer, helped her apply for a waiver this spring to go back on paper checks.

Read more in Inequality, Opportunity and Poverty

Finance

Yellen as Fed chair would be tougher on banks

Positions ‘miles away’ from Greenspan’s

Finance

Senators grill Treasury official about debit card program

Payments increased for contractor, poor hit with fees

Join the conversation

Show Comments