Introduction

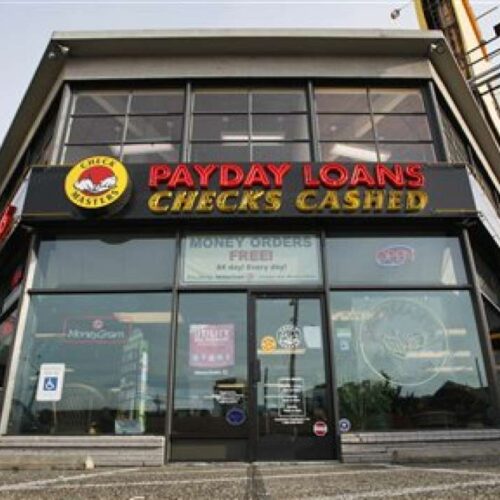

A U.S. group of storefront payday lenders is distancing itself from some online payday lenders, saying they want to avoid state regulation by partnering with Native America tribes.

“We abhor their practices,” Steven Schlein, a spokesman for the Consumer Financial Services Association of America (CFSA), a group that represents bricks-and-mortar payday lending stores, told iWatch News.

Lenders that peddle loans online make it difficult for states to regulate them, Schlein said. By contrast, he said, “we make money from customers who walk into our state-regulated stores.”

As iWatch News reported in February, Internet-based lenders have sparked legal fights in California, Colorado and elsewhere by claiming they’re immune from lawsuits and regulation because they are “tribal enterprises” owned and operated by Native American tribes. They say tribal-nation sovereignty allows them to operate outside state oversight — even though they’re making loans to non-Native Americans living far from Indian lands.

State regulators and consumer lawyers complain, in turn, that the tribes are being used as fronts for the lenders. The lender-tribe relationships, these detractors say, are ploys designed to allow the lenders to skirt consumer-lending laws.

The handful of tribes involved in the practice say they operate legitimate lenders that fill a need for consumers and provide revenue vital to the welfare of the tribes. Lawyers for the Miami Tribe of Oklahoma say profits from payday lending are used to fund “tribal law enforcement, poverty assistance, housing, nutrition, preschool, elder care programs, school supplies and scholarships.”

The Online Lenders Alliance, a Washington, D.C.-headquartered group whose membership includes Native American lenders, said it “supports business models that use legal, fair and transparent means” to deliver short term credit to millions of Americans.

“Traditional banking outlets have ignored these consumers for too long and their products may not be available and can be more costly, especially when you consider overdraft fees. If Native American tribes choose to be a part of this business, they’re meeting a need while bettering the financial situation for their tribe,” Lisa McGreevy, president of the Online Lenders Alliance told iWatch News.

In a typical payday loan transaction, a borrower pays a $50 finance charge to borrow $300 that’s scheduled to be paid back in two weeks, when his next payday comes around. Consumer advocates complaint that cash-strapped borrowers frequently end up having to roll over payday loans again and again, shelling out still more finance changes. In many states, the annual percentage rate on payday loans can exceed 300 percent.

The federal Consumer Financial Protection Bureau (CFPB), which officially opens its doors on July 21, was given explicit authority in the Wall Street reform law to examine payday lenders even though it is not allowed to cap interest rates.Experts say the CFPB will likely have rulemaking authority over tribal payday lenders. But it’s also likely, they say, that any effort by the agency to take enforcement action against them would spark drawn-out court battles that would delve into the minutiae of tribal immunity law, which generally shields tribes from state laws and, in some instances, federal laws.The group that represents storefront payday lenders, the CFSA, seeks to draw a sharp distinction between online lenders in general and online “tribal lenders” in particular.

CFSA board chairwoman Lynn DeVault has criticized the Native American partnerships struck by some online payday lenders. “While legal counsels may opine and courts are left to determine the legality of lender/Native American partnerships, partnering with a Native American tribe to avoid state licensing requirements for short-term lending defies CFSA Best Practices and would lead to the automatic expulsion of a company in violation,” DeVault said in a written statement.

TheStreet.com reported today that the Online Lender Association was prepared to work with the Consumer Financial Protection Bureau “to develop and enforce smart regulations for our industry that meet the needs of the millions of consumers who need short-term credit.”

Read more in Inequality, Opportunity and Poverty

Debt Deception?

Borrower Nightmares: $700 dormitory fee costs family its car

Auto-title loans are the credit of last resort, but are terms fair to borrowers?

Debt Deception?

Borrower Nightmares

These are faces of Americans trapped in confusing loans they couldn’t afford. Can the Consumer Financial Protection Bureau help?

Join the conversation

Show Comments